One of the first travel rewards cards to offer any flight any time potential, the RBC Avion Visa Infinite Card has been a mainstay in the travel credit card market for nearly two decades! The card was first reviewed by RWRDS Canada way back in 2011 (With regular updates) continues to be one of the most popular in Canada due to its longevity.

The review of the RBC Avion Visa Infinite Card is broken down into the following sections:

Overview

The RBC Avion Visa Infinite Card came out a few years after the release of the original Visa Platinum Avion card from RBC nearly two decades ago. In its long tenure, the card has had a few tweaks here and there with its insurance coverage and the expansion of reward options via Avion Rewards but outside of that it hasn't actually hasn't changed very much . The card itself falls into our "Hybrid Card" category which means it gives you the best of both worlds for travel rewards in that it offers points that can be used towards any travel or you can chose to covert those points into participating frequent flyer partner programs.

Costs & Sign up Features

The RBC Avion Visa Infinite Card has an annual fee of $120 which is now on the lower end of annual fees for premium cards like this one. Many competing cards charge $139 to $150 annually with several pushing closer to the $200 mark. Additional or supplementary cards are $50 annually per card.

The standard welcome bonus on the card offers 15,000 Avion Points however the card frequently has limited time increased welcome bonus offers.

Right now the RBC Avion Visa Infinite Card is being offered with an welcome offer of 35,000 Avion points upon approval^ (travel value of up to $750†)

The interest rates

on the card are 20.99% on purchases 22.99%* on cash advances and balance transfers (*21.99% if you reside in Quebec). Annual income requirements are $60,000

Personal or $100,000 Household.

Earning

The card earns Avion Rewards points as follows:

- 1.25 Points per dollar spent on eligible travel purchases

- 1 Points per dollar spent on all other eligible purchases

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Rate of return when booking via the Avion Air Travel Redemption Schedule | Rate of return when booking any travel via Avion Rewards | Rate of return Cash Back | Rate of return when converting to airline programs |

|---|---|---|---|---|---|

| Travel | 1.25 | Up to 2.91% | 1.25% | 0.73% | 1.25% to 9% or higher |

| All other spending | 1 | Up to 2.33% | 1% | 0.58% | 1% to 6% or higher |

Redeeming

The RBC Avion Visa Infinite Card participates in the Avion Rewards program which provides numerous avenues of redemption. The most famous of all those options is the Avion airline award chart also known as the Avion Air Travel Redemption Schedule. You can also redeem points for any travel you book via Avion Rewards or you can redeem points for any purchase you make on the card, RBC financial products, merchandise, gift cards and also famously you can convert your points to British Airways Executive Club, WestJet Rewards and several other programs.

