"Why do I end up having to pay $800, $900 or more on top of my tens of thousands of points for a reward flight to Europe?"

That's a common question posed to Rewards Canada from users of three credit card loyalty programs - primarily RBC Avion Rewards and to a lesser extent, CIBC Aventura Rewards and American Express Membership Rewards.

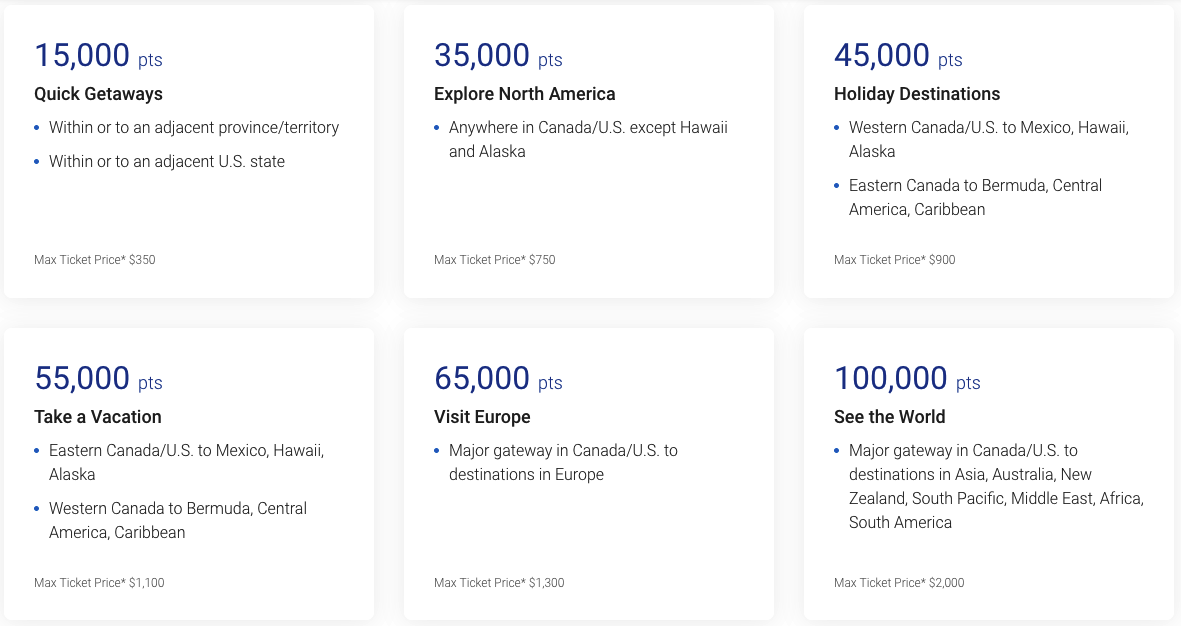

The reason why we get this question is these three proprietary credit card reward programs all offer their members a fixed points reward chart for redeeming for flights. RBC's is called the Avion Air Travel Redemption Schedule, CIBC's is the Aventura Airline Rewards Chart and Amex's is Fixed Points for Travel.

Regardless of the name, they all operate on the same principal and many credit card holders are surprised when they go to redeem their hard earned points for a flight to Europe and find they are subject to a huge cash amount they still have to pay in addition to the points.

This Loyalty Lesson will explain why that's the case and show you examples of those points+huge cash co-pay amounts. And if Europe is on your radar for future reward travels in economy class, the lesson closes out with a look at the programs and credit cards that can provide better value.

How a credit card flight reward chart works

A credit card flight reward chart is similar to traditional frequent flyer program charts where members redeem a set number of points to get a reward flight. The amount of points required depends on the region and unlike most frequent flyer programs, the points redeemed with these credit card reward charts only cover the base fare of a ticket up to a maximum set price per region.

As this loyalty lesson is looking at flights from Canada to Europe, these are the points requirements from the three programs for these flights:

| Program | Points required for a round trip economy class ticket to Europe | Maximum Ticket Value |

|---|---|---|

| American Express Fixed Points for Travel | 60,000 | $900 |

| CIBC Aventura Airline Rewards Chart | 50,000 to 70,000 | $1,300 |

| RBC Avion Air Travel Redemption Schedule | 65,000 | $1,300 |

Just as they all operate on the same principle, they also all have the same rule that the fixed amount of points only cover the base fare of the airline ticket up to maximum amount as shown in the chart above. In layman's terms, base fare is the price of the ticket not including any carrier surcharges, taxes or fees. This is where some confusion comes in for many of these cardholders as they assume they will be receiving $900 or $1,300 off the price of their ticket no matter what but unfortunately that's not the case.

Why they rarely provide good value for economy class to Europe

No matter where you are flying in the world, all airline tickets are comprised of a base fare, surcharges, taxes and fees but flights between Canada and Europe are unique in that they are almost always priced with really low base fares combined with huge carrier surcharges. On top of this they also have the all the standard taxes and fees that are levied on airline tickets. Flights within Canada, to the U.S. and other international destinations also have surcharges but are nowhere near out of proportion like they are for Europe so the reward charts tend to provide better value for those other regions.

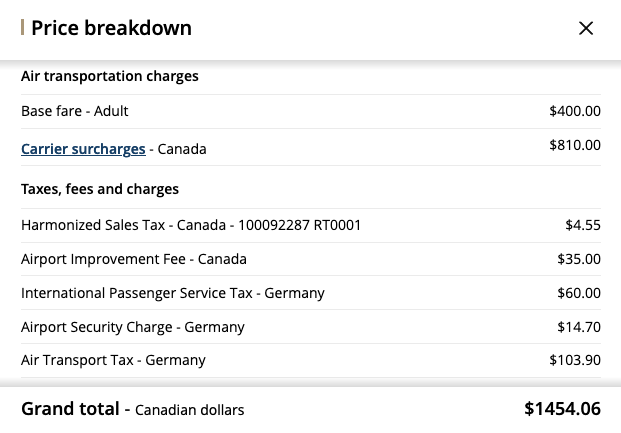

We'll start this section off by showing an example of the disproportionate pricing on a flight to Europe:

This $1,400 ticket is mostly comprised of the carrier surcharge, taxes and fees! In this example, a credit card reward chart options would only cover $400 plus a small amount of the surcharges that do move into the base fare when being billed through another agency like the credit card programs (see the Air Canada example below) and then the rest you would have to pay for with cash or additional points.

Therein lies the reason why these reward charts rarely provide good value for economy class flights to Europe, it is strictly due to the points being redeemed only covering the base fare. I think you are already getting the gist of this loyalty lesson but lets look at some real world examples to show you exactly how these rewards can turn out.

Examples of not so good to OK value

Here are examples of three popular round trip flights to Europe, Toronto to Frankfurt, Montreal to Paris and Calgary to London. In each we'll show you the price breakdown of purchasing the ticket outright with the airline and then how those same flights price out using the three credit card program's fixed points reward chart options.

