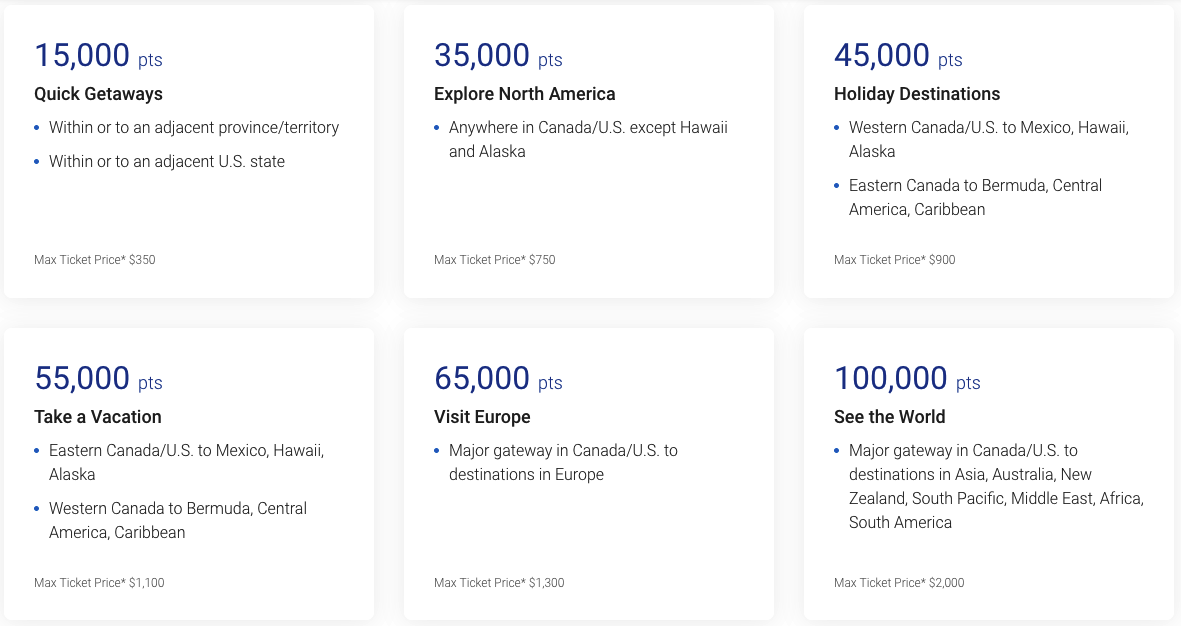

The RBC Avion suite of cards is one of a few major programs that runs primarily on a fixed redemption chart (AKA Avion Air Travel Redemption Schedule) for redeeming points towards flights. What that means, if you aren't familiar with the concept, is that you redeem a fixed amount of points for a flight from one specific region to another.

This takes a page from traditional frequent flyer programs where they have set redemption levels for flights regardless of the actual ticket price. RBC's Avion chart basically runs the same way albeit they do place a maximum ticket value for each redemption level. When you redeem Avion Rewards points via the Avion chart you ideally want to redeem for tickets that are near or at that maximum ticket value so you can maximize the return on your spending.

Tips to remember when using the RBC Avion Air Travel Award Chart

- The maximum ticket price is for base fare only - it does not include carrier/fuel surcharges, taxes or fees

- You need to have the full amount of points for the category you're redeeming (you can purchase points to top off your account)