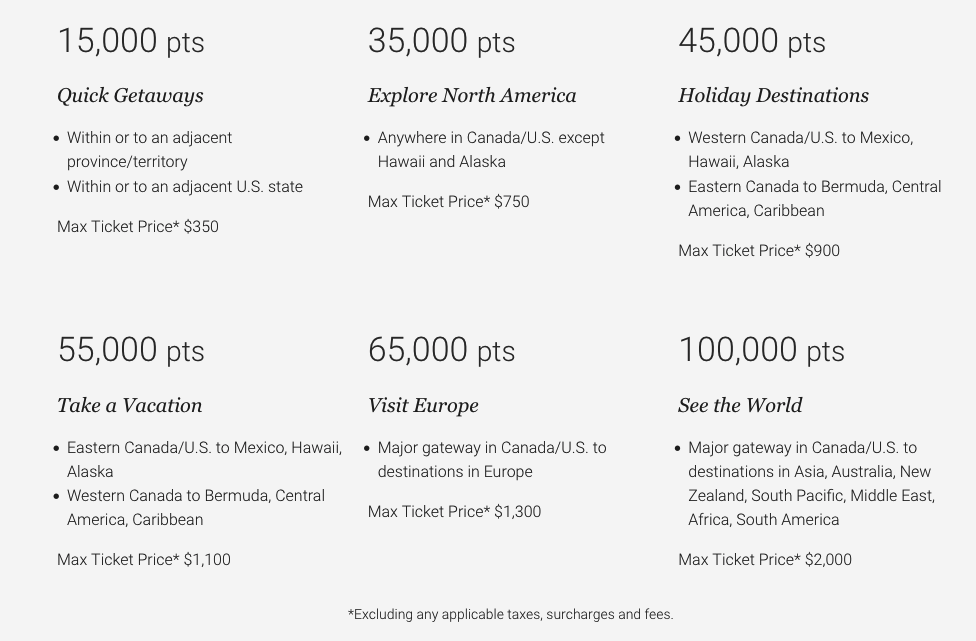

We'll start off by looking at the Air Travel Redemption Schedule which is the most popular redemption feature for this card. In basic terms this schedule is just like your traditional frequent flyer program award chart. You redeem a set number of points for a flight within a specific region or from one region to another. The only difference between this chart and traditional frequent flyer programs is that RBC does have a maximum ticket price for each award level.

Here is the schedule of points required per category and the maximum ticket price for each round trip ticket:

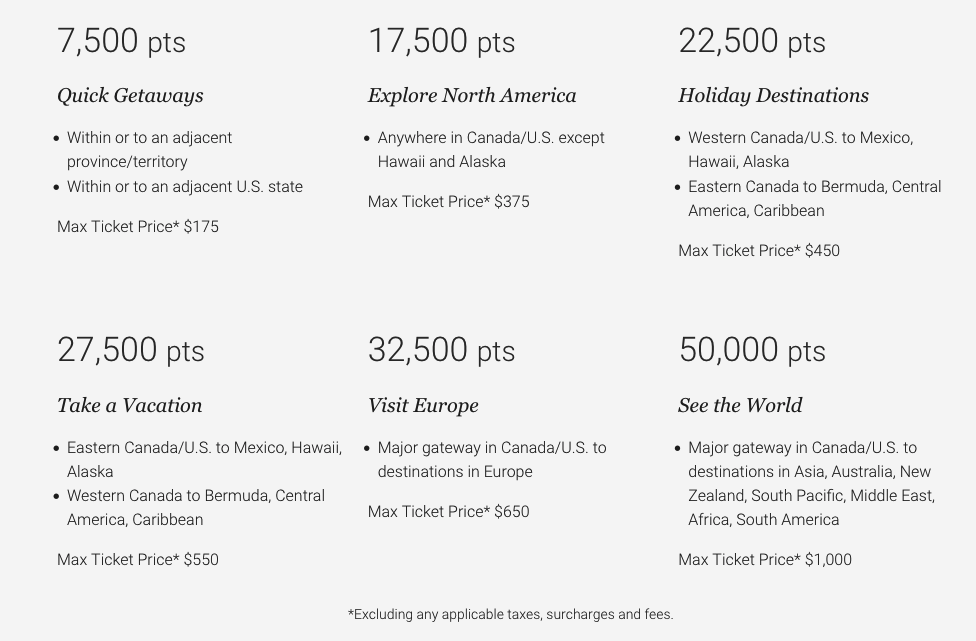

Recently Avion Rewards enhanced this reward option by adding one way reward options. They are exactly 1/2 the cost of the round trip options. Here is the one way Air Travel Redemption Schedule:

Recommended reading: How to maximize value out of the RBC Avion Airline Award Chart

As you can see from the schedules you have set points requirements for the various travel regions. For example you can redeem for a short haul flight with only 15,000 points. The maximum ticket value for that short haul flights is $350 before taxes and fees. If you redeem in this category it doesn't matter if the ticket is $225 or $350 before taxes and fees, it will require 15,000 points. Same goes for all the categories. Thus if you are someone looking to maximize the value of your points you'll essentially want to get as close as you can to each of those maximum ticket values to ensure you are getting the best value out of the points. While we do still believe in our mantra that any redemption is a good redemption as long as you are happy (see our piece on The True Value in Reward Redemptions) so for some of you, you won't care what the ticket price is however if you are about getting the most value out of credit card rewards you'll want to try to push to that maximum limit.

For the fees and taxes portion you can chose to just charge it to your card (basically paying cash for it) or you can choose to redeem points at a rate of 100 points to $1 towards those fees.