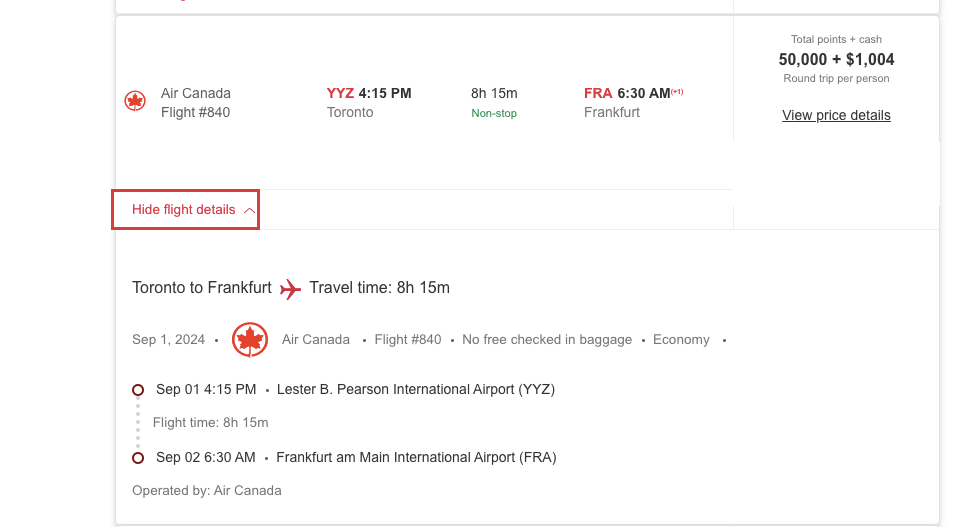

Air Canada: Toronto to Frankfurt - Sep 1 - 11

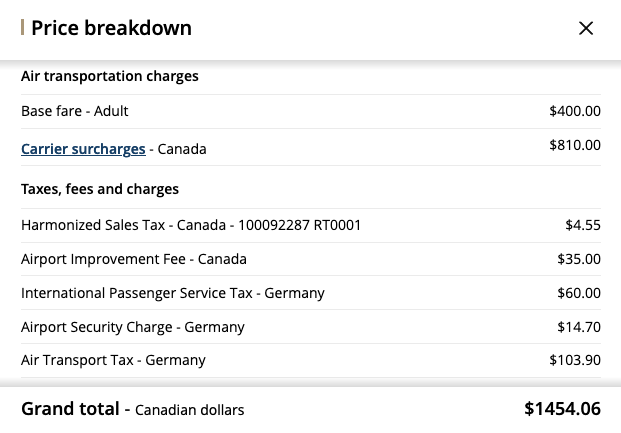

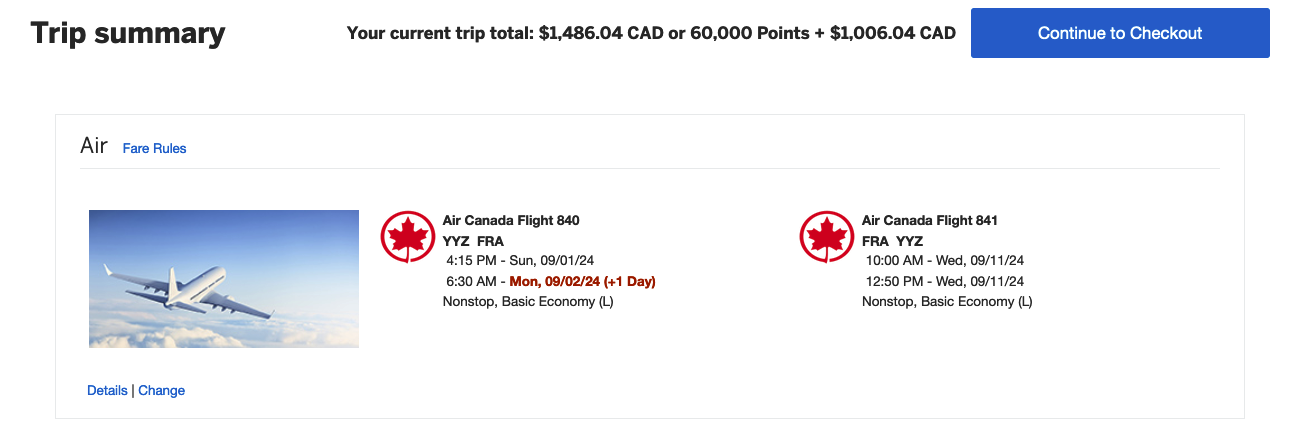

Here is the price breakdown if you were to buy this flight directly from Air Canada:

You'll notice the base fare is $400 and the total overall fare is $1,454.06! Over $1,000 of this ticket are extra charges, namely an $810 carrier surcharge.

American Express Membership Rewards

Here's the same flight via American Express Travel using their Fixed Points for Travel reward chart option:

If you choose this option you would have to redeem the fixed points amount of 60,000 and it only covers $480 of the total ticket cost - even with the chart allowing a maximum base fare of $900. You still have to pay $1,006.04 to cover all the surcharges, fees and taxes. With the 60,000 points only covering $480 of the ticket you would only receive 0.8 cents per point of value from each Amex Membership Rewards point. In this case you are better offer using Amex's Pay with Points option where you redeem 1,000 points for $10 against your charge and you would only end up using 48,000 points to cover the $480 plus any extra points you would want to use to cover the rest of the ticket.

CIBC Aventura Rewards

Here's the same flight via CIBC Rewards using their Aventura Airline Rewards Chart option:

If you choose this option you would redeem a fixed points amount of 50,000 as CIBC's chart is slightly dynamic based on the base fare and those points will only cover $450.06 of the total ticket cost - even with the chart allowing a maximum base fare of $1,300. You still have to pay $1,004 to cover all the surcharges, fees and taxes. With the 50,000 points only covering $450 of the ticket you would only receive 0.9 cents per point of value from each CIBC Rewards point. In this case you are better offer using CIBC's any travel redemption option where you redeem 100 points for $1 against your charge and you would only end up using 45,006 points to cover the $450.06 plus any extra points you would want to use to cover the rest of the ticket.

RBC Avion Rewards

Here's the same flight via RBC Avion Rewards using their Avion Air Travel Redemption Schedule option:

If you choose this option you would have to redeem the fixed points amount of 65,000 and it only covers $479.10 of the total ticket cost - even with the chart allowing a maximum base fare of $1,300. You still have to pay $974.96 to cover all the surcharges, fees and taxes. With the 65,000 points only covering $479.10 of the ticket you would only receive 0.74 cents per point of value from each Avion point. In this case you are better offer using RBC's Flexible Travel option where you redeem 100 points for $1 of travel booked via RBC Avion Rewards which means you would only end up using 47,910 points to cover the $479.10 plus any extra points you would want to use to cover the rest of the ticket.

