WestJet RBC® World Elite Mastercardǂ Review

Ranked as the number two airline credit card in Canada, the WestJet RBC World Elite Mastercard popularized many benefits that you can find on various other cards in Canada now. The card for Canada's second largest airline has proven very popular with Canadians as it was one of the first cards to offer an annual companion pass and first checked bag free benefit. In fact, in many of our discussions with readers and the general public, they choose to get this card just for those two reasons rather than for earning actual WestJet points.

Read our old review here: WestJet RBC World Elite Mastercard Review (Old 2016 version)

Overview

The WestJet RBC World Elite Mastercard is the co-brand card for the WestJet Rewards frequent flyer program. The card was launched in 2010 with RBC and has always been a really good option for WestJet travel. It is the ideal card for individuals who travel on WestJet regularly and check bags, as well as for couples or families who travel on WestJet at least once per year. There is one other version of the card, the WestJet RBC Mastercard which is their entry level card with a lower annual fee that has lower earn rates and has less benefits.

Costs & Sign up Features

The WestJet RBC World Elite Mastercard comes with a $119 primary card annual fee which is now on the lower end as we have seen many premium cards bump up their annual fees to $139 and $150. Supplementary cards are $59 each which is higher than most competing cards that charge $50 for each additional card but lower than its most direct competitor the TD® Aeroplan® Visa Infinite* Card.

Welcome bonus of up to 45,000 WestJet points!

Currently the WestJet RBC World Elite Mastercard is being offerd At this moment the card is being offered with it's standard welcome bonus offer of up to 45,000 WestJet points.

The bonus is awarded as follows:

- 25,000 WestJet points on your first purchase with the card,

- 20,000 points when you spend $5,000 in the first three months

The interest rate on the card is 20.99% on purchases. 22.99% on cash advances and balance transfers (21.99% in Quebec). These rates are equivalent to or below many cards at this level.

As it is a World Elite Mastercard, the card does have higher annual income requirements of $80,000 personal or $150,000 household.

Earning

The card earns WestJet points and earns them as follows:

- 2 WestJet points per $1 spent on flights or packages with WestJet or WestJet Vacations

- 1.5 WestJet points per $1 spent on all other eligible purchases

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Effective Rate of return when redeemed towards base fares |

|---|---|---|

| WestJet & WestJet Vacations | 2 | 2% |

| All other spending | 1.5 | 1.5% |

Redeeming

As this is a co-brand airline card you guessed it, the points you earn on this card are redeemable for flights on WestJet through the WestJet Rewards program. WestJet's program works more like a cash back program rather than your traditional frequent flyer programs which have or had set mileage award charts. One hundred WestJet points are equivalent to one Canadian dollar and you can redeem them when you have as little as 2,500 WestJet points in your account.

When you redeem, you are buying an actual ticket from WestJet (not an award ticket like your traditional frequent flyer programs) for cash and then applying WestJet points towards that ticket as a discount. So if you buy a ticket for $450 and have 12,500 WestJet points you can apply that amount to the ticket and end up paying $325 plus any taxes and fees.

You can also choose to use WestJet points towards surcharges, taxes and fees. There are two options in this regard. The first is that you can cover 50% of the surcharges, taxes and fees with points and pay the rest on your credit card. With the first option your points redemption rate is approximately 110 points to $1. The second option is to pay for 100% of the surcharges, taxes and fees with points. With this second option your points redemption rate is approximately 105 points to $1.

WestJet Rewards also has a flight redemption option called Member Exclusive Fares. These are sort of like WestJet's take on the traditional frequent flyer reward chart as you need to have the full amount of points to redeem for them. When they were first introduced they provided excellent value (such as $99 one way in Canada) and you could also redeem for flights on partner airlines like Qantas. However, more recently WestJet revamped this redemption option and the potential outsized value it provided has disappeared.

The current incarnation of Member Exclusives Fares is akin to a small discount on the fare you would normally pay if you were just using cash. Sure a discount is great but the competitiveness of this option when compared to other programs is no longer there. At the time these were changed WestJet also removed the option to redeem for travel on their partner airlines. There are still ways you can use WestJet points on airlines like Air France, Delta and Qantas and that is to book a WestJet codeshare on those airlines, in those cases you can redeem WestJet points towards the fare.

Finally you can also redeem your WestJet points for vacation packages booked via WestJet Vacations or Sunwing Vacations and in the near future there will be options to be able to redeem with partners such as Skip and Telus.

Features and Benefits

This is the area where this card shines as it has some great features and benefits that are particularly useful to those who fly with WestJet. Two of those key benefits are the first checked bag free and the annual companion voucher and these are what make this card popular. I remember being at my kid's sporting events and the other parents on the team telling me that's why they have this card. Some get it for the free bags others for the companion fare and of course, for some it is for both of those benefits.