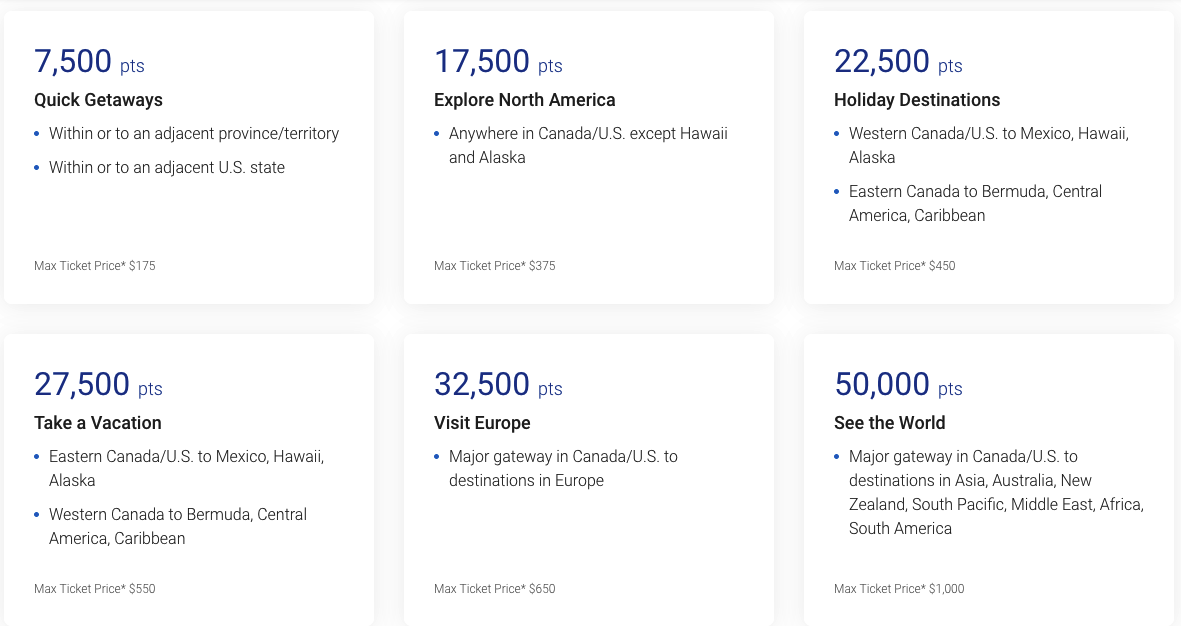

- One way flights are available for exactly half the amount of points and half the maximum ticket price

- Taxes and fees must be paid for with credit card or you can redeem 100 Points for every dollar

- If the ticket exceeds the maximum ticket price set in the chart you can pay difference with your credit card or you can redeem 100 Points for every dollar

- Travel must originate in Canada or the U.S.

Required points and maximum ticket prices - round trip

Required points and maximum ticket prices - one way

Redemption Examples

We'll now look at some example ticket prices and corresponding Avion Rewards points redemption rates to give you an idea of what is a good value redemption and what may be considered poor value. We say 'may be' as we also need to abide by our own mantra that any redemption that makes you happy is a good redemption no matter what value you get. So this post is more for those of you who are value maximizers and love to run the numbers! These numbers are based on holding the RBC Avion Visa Infinite Card with points earning at 1 point per dollar spent.