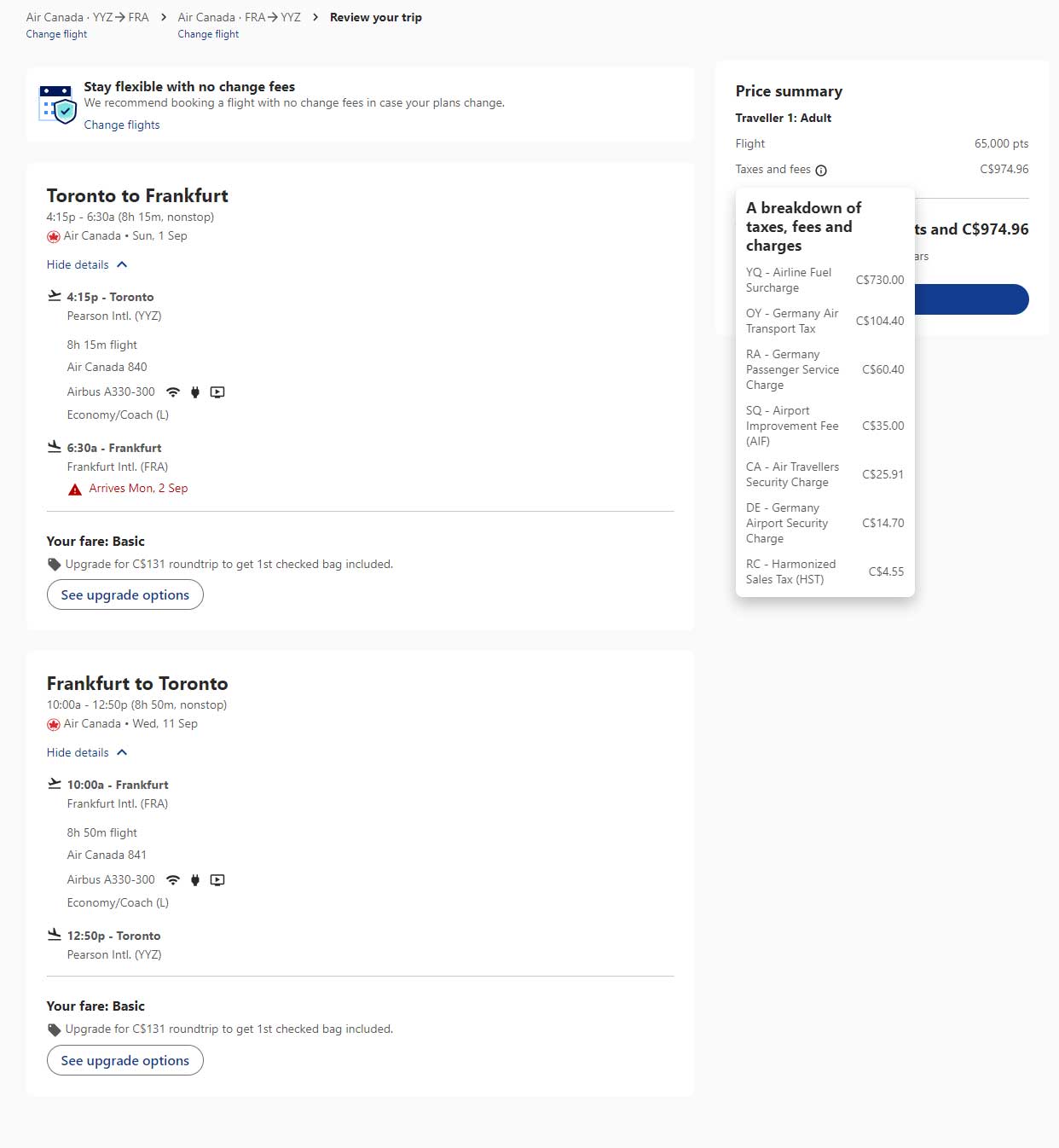

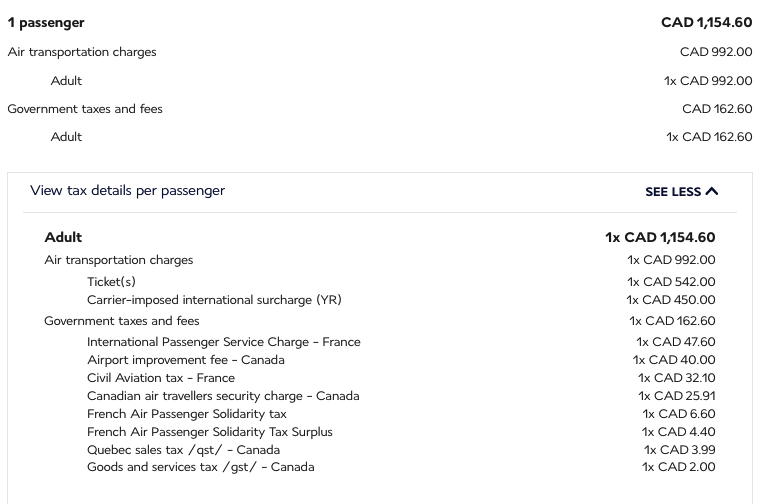

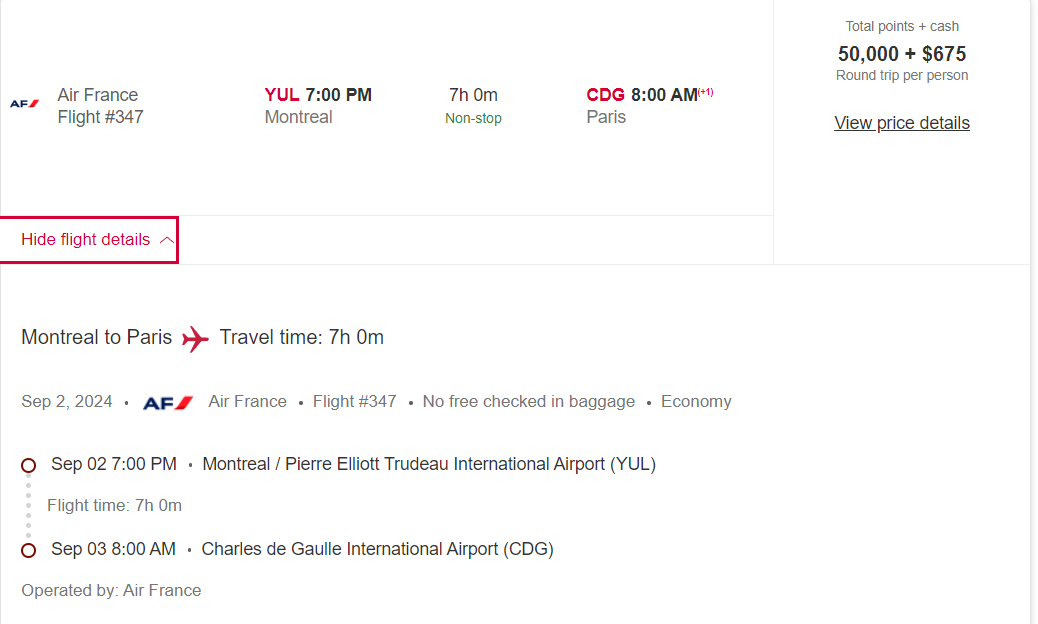

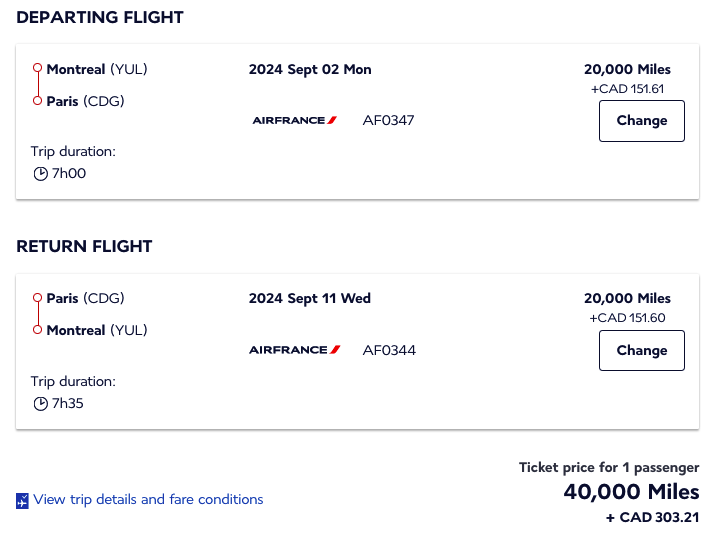

Air France: Montreal to Paris Sep 2 -11

Here is the price breakdown if you were to buy this flight directly from Air France:

You'll notice the base fare is $542 with the total overall fare coming in at $1,154.60. Just over $600 of this ticket are extra charges, namely an $450 carrier surcharge.