If the ticket you are purchasing has a base value higher than the set maximum you can still use a combination of points or points and cash to buy the ticket. Let's take the short haul example, if the base ticket price is $380 before taxes and fees you can redeem the 15,000 points to cover $350 of the ticket and the additional $30 (plus all the taxes and fees) can be paid with cash or points at that 100 points to $1 ratio.

The next travel redemption option is being able to redeem points for any travel you book via Avion Rewards. That is, you don't have to use the above schedules to book flights. You can simply go online or call up Avion Rewards travel and book flights, hotels, car rentals or other travel and simply redeem towards that travel at a rate of 100 points to $1. This is a good option for flights that may be coming in super cheap where it wouldn't make sense to use the air travel redemption schedule and of course for any non-air travel requirements.

The third redemption option that falls under travel and is a favourite of points and miles enthusiasts is converting your Avion Rewards points to a frequent flyer program. A lot of enthusiasts will strictly get this card for the welcome bonus offer and then convert those Avion Rewards points over to one of the partner programs.

Those partners are American AAdvantage, British Airways Executive Club, Cathay Pacific Asia Miles and WestJet Rewards. The most popular are British Airways and WestJet and those two also happen to be ones that Avion Rewards will sometimes offer an extra limited time bonus when converting your points. Typically seen once or twice per year, RBC offers a 30 to 50% bonus when converting to British Airways Executive Club while WestJet Rewards has seen a steady 10% bonus during the last few times it was offered. It is this bonus, especially the 50% to British Airways that made this card so popular in the points and miles community.

The conversion to an airline like British Airways or Cathay Pacific opens up possibilities for you to use the points you earned on your credit card spend for business class or first class flights at a much better value than if booked those same flights via Avion Rewards Travel and redeemed points at at that 100:1 ratio which is a 1% return. With the frequent flyer programs it's easy to have returns 3 to 4 times higher than that, if not more.

Current Avion Rewards Transfer partners and the transfer ratio:

- American AAdvantage - 10 points to 7 AAdvantage Miles

- British Airways Executive Club - 1 points to 1 Avios

- Cathay Pacific Asia Miles - 1 points to 1 Asia Miles

- WestJet Rewards - 100 points to 1 WestJet dollar

Having these transfer options opens up options to fly on airlines like Qatar Airways out of Toronto and Montreal, Fiji Airways out of Vancouver and more!

After travel you have several other redemption options via Avion Rewards. One of the more popular ones is to redeem points for RBC Financial Products at a rate of 12,000 points to $100 for RRSP contributions, TFSA contributions or other financial options. You can also choose to pay your credit card with points (this is basically a cash back option) which requires 17,200 points for a $100 statement credit.

You can also redeem points for merchandise via Avion Rewards' merchandise catalog as well as with Apple or Best Buy or you can redeem for over 100 different gift card options.

Features and Benefits

For being RBC's flagship premium card you would think the card would provide a lot of bells and whistles. It does not. Unlike many of the card's competitors this card does not provide business class lounge access, annual travel or statement credits, it charges a foreign transaction fee and so on. Outside of the decent insurance package, standard Visa Infinite benefits, the RBC Offers program and select partner benefits there is lot left to be desired with this card in the face of what the competition provides!

Visa Infinite benefits

- GigSky Data Roaming 1GB, complimentary Gigsky plan per calendar year AND a 20% discount on all subsequent purchases. Click here to learn more

- Visa Infinite Luxury Hotel Collection provides benefits like room upgrades, complimentary Wi-Fi and breakfast, late checkout, and so much more at over 900 Visa Infinite Luxury Hotel Collection properties around the world.

- Visa Infinite Dining Series - Each event includes multi-course meals, drink pairings and an interactive experience. You'll get to taste dishes from some of the country's top chefs and restaurants as they guide you through each course.

- Wine country benefit from wineries across Ontario and British Columbia including complimentary tastings and tours. You can also get access to online offers like complimentary shipping and savings on wine purchases.

- Get golf perks with Troon Rewards® through your Visa Infinite card and automatically receive Silver Status. You’ll save 10% on golf fees, merchandise, and lessons at over 150 courses around the world.