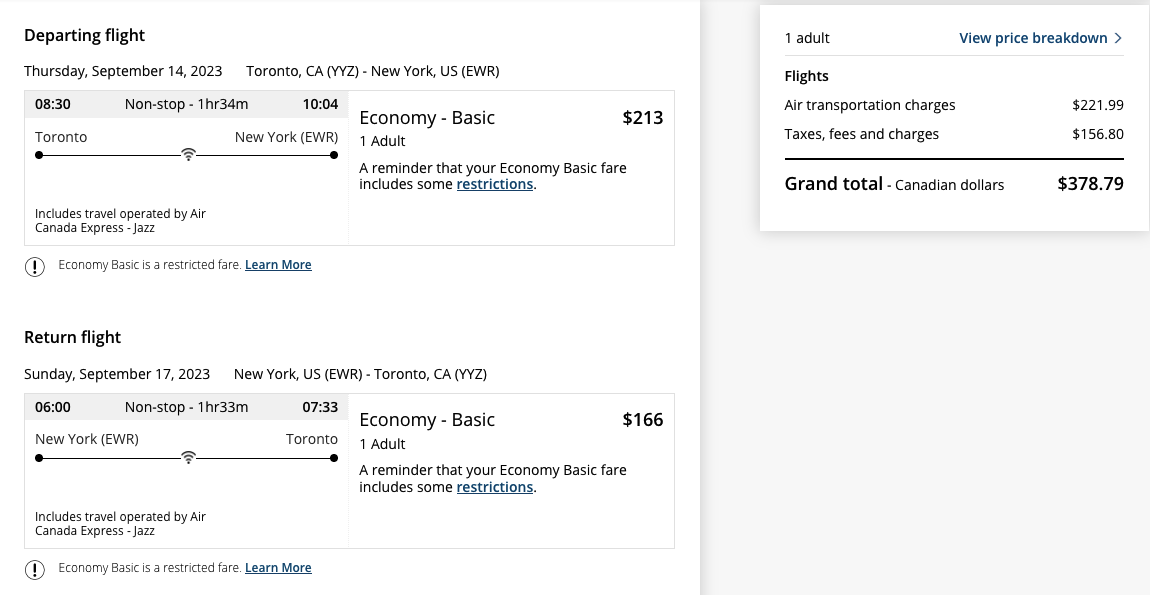

Short haul flight example

Our first example is a short haul flight - that is a flight within or to an adjacent Province/Territory/U.S. State with a maximum base ticket value $350. If you can find a flight for exactly $350 before taxes and fees you're looking at a return of 2.33% which is the highest possible return you can get with an Avion card.

A weekend trip to New York from Toronto

As you can see the flight is $378.79 in total but the 15,000 RBC Rewards points will only cover the base fare of $221.99, you'll still have to cover the $156.80 with cash or additional points. Redeeming 15,000 points to cover $221.99 is a 1.48% return, this is OK bad but it could be better! You'll have to shell out an additional 15,680 points if you want to cover the taxes and fees with points. If you want the flight to be 100% free you'd have to redeem 30,680 points in total for a return of 1.23%.

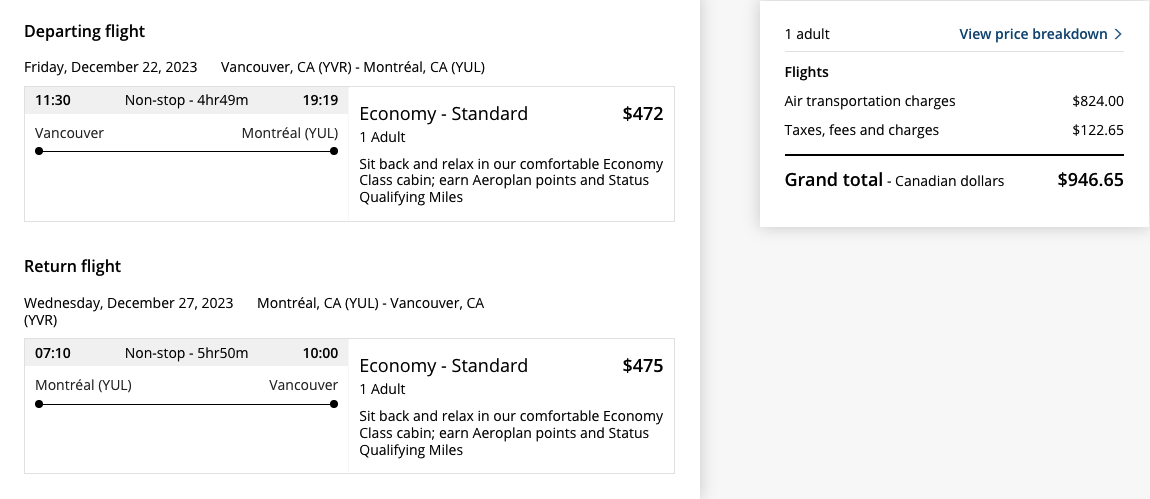

Long haul (North America) flight example

Our next example is a long haul flight in North America which tends to be the most popular redemption across most loyalty programs. This coves flights within Canada and the U.S. (Excluding Alaska and Hawaii) with a maximum base ticket value $750. If you can find a flight for exactly $750 before taxes and fees you're looking at a return of 2.14%