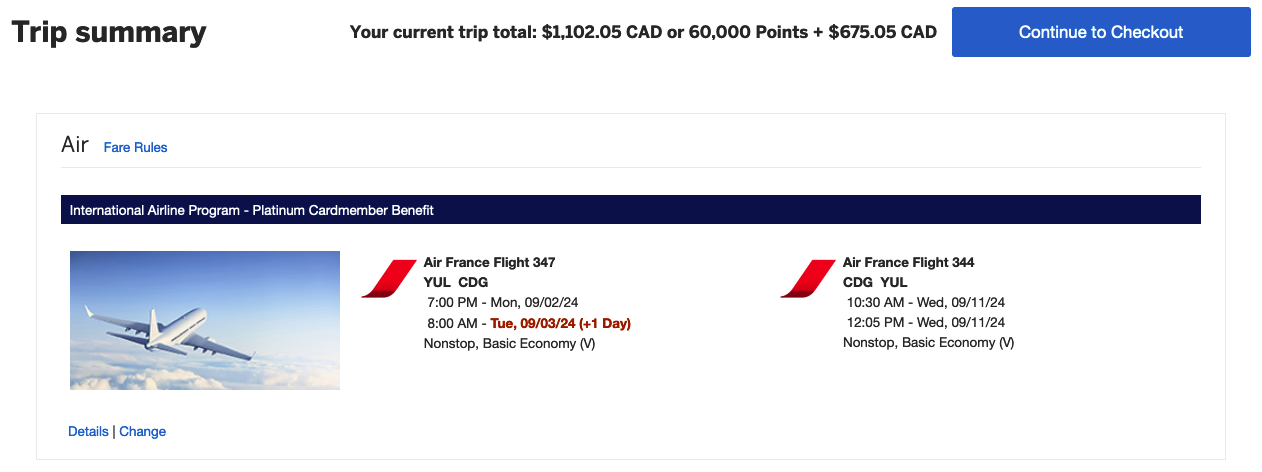

American Express Membership Rewards

Here's the same flight via American Express Travel using their Fixed Points for Travel reward chart option:

If you choose this option you would have to redeem the fixed points amount of 60,000 and it only covers $479.55 of the total ticket cost - even with the chart allowing a maximum base fare of $900. You still have to pay $675.05 to cover all the surcharges, fees and taxes. With the 60,000 points only covering $479.55 of the ticket you would only receive 0.8 cents per point of value from each Amex Membership Rewards point. In this case you are better offer using Amex's Pay with Points option where you redeem 1,000 points for $10 against your charge and you would only end up using 47,955 points to cover the $479.55 plus any extra points you would want to use to cover the rest of the ticket.

CIBC Aventura Rewards

Here's the same flight via CIBC Rewards using their Aventura Airline Rewards Chart option:

If you choose this option you would redeem a fixed points amount of 50,000 as CIBC's chart is slightly dynamic based on the base fare and those points will only cover $479.60 of the total ticket cost - even with the chart allowing a maximum base fare of $1,300. You still have to pay $675 to cover all the surcharges, fees and taxes. With the 50,000 points only covering $479.60 of the ticket you would only receive 0.96 cents per point of value from each CIBC Rewards point. In this case you are better offer using CIBC's any travel redemption option where you redeem 100 points for $1 against your charge and you would only end up using 47,960 points to cover the $479.60 plus any extra points you would want to use to cover the rest of the ticket

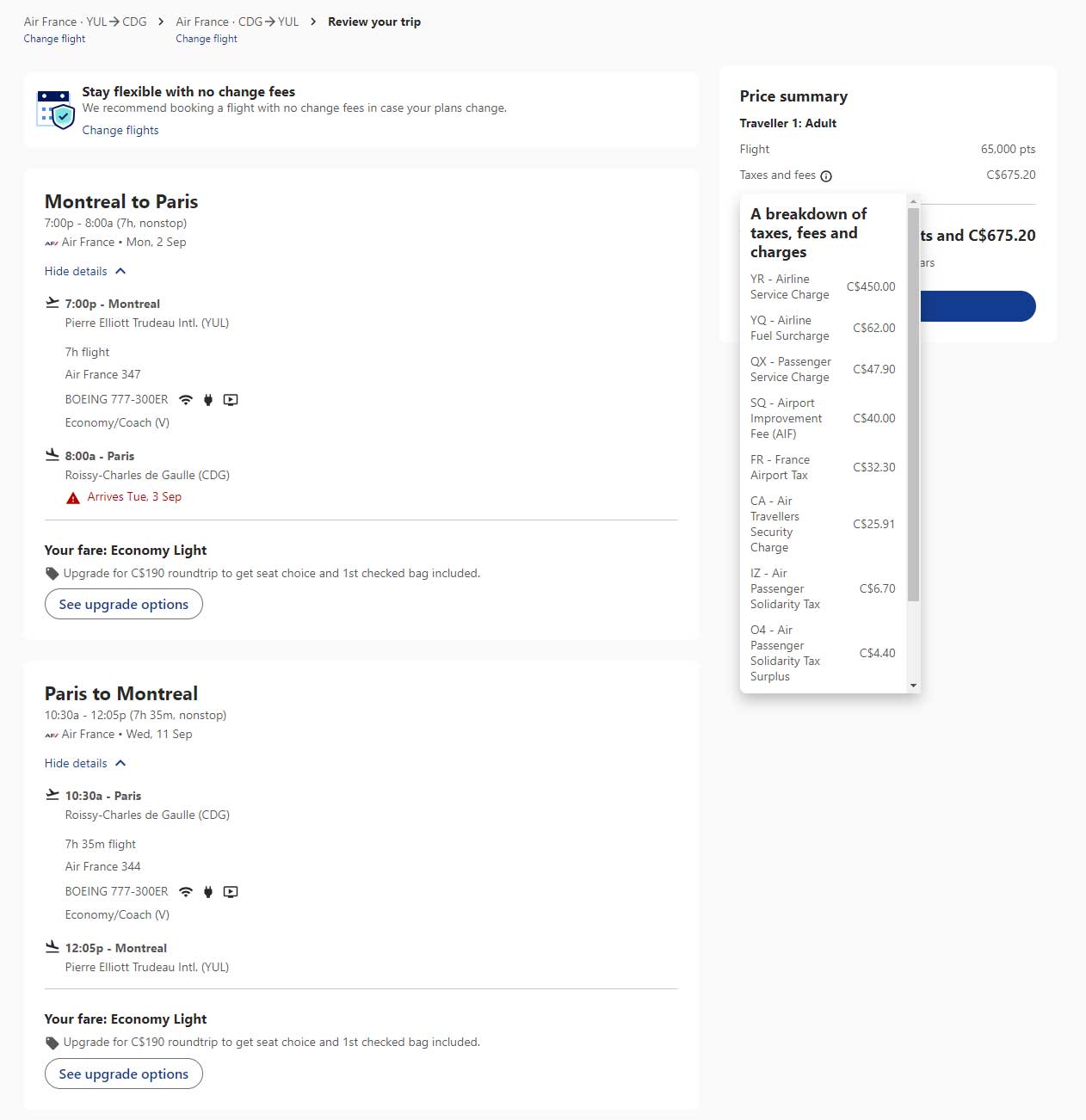

RBC Avion Rewards

Here's the same flight via RBC Avion Rewards using their Avion Air Travel Redemption Schedule option:

If you choose this option you would have to redeem the fixed points amount of 65,000 and it only covers $479.40 of the total ticket cost - even with the chart allowing a maximum base fare of $1,300. You still have to pay $675.20 to cover all the surcharges, fees and taxes. With the 65,000 points only covering $479.40 of the ticket you would only receive 0.74 cents per point of value from each Avion point. In this case you are better offer using RBC's Flexible Travel option where you redeem 100 points for $1 of travel booked via RBC Avion Rewards which means you would only end up using 47,940 points to cover the $479.40 plus any extra points you would want to use to cover the rest of the ticket.