- Access to private movie events and at-home offers as part of the Visa Infinite Screening Series. In the fall, get special perks at the Toronto International Film Festival®.

- Visa Infinite card includes a Complimentary Concierge service that can offer help with anything like the perfect travel itinerary, restaurant recommendations, finding the perfect birthday gift, and more

RBC offers

As with all RBC cards the RBC Avion Visa Infinite Card receives RBC Offers. These exclusive limited time offers are sent out to cardmembers to receive statement credits, discounts or bonus points for using their card at select merchants. Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to RBC Royal Bank 'RBC Offers'

Partner benefits

RBC offers some exclusive benefits for all their credit cardholders with select retail partners in Canada. For the RBC Avion Visa Infinite Card those benefits are:

Link your Petro-Points card to your new RBC credit or debit card and use it to pay for purchases at Petro-Canada to always:

Save 3 ¢/L on gas with every fill-up

Earn 20% more Petro-Points

Earn more Be Well points at Rexall

Get 50 Be Well points for every $1 spent on eligible purchases when you shop at Rexall with your linked RBC® card

Enjoy $0 delivery fees with DoorDash

Get a complimentary DashPass subscription for up to 12 months with an eligible RBC credit card – a value of almost $120

Insurance

The RBC Avion Visa Infinite Card comes with a very strong insurance package that includes the following:

- Out of Province/Country Emergency Medical Insurance - 15 days under age 65, 3 days for 65+

- Trip Cancellation Insurance - $1,500 per person (up to $5,000 per trip)

- Trip Interruption Insurance - $5,000 per person (up to $25,000 per trip)

- Flight Delay Insurance - 4 hours $250 per person / $500 in total

- Baggage Delay Insurance - 4 hours $500 per person / $2,500 in total

- Lost or Stolen Baggage Insurance - $500 per person / $2,500 in total

- Car Rental Theft and Damage Insurance - 48 Days Up to $65,000 MSRP

- Hotel Burglary Insurance - Up to $2,500

- Travel Accident Insurance - $500,000

- Purchase Security Insurance - 90 Days Up to $50,000 annually

- Extended Warranty Insurance - Up to 1 extra year

- Mobile Device Insurance - Up to $1,500

What is good about this card

The welcome bonus - it is one of the easiest to achieve right now! 35,000 points on approval is really good! There are reports of the points posting to the account even before the physical card is received!

The airline conversion options are what most points and miles enthusiasts get this card for and are really what keep this card ranking in the top 10 cards in Canada. Plus, if you convert when they have a transfer bonus in place it provides that much more value for you.

The additional partner benefits, if you can utilize them, are great. The savings and extra points at Petro-Canada, the free Door Dash membership and extra Be Well points are welcome benefits with this card.

What is not so good about this card

The amount you have to spend to be rewarded. Once you earn your welcome bonus and have redeemed those bonus points it is going to take you a long time to earn enough points to redeem again, especially compared to the competition. If we take an example of a long haul flight in North America requiring 35,000 Avion Rewards points that means you need to spend between $28,000 and $35,000 on your Avion Card. Some cards in our market can achieve that same reward in their respective programs with as little as $8,000 in spending! That's a huge difference that must be considered.

Recommend reading: Loyalty Lesson: How to extract more value from Avion Rewards

In this lesson we discuss how you can increase your Avion Rewards points earn rates so that you don't have to spend as much!

The limited flexibility of the Air Travel Redemption schedule is another potential drawback with this card. While you can virtually book any flight, you can lose value if the price goes over or is well under the maximum ticket price. The issue of taxes and fees also comes up as you can only redeem points at a 100 to $1 ratio (a 1% return) thus eroding value again when compared to the competition.

No option to go book travel yourself and redeem points against the charge without losing value. Technically speaking, you can go book any travel you like outside of Avion Rewards Travel but then you have to redeem with the Pay Your Credit Card ratio of 17,200 points to $100. That's a big reduction in the value of your points and again there are competing cards that allow you to do the same all without losing value of your points for such a redemption.