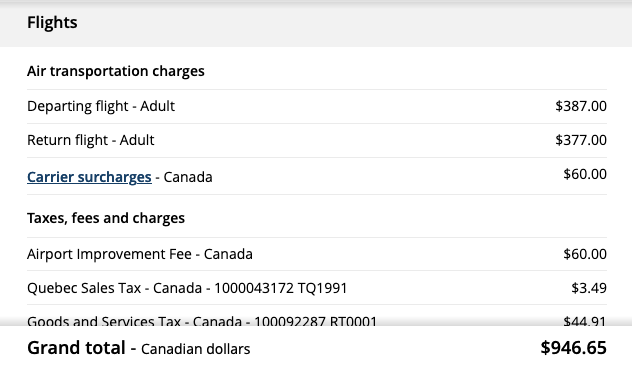

Christmas break in Montreal, departing from Vancouver

As you can see the flight is $946.65 in total but the 35,000 RBC Rewards points will only cover $750 of the $764 base fare. You'll still have to cover the $196.65 with cash or points. 35,000 points to cover $750 gives you the maximum 2.14% return for this category and that is considered a good return! You'll still have to shell out an additional 19,665 points if you want to cover the rest of the base fare plus taxes and fees with points. Total points 54,665 or a return of 1.73%, that's a respectable return for an economy class flight considering it is over Christmas break!

Canada to Europe flight example

Next example is a long haul flight to Europe that has a maximum value $1,300 when redeeming 65,000 points. If you can find a flight for $1,300 before taxes and fees you're looking at a return of 2% but Europe proves to be a trickier situation. Most airlines charge very low base fares for flights to Europe and then tack on a large carrier surcharge - which unfortunately is not covered by the 65,000 points. This issue is not limited to Avion Rewards, you'll find AIR MILES and Amex's Fixed Point for Travel are also hit by this issue . Lets look at a real example:

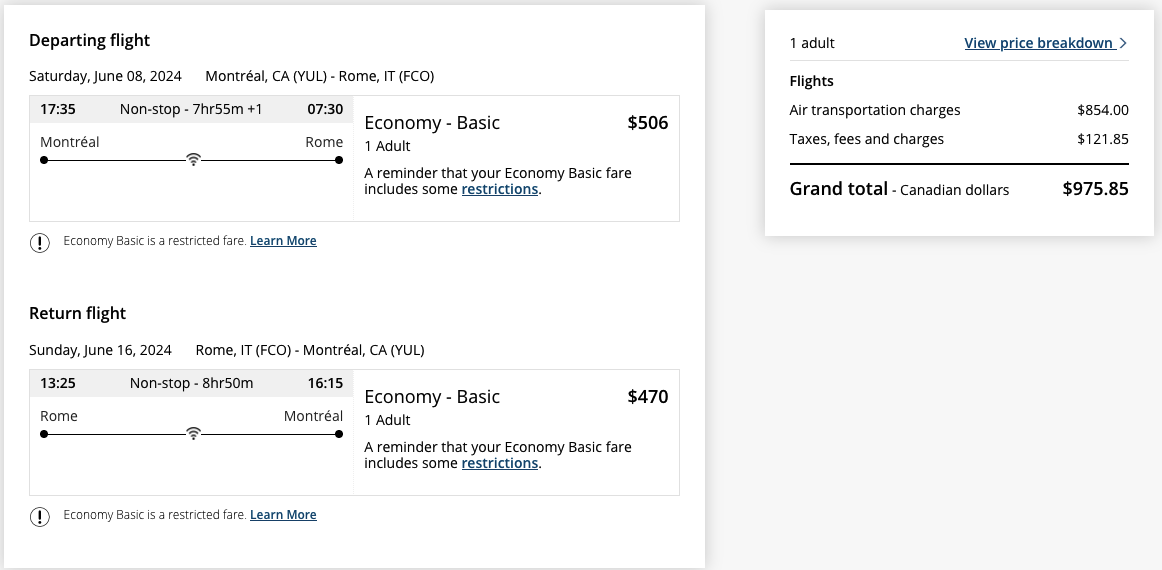

How about a trip from Montreal to Rom in late spring 2024?