First Checked Bag Free

When you hold the WestJet RBC World Elite Mastercard, you and up to 8 guest travelling on the same reservation can each check your first bag for free. That is at least a $35 savings per person per direction of flight. If you have a family of four and you all check bags in both directions on a round trip that's $280 in savings right there.

Annual Companion Voucher

The second and potentially most valuable benefit that this card comes with is the annual Companion Voucher. You get it each year when you pay your annual fee on the card and it can provide some amazing value. The way it works is that when you purchase one ticket with WestJet you can get a companion ticket for as a little as $119.

The annual companion ticket options are as follows (prices don’t include surcharges, taxes, and fees):

- Travel to Canada and the Continental US for $119 CAD Economy / $219 CAD Premium

- Travel to the rest of the WestJet network for $399 CAD Economy / $499 CAD Premium

- The revamped WestJet Rewards program now allows members to redeem WestJet points towards the above co-pay requirements and surcharges, taxes, and fees levied on the companion vouchers.

What does this mean? Well, it means it can save a boat load of money when you travel as the beauty of the voucher is that it works on any economy fare class including Premium at anytime with no blackouts. So you could book a more expensive Premium Fare to Hawaii and get your companion in Premium as well for only $499 + taxes and fees! Or it can provide huge savings on last minute travel when fares tend to skyrocket (this is typically when we have used them as a lot of our travel is not planned very far in advance)

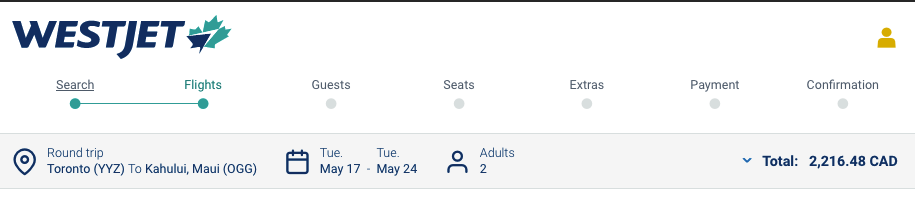

Here is an example of economy class flights between Toronto and Kahului, Maui in May 2022:

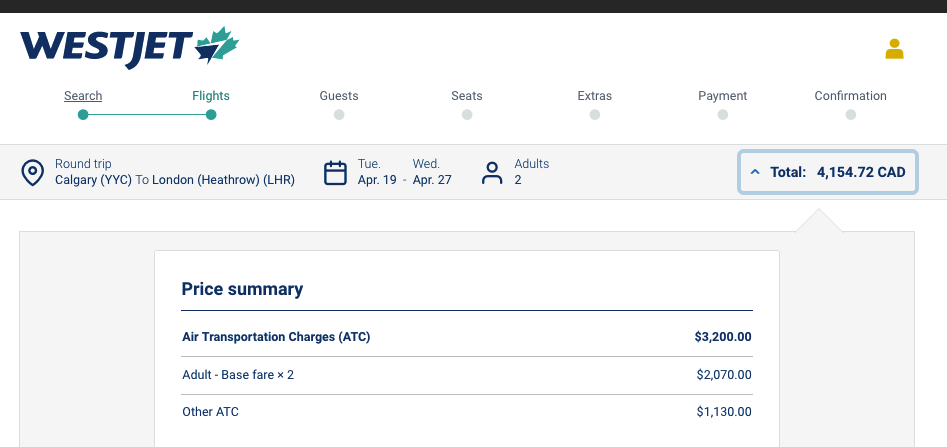

The cost of two tickets without the voucher

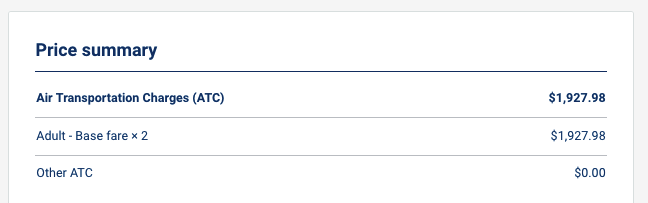

The cost of two tickets with the voucher

In the above example the voucher provides a $565 savings. Not bad considering the card only costs you $119 per year and then you have to take into account the card will save you on your bag fees on this flight as well!