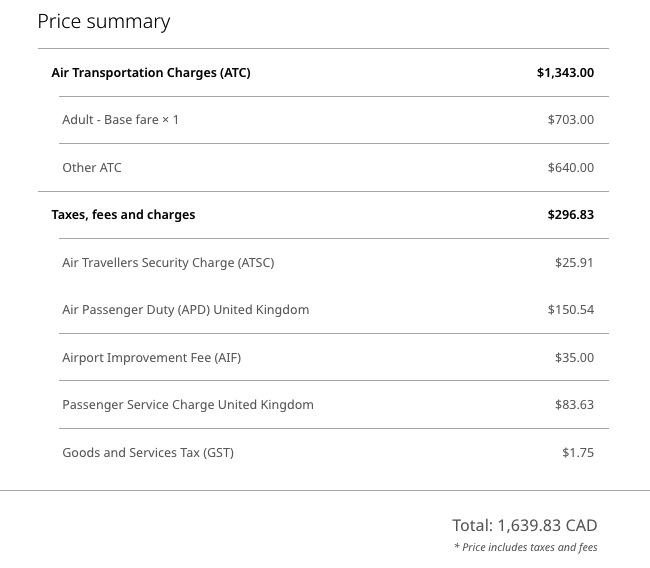

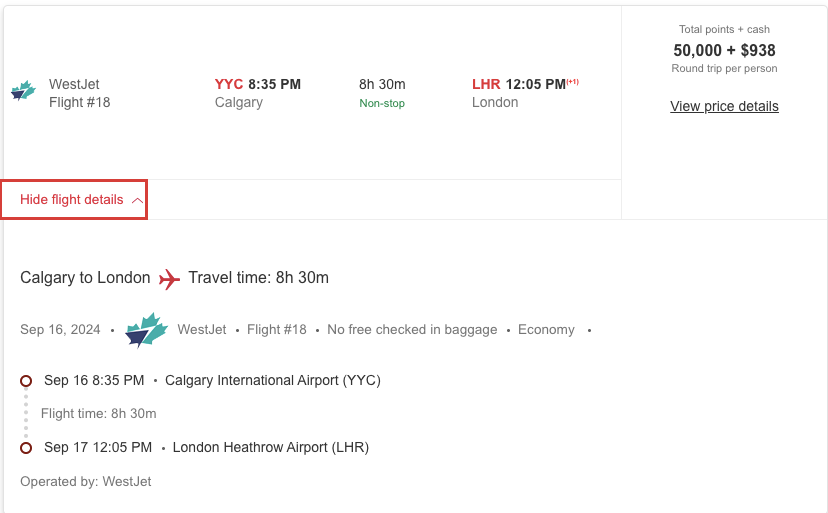

WestJet: Calgary to London Sep 1 - 11

Here is the price breakdown if you were to buy this flight directly from WestJet:

You'll notice the base fare is $703 with the total overall fare coming in at $1,639.83. You have nearly $1,000 of extra charges, of which $640 carrier surcharge.

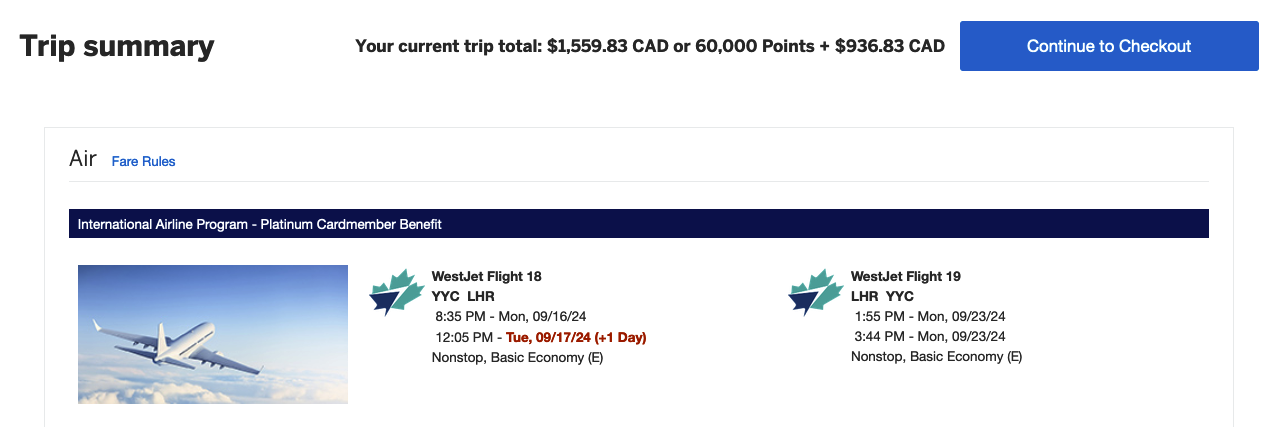

American Express Membership Rewards

Here's the same flight via American Express Travel using their Fixed Points for Travel reward chart option:

If you choose this option you would have to redeem the fixed points amount of 65,000 and it only covers $623 of the total ticket cost - even with the chart allowing a maximum base fare of $900. You still have to pay $936.83 to cover all the surcharges, fees and taxes. With the 60,000 points only covering $623 of the ticket you would receive 1.04 cents per point of value from each Amex Membership Rewards point - that's actually OK and is just ever so slightly better than Amex's Pay with Points option where you redeem 1,000 points for $10 against your charge but still lower than other potential options with the reward chart. And, you are still on the hook for $900+ in fees which you pay for with cash or use the Pay with Points option for.

CIBC Aventura Rewards

Here's the same flight via CIBC Rewards using their Aventura Airline Rewards Chart option:

If you choose this option you would redeem a fixed points amount of 50,000 as CIBC's chart is slightly dynamic based on the base fare and those points will only cover $701.83 of the total ticket cost - even with the chart allowing a maximum base fare of $1,300. You still have to pay $938 to cover all the surcharges, fees and taxes. With the 50,000 points covering $701.83 of the ticket you receive 1.4 cents per point of value from each CIBC Rewards point. That's actually quite good considering you can earn up to 3x points with Aventura cards, still lower than the maximum potential values but in the end this is one of those rare occasions the reward chart works out better. Still, like all the other examples you are on the hook for $900+ in fees which you can pay for with cash or use the flexible travel option for.