As you can see the flight is $975.85 in total but the 65,000 RBC Rewards points required will only cover the base fare of $148.98!!! You'll still have to cover the $826.87 with cash or points. 65,000 points for $148.98 is a 0.2% return! You'd be better off just redeeming at the 100 points for $1 rate that is also an option with Avion Rewards. With this latter option it would take 97,585 points to cover the entire flight. Compare this to 147,687 if you used the 65,000 points from the chart and then points to cover all the taxes and fees.

Redeeming points for economy class travel to Europe is not a very good value proposition with Avion Rewards!

Loyalty Lesson

Why credit card reward charts rarely provide good value for economy class flights to Europe

Click here to read the lessonCanada to Japan flight example

This next example is a long haul flight to Japan that has a maximum value $2,000. If you can find a flight for $2,000 before taxes and fees you're looking at a return of 2%. Lets look at a real example:

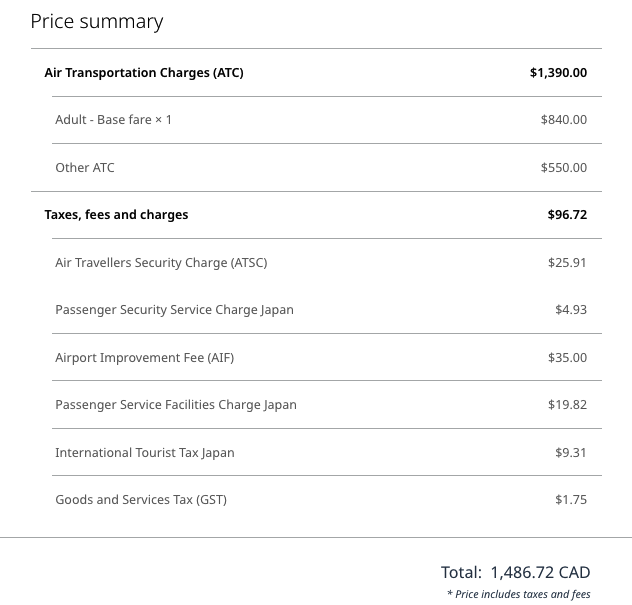

Calgary to Tokyo in the middle of spring 2024

As you can see the flight runs $1468.72 in total and the 100,000 RBC Rewards points required will only cover the base fare of $840. You'll still have to cover the $628.72 with cash or points. 100,000 points for $840 is a 0.84% return. Not very good in our books! Just like the Europe example you are better off redeeming 100 points for $1 for a 1% return instead of using the award chart option. With this latter option it would take 146,872 points to cover the entire flight. Compare this to 162,872 if you used the 100,000 points from the chart and then points to cover all the taxes and fees.

In general flights to other parts of the world can present decent value with Avion Rewards. While the above example is not one of them, many times flights to Australia, New Zealand, Africa, and other more exotic places like the Maldives can be very expensive. It is those type of flights where you can definitely increase the value you receive from your Avion Rewards points.

Calculation notes:

Please note that all of our calculations above do not take into account the RBC Avion Visa Infinite's increased earn on travel purchases of 1.25 points per dollar or the Avion Infinite Privilege's 1.25 points on all spending. All the numbers are based upon earning 1 point per dollar which is the base earn rate for the Avion Visa Infinite and Visa Platinum Cards.