One more example, here is Calgary to London Heathrow in Premium Economy on their Boeing 787 Dreamliner:

The cost of two tickets without the voucher

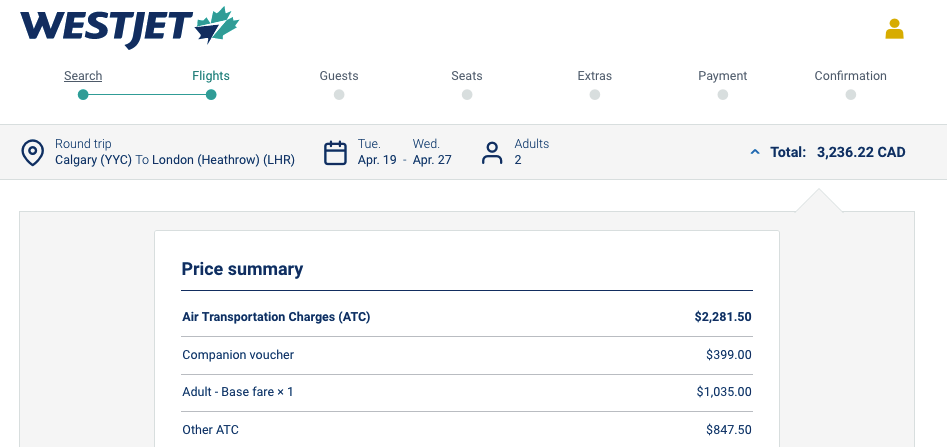

The cost of two tickets with the voucher

Here you have $718.50 in savings just from the voucher. That's over five years of annual fees saved in one fell swoop on this card and you still get this voucher each and every year.

Solo Traveller Tip: WestJet also provides the option to exchange your annual round-trip companion voucher for 4 business class lounge vouchers.

If you are a family of four or more, and do fly WestJet, Rewards Canada recommends that two people in the family each get their own card (not a supplementary card but rather own account) as that would provide you with two companion vouchers to use each year. To learn more read the following article:

Recommended reading: Why my wife and I each grabbed our own WestJet RBC World Elite Mastercards

Status Lift

With the revamped WestJet Rewards program, you can earn elite tier status without even flying! Cardholders can now achieve Silver, Gold and even Platinum Status with Status Lift up to 50 times per year. Get 200 CAD in tier qualifying spend for every $5,000 in purchases on your card..

World Elite Mastercard benefits

- Mastercard Travel Pass provided by DragonPass Complimentary membership to Mastercard Travel Pass provided by DragonPass gives access to over 1,300 airport lounges worldwide at discounted rate of $32 USD per person per visit

- FlexiRoam Global Data Roaming Stay connected around the world without a SIM card and get up to 15% off a Global Data Roaming plan plus up to 3GB of data, free.

- Fubo Discount Access 50+ live-stream sports channels and save $30 on your first three months of Fubo

- H&R Block Discount Save up to 30% when you pay for your tax preparation services using your eligible Mastercard

- Booking.com Discount Up to 7% off prepaid stays and save as you explore

Insurance

The WestJet RBC World Elite Mastercard has a strong insurance package that places it in the middle of the road with its competitors. The coverage is as follows:

- Out of Province/Country Emergency Medical Insurance (up to 15 days for hose under age 65, 3 days for 65+)

- Trip Interruption Insurance

- Flight Delay Insurance

- Baggage Delay Insurance

- Car Rental Theft and Damage Insurance (up to $65,000 MSRP)

- Hotel Burglary Insurance

- Travel Accident Insurance

- Purchase Protection Plan

- Buyer’s Assurance Protection Plan

Some key insurance coverage it is missing compared with competing cards are lost or damaged baggage insurance and trip cancellation insurance.

Rewards Canada's Guide to Business Class Lounge Access

The ultimate guide to accessing business class lounges for Canadians!

Check it out hereWhat is good about this card

The welcome bonus of up to 45,000 WestJet points is great and allows for a sizable discount on future WestJet flights.

Next is the first checked bag free benefit, to save $35 or more per bag per direction is such a great benefit for those who buy fares that don't include checked bags. In fact by having the card, you can actually choose those lower fares to save some money.

The primary card $119 annual fee could also be seen as a good thing as we have seen many premium cards including some direct competitors bump up those primary card fees as high as $199 annually.

What is not so good about this card

There are just a few things that are not so good about this card. The first is the earn rate, while 1.5 points on the majority of purchases is equal to many competitors, the latter tend to have category spend accelerators (ie grocery, dining, recurring bills etc.) where you can really rack up to points and miles. This card's only accelerator, the 2 points per dollar is only good for WestJet purchases whereas other cards will award a similar amount or more on WestJet and other travel purchases including hotels, car rentals and so on.

The second issue we have with the card is more so with the WestJet Rewards program and not the card itself but being a co-brand card these go hand in hand! This is an inherent issue with all co-brand cards as you are limited by the attached reward program. And with WestJet Rewards you are limited in the redemption options in terms of where and whom you can fly with.