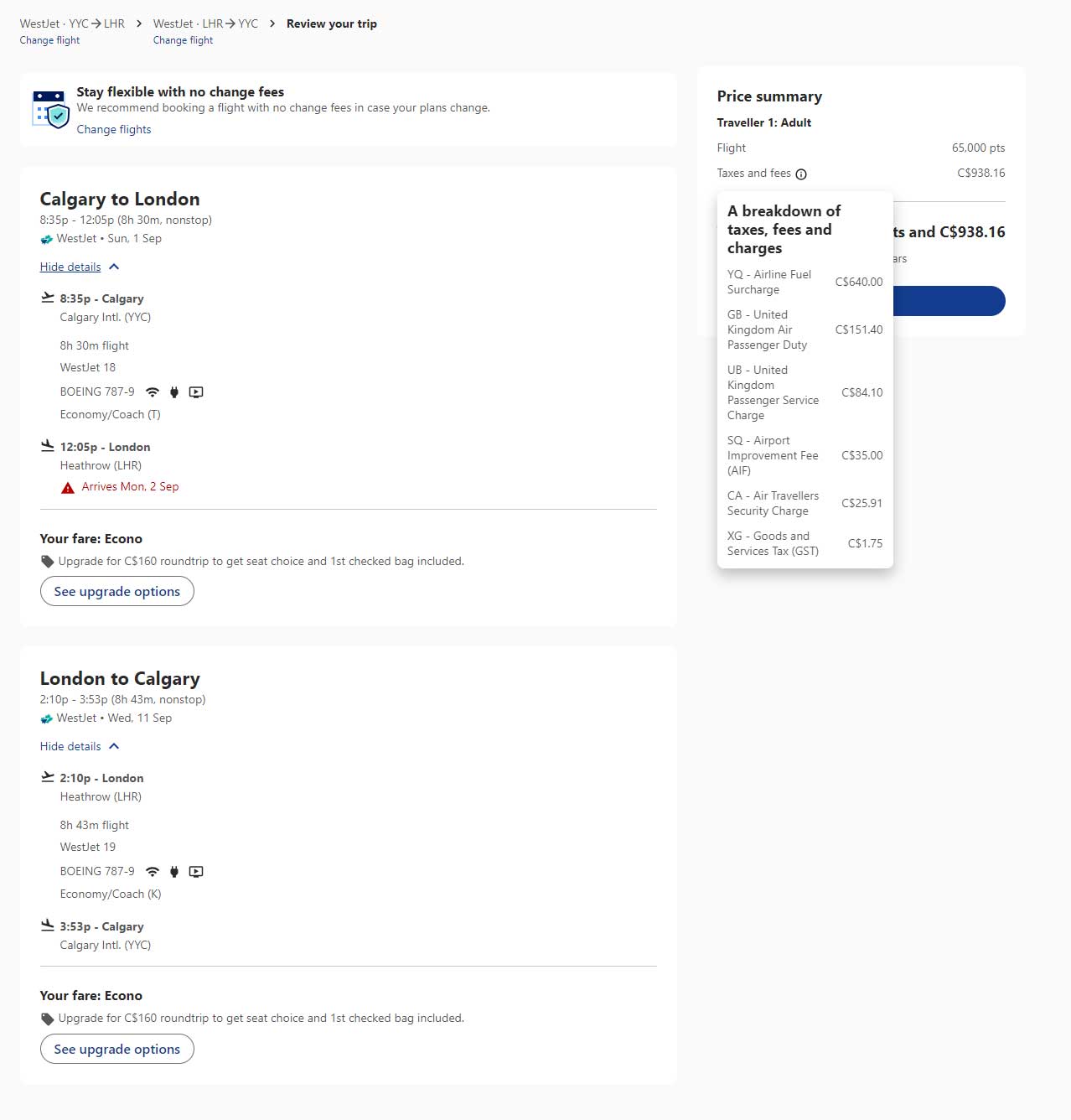

RBC Avion Rewards

Here's the same flight via RBC Avion Rewards using their Avion Air Travel Redemption Schedule option:

If you choose this option you would have to redeem the fixed points amount of 65,000 and it only covers $701.76 of the total ticket cost - even with the chart allowing a maximum base fare of $1,300. You still have to pay $938.16 to cover all the surcharges, fees and taxes. With the 65,000 points only covering $701.76 of the ticket you would only receive 1.1 cents per point of value from each Avion point - that's actually OK and is just ever so slightly better than RBC's Flexible Travel option where you redeem 100 points for $1 of travel but still lower than other potential options with the reward chart. And, you are still on the hook for $900+ in fees which you can pay for with cash or use the flexible travel option for.

Credit Card Reward Chart Summary

There you have it, even though we're only showing three possible redemption options out of thousands, the results will be the same for the majority of them and this is the reason why credit card reward charts rarely provide good value for economy class flights to Europe. There is the potential for them to provide better value if you are purchasing more expensive economy class tickets such as last minute flights, but you will still have a large co-pay amount. A $2,000 last minute ticket might have a base fare of $1,100 and all the surcharges, taxes and fees in that $900 range. In that case the 60,000, 65,000 or even 70,000 points redeemed for an $1,100 base fare will provide a much better value per point.

In general though, the problem with the reward charts and their respective points only covering the base fare is that most cardholders who look at these charts aren't digging into the fine print. They will see the points are worth up to $1,300, find a flight to Europe that is $1,400 and think they are golden as the points will cover all but $100 of the ticket - unfortunately that's not the case and that's when we get an email from them asking why?

And the card issuers don't help the situation either. We've often seen claims that a welcome bonus offer provides enough points for a flight to Europe - and sure enough it does, but they're not telling you that you'll also have fork over a good chunk of cash along with the points.

All is not lost however! Continue reading this Loyalty Lesson to see which reward programs do provide good value for economy class flights to Europe.

Programs that can provide good value for economy class flights to Europe

American Express Membership Rewards

Yes, we just finished explaining how Amex's Fixed Points for Travel may not provide the best value for flights to Europe but Amex's Membership Rewards isn't ranked the number one loyalty currency in Canada for nothing! It has other travel options like it's Pay with Points redemption which provides up to a 5% return (which in many cases beats the value found on the Avion Rewards or CIBC Rewards charts and for most flights to Europe beats the value of Amex's own chart) The Membership Rewards program also provides an option to convert points to frequent flyer programs, three of which, Air Canada Aeroplan, Air France KLM Flying Blue and British Airways Executive Club are all listed below since they are all good programs for economy class flights to Europe!

Air Canada Aeroplan

With the Air Canada Aeroplan program no longer passing along carrier surcharges on award tickets, the program has the ability to provide good value on economy class tickets across the pond as they can run as low as 60,000 to 70,000 points round trip. Finding flights at those rates however can be a prove to be a task in itself depending on when and where you are flying as Aeroplan award flights are dynamically priced.

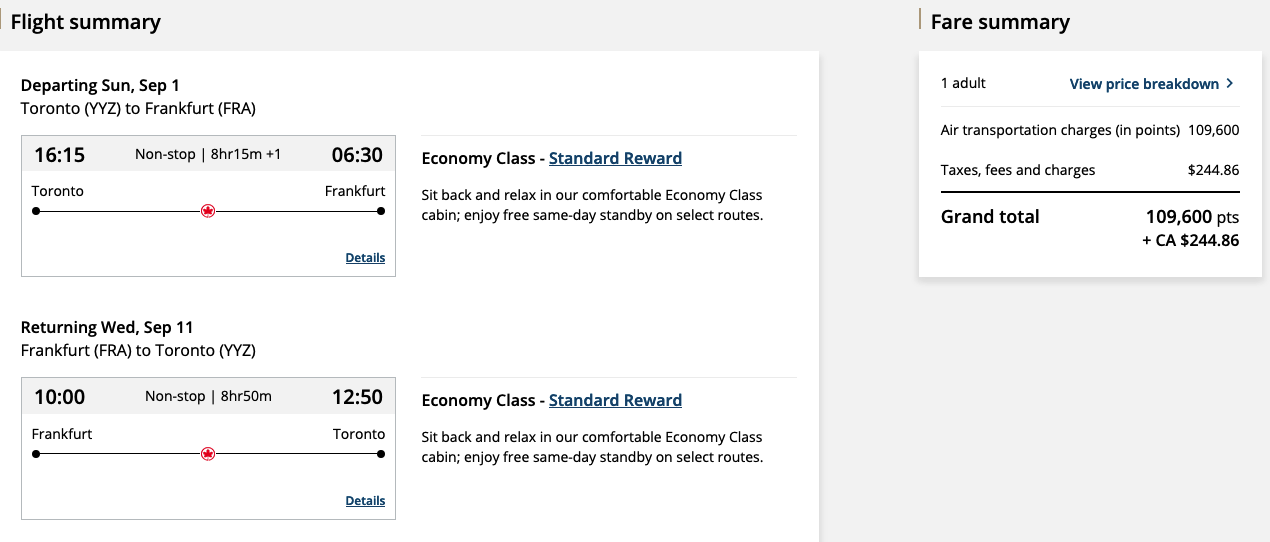

For example, if we look at the Toronto to Frankfurt example from above, here's how many Aeroplan points it requires:

As you can see you can redeem 109,000 Aeroplan points for this flight + $244.86 in taxes. That's much higher than the 60,000 to 70,000 points one would hope for but still this works out to 1.1 cents per point in value. With the Aeroplan program that isn't the greatest value but it's better than the redemption amounts for the same flight using the credit card reward charts. For example if you earned these Aeroplan points with the American Express Cobalt Card's 5x points on eats and drinks, that works out to a 5.5% return on spending, which most cards in Canada can't even compete with! Compare this to using those same points with Amex's Fixed Points for Travel where the return is 4% since it only had a value of 0.8 cents per point or even Amex's Pay with Points which would be a 5% return.