Depending on how much you spend on your card for travel you will see your return increase on all of our numbers above. You can also increase your return with the RBC Avion Visa Infinite Privilege card with its 1.25 points on every dollar spent. In the Vancouver-Montreal example above if you have the Privilege Card your return before taxes and fees would be 2.675% which is really good!

Breakdown of Avion Reward Chart return on spending

Here is a breakdown of each category, the maximum ticket price and the return you get at that maximum ticket price (not including taxes and fees) based on the one point per dollar spend.

Category |

Points Required |

Max Ticket Value |

Maximum Return |

| Short Haul Canada/US | 15,000 | $350 | 2.33% |

| Long Haul Canada/US | 35,000 | $750 | 2.14% |

| Long Haul Western Canada/U.S. to Mexico, Hawaii, Alaska Eastern Canada to Bermuda, Central America, Caribbean |

45,000 | $900 | 2% |

| Long Haul Eastern Canada/U.S. to Mexico, Hawaii, Alaska Western Canada to Bermuda, Central America, Caribbean |

55,000 | $1,100 | 2% |

| Long Haul: Europe | 65,000 | $1,300 | 2% |

| Long-haul: Asia, Australia, Middle East, Africa & South America | 100,000 | $2,000 | 2% |

Maximizing Value

Ultimately you'll want to get as close as you can to each of those maximum ticket values to ensure you are getting the best value out of the points you have earned on the Avion card. We do still believe in our mantra that any redemption is a good redemption as long as you are happy with it (see our piece on The True Value in Reward Redemptions) but if you are about getting the most value out of your credit card rewards you'll want to set a cut off between actually paying cash for a flight or using your Avion Rewards Points.

Personally, if I did have this card I would make the cutoff 0.3 points below the maximum returns listed above except for short haul which I would maybe go as far as 0.6 points. Essentially if a short haul ticket price worked out to a 1.7% return or higher I would redeem points for the ticket but anything under that return and I would pay cash and save the points for another redemption. Also if you are a maximizer you won't want to use your points for the taxes and fees as that is only a 1% return. Rather save them for another ticket redemption and pay cash for the taxes/fees, well - charge it your Avion card so that you earn points on it.

A trick to extracting more value from the Avion chart!

There is a recently new technique to being able to receive more value from your RBC credit card spending. That technique or trick is to add the RBC ION+ Plus Visa Card to your wallet in addition to whatever Avion card you already have. The reason why is the ION+ card earns 3 points per dollar spent on grocery, dining, food delivery, rides, gas, EV charging, streaming, digital gaming, and subscriptions purchases. Then, as long as you have an Avion credit card those points can be transferred 1 to 1 to your Avion Elite account meaning the 15,000 points for a short haul flight could be earned with as little as $5,000 in spending instead of $15,000!! (or a up to 7% return before taxes and fees)

We have a whole Loyalty Lesson article dedicated to this technique which you can read here.

Other card options

To be honest with you if you just want to redeem points for travel at anytime and don't want to have to worry about pushing the maximum ticket value you will be much better off with a different rewards card. The best options are the cards Rewards Canada classifies as Points Earning Machines and they are the American Express Cobalt Card, mbna Rewards World Elite Mastercard and the Scotiabank Gold American Express Card.

With these cards you'll always receive a 1 to 6% return on travel, you don't have to worry about being well below or well above the maximum ticket price as points remain equal across the board. Plus, you don't have to worry about the lower value of points for covering taxes and fees as those would remain at the 1% to 6% range depending on which card(s) you have and what your spending habits are like.

Converting points can provide big value too!

There is another very good option to the RBC Avion cards that can justify having one these card sand that is due to the cards being hybrid cards. It is this hybrid option that keeps the card ranking high in our Top Travel Credit Card Rankings. Hybrid means you can also convert the Avion Rewards Points you earn to airline frequent flyer programs like American AAdvantage, British Airways Executive Club, Cathay Pacific Asia Miles and WestJet Rewards. With frequent bonuses for transferring points to these airlines you can frequent pull out value well over 2% on the redemptions from those programs.