Recommended reading: There is one very popular travel rewards credit card in Canada that is due for a major overhaul

Who should get this card

- Consumers who want quick access to being able to redeem for an award (Thanks to the easily earned welcome bonus!)

- Consumers who bank at RBC and want to keep all financial products with one bank (especially if your accounts give you a discount on your annual fee)

- Consumers who like having multiple redemption options with their points

- Consumers who are members of the Avion card's frequent flyer transfer partners and want a credit card to be able to earn more points or miles in those programs.

Conclusion

The RBC Avion Visa Infinite Card is one of Canada's most popular travel rewards credit cards thanks to its longevity and some hefty marketing dollars spent back in the day to promote the card! It was back in that day when this card reigned supreme by being a front runner in the any travel anywhere category and fired a direct shot at frequent flyer programs which back then were driving Canadians mad with a lack of award seat availability.

The problem is when you get that popular early on you don't think you have to change - in fact an RBC executive once told me this card is a hero product and didn't require any changes but unfortunately that wasn't and still isn't the case. The bank has stood idly by keeping this card the way it has been for the better part of two decades and they have let the competition fly right by them (pardon the pun) with credit cards that can get you a seat on a plane with a lot less spend and with more flexibility.

With all that being said however, it's not like the card is bad, in fact we still like it a lot and currently rank it as the 9th best card overall in Canada (years ago it used to be in the top 5!). This current ranking though is in large part due to being able to convert your points to airlines like British Airways. If the card didn't have that option there's a good chance it wouldn't even make the top 20.

Latest card details:

RBC Avion Visa Infinite Card

Get up to 55,000 Avion points^ (a value of up to $1,100†), that’s enough to fly anywhere in North America or the Caribbean!

Annual Fee: $120 | Additional Card Fee: $50 | 20.99% on purchases 22.99%* on cash advances and balance transfers *21.99% if you reside in Quebec.

- Earn 1 Avion point for every dollar you spend* and an extra 25% on eligible travel purchases.

- When you are ready to travel again, Avioners can book flights with points on any airline, on any flight, at any time, early or last minute, with no blackout periods or restrictions.

- Avioners earn points that never expire so your points will be waiting for your next adventure.

- Redeem your points for travel and more. Use points for anything from paying bills and paying your card balance to redeeming for Gift Cards and Merchandise at top brands like Apple. The Avion Rewards program gives you the freedom of choice to use your points your way, and helps you make the most as an Avioner.

- Eligible Avion Rewards members can also convert points to other loyalty programs including WestJet Points, British Airways Avios points and Hudson’s Bay Rewards points.

- Link your RBC card with a Petro-Points membership to instantly save 3₵ per litre on fuel at Petro-Canada stations and earn 20% more Petro-Points and 20% more Avion rewards points

- Link your RBC card with a Rexall Be Well account and get 50 Be Well points for every $1 spent on eligible products at Rexall. Redeem Be Well points faster for savings in store on eligible purchases where 25,000 Be Well points = $10

- Get access to RBC offers which provides access to earn points faster at specified brands

- Extensive insurance including: mobile device insurance, travel insurance (trip cancellation, interruption and emergency medical) and other eligible purchases to protect you and your family

- Avioners get access to luxury Visa Infinite benefits including first in line for exclusive events, and hotel and dining benefits.

- Up to a 2.3% return on your spending depending on which reward ticket you book

- Get $0 delivery fees for 12 months from DoorDash17 - Add your eligible RBC credit card to your DoorDash account to:

• Get a 12-month complimentary DashPass subscription18 – a value of almost $120

• Enjoy unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay with your eligible RBC credit card

Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

Other cards to consider if you are looking at this card:

- American Express Cobalt® Card

- American Express® Gold Rewards Card

- CIBC Aventura® Visa Infinite* Card

- Desjardins Odyssey World Elite Mastercard

- MBNA Rewards World Elite® Mastercard®

- National Bank of Canada World Elite Mastercard

- Scotia Gold American Express Card

- Scotiabank Passport Visa Infinite card

- TD First Class Travel® Visa Infinite* Card

This review was first posted on October 26, 2011 and is updated on a regular basis.

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!