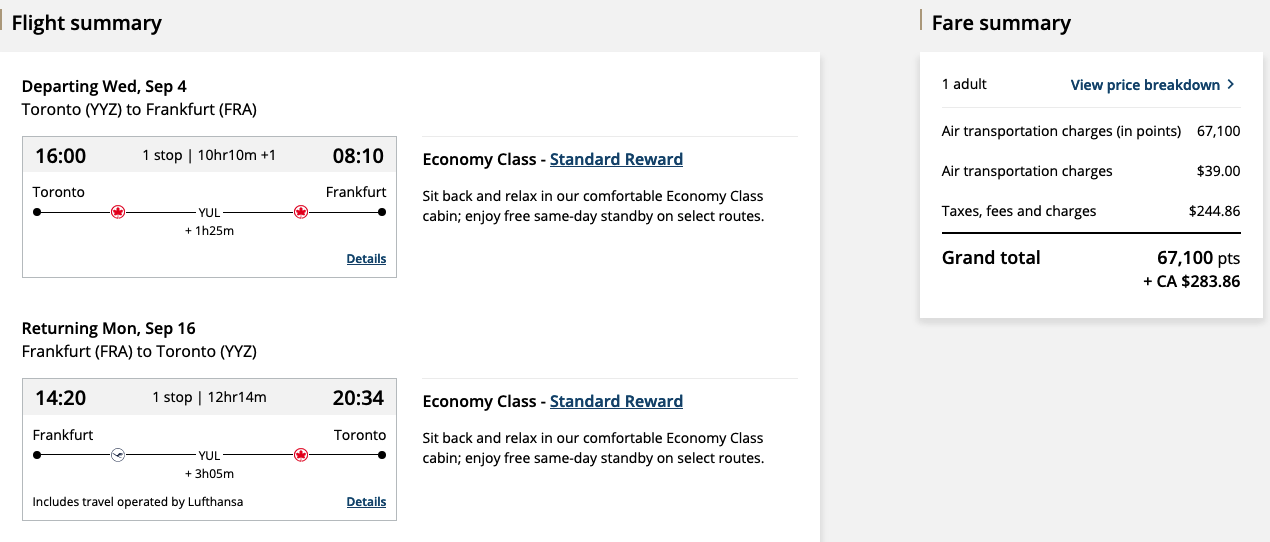

All that being said if you are flexible and don't mind a connection, Aeroplan has lower priced options. Here's Toronto to Frankfurt from Sep 4 to 16 with a connection:

The cash price for the above flight is $1549.86, so the 67,100 points covers $1266.00 of the ticket price which provides a better value of 1.89 cents per point.

Air France KLM Flying Blue

Rewards Canada considers Air France KLM's Flying Blue program the best option for economy class reward travel between Canada and Europe thanks to low minimum mileage requirements and them offering flights out of seven major Canadian cities.

If we look at the Montreal to Paris example from above, it is much better to book it using Flying Blue miles:

As you can see you can redeem as little as 40,000 Flying Blue Miles for this flight + $303.21 in surcharges, fees and taxes. That's a much better value proposition than the credit card reward charts shown above! For those who are interested, this works out to 2.13 cents per mile in value. That is a great value for economy class.

What makes booking with Flying Blue even more valuable is the economy class award tickets include the first checked bag free. The credit card reward chart examples above do not, nor do the Aeroplan examples right above this - in all those cases you still have to pay bag fees over and above everything else.

Outside of flying with Air France, KLM or their airline partners (which include WestJet) there are many ways to earn Flying Blue Miles in Canada including the Air France KLM World Elite Mastercard, transfers from American Express, hotel stays with many brands including Marriott and Accor, Ticketmaster purchases and the Flying Blue online shopping portal just to name a few.

Once again though this is where Amex shines as you can convert 53,400 Membership Rewards points to 40,050 Flying Blue Miles. This means with Amex's conversion option you would only end up only using 53,400 points and paying $303.21 in fees instead of the Amex Fixed Points for Travel reward chart option of 60,000 points + $675.05 in fees.

What we haven't even touched upon here with Flying Blue are their Promo Rewards, which are monthly promotional offers of 25% to 50% off award tickets from select cities in Canada to Europe, North Africa and Turkey. Quite often we do see 25% off economy class which means those round trip flights can be had for 30,000 Flying Blue Miles (40,000 Amex Membership Rewards Points), which means the value just gets even better.

British Airways Executive Club

Another program that can provide better value on Transatlantic economy class flights, especially to the UK and Ireland, is British Airways Executive Club.

Let's take a look at some examples of economy class flights with this program. First, Toronto to London Heathrow:

As you can see you can redeem as little as 50,000 Avios for this flight + only $200 in surcharges, fees and taxes. That's a much better value proposition than the credit card reward charts shown above! For those who are interested, the cash price for this flight was $985.86 which means this reward works out 1.57 cents per Avios in value.

Outside of flying with British Airways or their airline partners there are many ways to earn Avios in Canada including the RBC British Airways Visa Infinite Card, transfers from American Express, transfers from RBC Avion Rewards (only if you have an Avion Visa card) hotel stays with many brands like Marriott and Accor, car rentals and more.

For RBC Avion cardholders, a redemption like this is a better option since you can convert Avion points to British Avios on a 1:1 basis (plus once or twice per year they offer a bonus on transfers that is typically 30%). If you convert at 1:1 you would only need 50,000 RBC Avion Points + $200 cash versus the air redemption schedule at 65,000 points plus $900+ in fees, taxes, etc. (The base fare for this ticket is $45) If you convert with a 30% bonus you would be looking at only redeeming 39,000 Avion Rewards points!

And again Amex shines as you can also convert Membership Rewards points to Avios on a 1:1 basis. This means with Amex's conversion option you would only end up only using 50,000 points and paying $200 in fees instead of the Fixed Points for Travel reward chart option of 60,000 points + over $900 in fees. What makes this really shine is Amex's Cobalt Card with its 5x points earning means you only need to spend as little as $10,000 for this reward - compare this to the RBC Avion cards needing a minimum of $31,200 in spending and that's taking into account a 30% transfer bonus to British Airways!