With the WestJet points you earn you are limited to only redeeming for WestJet flights or WestJet code-share flights on partner airlines. This limits the number of destinations you can get to using WestJet points (or portion thereof) and there is no outsized value in redeeming what you have earned like you can find with traditional frequent flyer programs (such Aeroplan points for first class on Lufthansa).

Who should get this card

- Anyone who flies with WestJet several times per year and checks bags on those flights to save on the fee (or even just one flight per year when travelling with 2 or more people)

- Couples or families who fly with WestJet as least once per year to make use of the savings the companion voucher can provide

- Frequent WestJet travellers who earn quite a few WestJet points and want to contribute more to that balance by earning points with the card

Conclusion

Should you get this card? As is always the case it depends on your travel habits! If you travel on WestJet then in most cases the card will make sense but not always. If you are a solo traveller who rarely checks bags and who only flies WestJet once or twice per year you are better off getting a credit card that offers a higher return like MBNA Rewards World Elite Mastercard as you'll get a better return on your purchases that you can still redeem on WestJet flights. Being a solo traveller you won't make use of the companion voucher but you can convert them to lounge vouchers.

However if you travel at least once a year with two or more people or as a single traveller frequently with checked baggage on WestJet then the card is a no-brainer as you can make use of the companion voucher and the first checked bag free benefits to save you a ton of cash. On the flip side if you travel to places that WestJet doesn't serve or their partners don't serve the card doesn't make much sense.

With all that being said, at a minimum if you know you are going to fly WestJet at least once, and this goes for even that solo traveller as well you may want to get the card just to save on that one flight. How? Why? Well for the $119 annual fee you can get up to $450 in value from the WestJet points with the welcome bonus. This means you can save $331 on that one WestJet flight almost immediately!

Overall this card makes great sense for a lot of Canadians who foresee themselves travelling on WestJet with a companion at least once per year or a few times per year individually. The benefits the card comes with are really second to none as no other card has a companion voucher offer like this and only several others have a checked bag benefit. When you get this card you'll do ok with WestJet points earning on your everyday spending but the card is really it is about the two huge benefits it comes with.

Latest card details:

WestJet RBC® World Elite Mastercardǂ

Get up to $450 in WestJet points1 with the WestJet RBC World Elite Mastercard

Plus a Round-Trip Companion Voucher Every Year3

Annual Fee $119 | Additional Cards: $59 | Annual interest rate 20.99% on purchases, 22.99%* on cash advances and balance transfers (*21.99% if you reside in Quebec) | $80,000 personal or $150,000 household annual income

- Get up to 45,000 WestJet points1:

- 25,000 WestJet points upon your first purchase1

- 20,000 WestJet points when you spend $5,000 in the first 3 months1

- Check your first bag for free for the primary cardholder and up to 8 guests on the same reservation4

- Cardholders can now achieve Silver, Gold and even Platinum Status with Status Lift up to 50 times per year – you’ll earn 200 CAD in tier qualifying spend for every $5,000 in purchases on your card

- Receive a round-trip companion voucher – every year – for any WestJet destination starting from $119 CAD (plus taxes, fees, surcharges and other ATC)3 or choose to exchange it for 4 lounge vouchers7

- Travel to Canada and the Continental US for $119 CAD Economy / $219 CAD Premium

- Travel to the rest of the WestJet network for $399 CAD Economy / $499 CAD Premium

- Earn WestJet points 1.5 points for every $1 spent on everyday purchases and 2 points for every $1 spent on flights or vacation packages with WestJet or WestJet Vacations8.

- WestJet Points never expire Use your WestJet points to book flights anytime so you can travel when and where you want – no blackout periods.

- WestJet points can now be redeemed to cover taxes, fees and surcharges9

- You can truly relax while you’re travelling with comprehensive coverage18.

- Link your RBC card with a Petro-Points membership to and instantly save 3₵ per litre on fuel12 and always earn 20% more Petro-Points13 at Petro-Canada.

- Get $0 delivery fees for 12 months from DoorDash^

- Add your eligible RBC credit card to your DoorDash account to:

- Get a 12-month complimentary DashPass subscription± – a value of almost $120

- Enjoy unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay with your eligible RBC credit card!

Refer to RBC page for up to date offer terms and conditions

Other cards to consider if you are looking at this card:

- American Express® Aeroplan®* Card

- American Express Cobalt™ Card

- American Express® Gold Rewards Card

- BMO VIPorter World Elite®* Mastercard®*

- RBC Avion Visa Infinite Card

- Scotiabank Passport Visa Infinite card

- TD® Aeroplan® Visa Infinite* Card

This review was first posted on November 23, 2016 and is updated on a regular basis

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!