For example you can fly between Toronto and Dublin for only 26,000 Avios with the British Airways Executive Club program. With the frequent bonus from RBC for converting to BA you could actually get that flight for 20,000 RBC Rewards points if the bonus is at the typical 30%. As you can see flying to Dublin for 20,000 RBC Rewards Points is way better than redeeming 65,000 points via the Avion chart! Heck for that amount of points you could get three tickets with the BA option. To learn more about this Toronto-Dublin trick read our post How to score flights to Ireland for as little as $120 plus taxes and fees

Wrapping it up

Maximizing the value of your hard earned Avion Rewards points via the RBC Avion Rewards Airline Award Chart can prove to be a difficult task but hopefully we have made that easier with this guide! As you can see the best options from the chart are for redeeming for travel in North America (short haul being #1 at 2.33% and long haul #2 at 2.14%) This is perfect for the majority of Canadians as the most popular flights redemptions across all loyalty programs are for flights within North America.

Granted to maximize value you need to redeem at that maximum base ticket price level which can be tough to do - and then you still have to deal with the taxes and fees. That's where we feel other cards are so much simpler (the Points Earning Machines) however if you are already heavily invested in Avion Rewards where you would find it tough to switch, hopefully you can use this guide to help you maximize your value!

Details: The RBC Avion Visa Infinite Card

RBC Avion Visa Infinite Card

Get up to 55,000 Avion points^ (a value of up to $1,100†), that’s enough to fly anywhere in North America or the Caribbean!

Annual Fee: $120 | Additional Card Fee: $50 | 20.99% on purchases 22.99%* on cash advances and balance transfers *21.99% if you reside in Quebec.

- Earn 1 Avion point for every dollar you spend* and an extra 25% on eligible travel purchases.

- When you are ready to travel again, Avioners can book flights with points on any airline, on any flight, at any time, early or last minute, with no blackout periods or restrictions.

- Avioners earn points that never expire so your points will be waiting for your next adventure.

- Redeem your points for travel and more. Use points for anything from paying bills and paying your card balance to redeeming for Gift Cards and Merchandise at top brands like Apple. The Avion Rewards program gives you the freedom of choice to use your points your way, and helps you make the most as an Avioner.

- Eligible Avion Rewards members can also convert points to other loyalty programs including WestJet Points, British Airways Avios points and Hudson’s Bay Rewards points.

- Link your RBC card with a Petro-Points membership to instantly save 3₵ per litre on fuel at Petro-Canada stations and earn 20% more Petro-Points and 20% more Avion rewards points

- Link your RBC card with a Rexall Be Well account and get 50 Be Well points for every $1 spent on eligible products at Rexall. Redeem Be Well points faster for savings in store on eligible purchases where 25,000 Be Well points = $10

- Get access to RBC offers which provides access to earn points faster at specified brands

- Extensive insurance including: mobile device insurance, travel insurance (trip cancellation, interruption and emergency medical) and other eligible purchases to protect you and your family

- Avioners get access to luxury Visa Infinite benefits including first in line for exclusive events, and hotel and dining benefits.

- Up to a 2.3% return on your spending depending on which reward ticket you book

- Get $0 delivery fees for 12 months from DoorDash17 - Add your eligible RBC credit card to your DoorDash account to:

• Get a 12-month complimentary DashPass subscription18 – a value of almost $120

• Enjoy unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay with your eligible RBC credit card

Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

This feature was first posted on January 23, 2017 and is updated on a regular basis

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

About the author

Patrick Sojka

Patrick is one of Canada's foremost leading experts on loyalty programs and credit cards. Having founded Rewards Canada in 2001 he brings nearly 24 years of experience to the forefront of helping Canadians make the most of their rewards. He has also provided consulting to credit card companies, airlines, hotels and is regularly featured in the media for his expertise on loyalty programs and credit cards.

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!