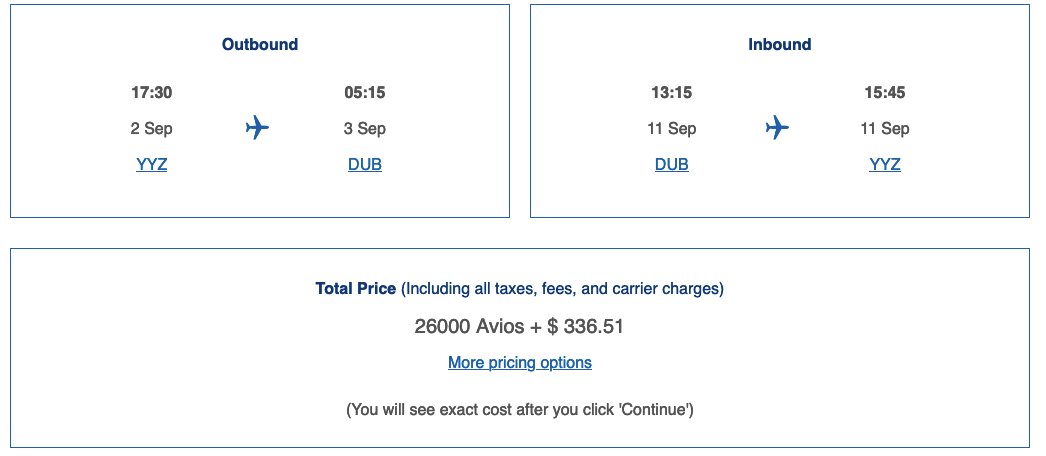

Let's look at one more British Airways example and that's the famous redemption option from Toronto to Dublin on Aer Lingus:

This reward has been famous for years as British Airways Executive Club Off-Peak pricing on this route is only 13,000 Avios one way or 26,000 round trip. Technically speaking you can actually get Toronto to London rewards for the 26,000 Avios as well but the surcharges, fees and taxes are extremely high, whereas to Dublin they are still reasonable.

As you can see you can redeem as little as 26,000 Avios for this flight + only $336.51 in surcharges, fees and taxes. That's a immensely better value proposition than the credit card reward charts shown above! And like the Flying Blue rewards, these reward flights include your first checked bag as well! For those who are interested, the cash price for this flight was $832.50 which means this reward works out 1.9 cents per Avios in value.

For RBC Avion cardholders, a redemption like this is a great option since you can convert Avion points to British Avios on a 1:1 basis (plus once or twice per year they offer a bonus on transfers that is typically 30%). If you convert at 1:1 you would only need 26,000 RBC Avion Points + $336.51 cash versus the air redemption schedule at 65,000 points plus almost $500 in fees, taxes, etc. If you convert with a 30% bonus you would be looking at only redeeming 20,000 Avion Rewards points!

And again Amex shines as you can also convert Membership Rewards points to Avios on a 1:1 basis. This means with Amex's conversion option you would only end up only using 26,000 points and paying $336.41 in fees instead of the Fixed Points for Travel reward chart option of 60,000 points + nearly $500 in fees. What makes this really shine is Amex's Cobalt Card with its 5x points earning means you only need to spend as little as $5,200 for this reward - compare this to the RBC Avion cards requiring a minimum of $16,000 in spending when you take into account the 30% transfer bonus to British Airways!

Any travel at anytime credit card rewards

Finally, another good option for Transatlantic economy class flights, well in fact any flights worldwide, are the credit cards with high accelerated earn rates that offer any travel at anytime redemption options. These are the cards that we refer to as "points earning machines" and they are the American Express Cobalt Card, MBNA Rewards World Elite Mastercard and the Scotiabank Gold American Express Card. For this feature we'll even put the National Bank of Canada World Elite Mastercard into the mix.

These cards earn up to 6 points per dollar spent on select everyday spending categories that when redeemed for their respective best any travel anytime reward option (which for all of them is 1 cent per point) end up providing up to a 6% return on spending.

- American Express Cobalt Card:

- 5x points on groceries, dining, food delivery, bakeries, coffee shops etc. = 5% return

- 3x points on select streaming services = 3% return

- 2x points on transit, travel, gas, ride sharing = 2% return

- 1x points on all other purchases = 1% return - MBNA Rewards World Elite Mastercard:

- 5x points on restaurant, grocery, digital media, membership, and household utility purchases + 10% annual bonus (up to 15,000 points annually) = 5% return (5.5%with the annual bonus)

- 1x points on all other purchases = 1% return (1.1%with the annual bonus)

- Scotiabank Gold American Express Card:

- 6x points at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op = 6% return

- 5x points at eligible grocery stores, restaurants, fast food, and drinking establishments. Includes popular food delivery and food subscriptions = 5% return

- 3x points on eligible gas and daily transit. Includes rideshare, buses, taxis, subway, and more = 3% return

- 1x points on all other purchases = 1% return - National Bank of Canada World Elite Mastercard

- Earn up to 5x points per dollar in eligible grocery and restaurant purchases = up to a 5% return

- 2x points per dollar in eligible gas and electric vehicle charging purchases, recurring bill payments and À la carte travel purchases = 2% return

- 1x point per 1 dollar in other purchases = 1% return

Recommended reading: Credit Cards Ranked: Any Travel at Anytime Rewards

5 Takeaways from this Loyalty Lesson:

- Don't let the relatively poor value of the European reward options from these charts dissuade you from ever using the charts for other regions as those can provide some great value for travel to other parts of the world.

- It solidifies our ranking of American Express Membership Rewards as the number one travel rewards points currency in Canada as the program provides so many options to get the best possible redemption for you. Whether it's any travel at anytime, the fixed points for travel chart (other than Europe in most cases) or conversions to Air Canada Aeroplan, Air France KLM Flying Blue, British Airways Executive Club and so on - you are covered.

- No matter what other cards you have in your wallet, it is really beneficial to have one of the points earning machines as part of your credit card portfolio. The American Express Cobalt Card is our number one choice since it gives you high earn rates combined with the entire gamut of redemption options but the other cards listed above also provide excellent value.

- Air France KLM Flying Blue is one of the best frequent flyer programs for Transatlantic flights out of Canada but other programs like British Airways Executive Club are also a viable and valuable option. It will come down to where you want to travel!

- Unfortunately, just like quite a few of our other features, lessons and articles, it continues to show the inherent weakness of the suite of RBC Avion Visa cards. They had the lowest cents per point value out of any of the examples above and with low earn rates, it takes a lot of spending to earn enough points for a reward. Not to mention if you do go the route of one of the frequent flyer programs, the RBC cards have a hard time competing against American Express in terms of earning those miles, points and Avios.

Wrapping it up

You should be able to see from this Loyalty Lesson, that for the most part, the three credit card reward chart options rarely provide good value for Transatlantic economy class flights. Our WestJet example is one of them that ever so slightly works in favour of the charts over a flexible travel redemption but in our experience this is few and far between - and you're still paying hundreds of dollars in fees. That's where the biggest issue lies as cardholders see that they can get a ticket worth up to $1,300 and think they may only have to pony up an extra three hundred odd dollars for the WestJet flight - not the $900+ that is actually being charged.

So we hope this Loyalty Lesson helps answer that frequent question we get of "Why do I end up having to pay $800, $900 or more on top of my tens of thousands of points for a reward flight to Europe?" and helps you make an informed decision as to what the right credit card and loyalty program is for you if you are looking for reward flights to Europe.

Special thanks to Yves, Omkar, and Yu Tin for providing some of the screenshots used in this feature

Title image by B. Hochsprung from Pixabay

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

Check out some of our other loyalty lessons:

- When earning 5x points isn't the same as earning 5x points - a loyalty lesson

- There is one very popular travel rewards credit card in Canada that is due for a major overhaul

- Loyalty Lesson: The first points & miles credit card you should get

- Loyalty Lesson: Why hybrid rewards credit cards are the best bet for most Canadians

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation in our Facebook Group or on Twitter!