In this review we look at the Marriott Bonvoy™ American Express®* Card which is the credit card that receives an honourable mention in Rewards Canada's annual Top Travel Credit Card rankings. This is thanks to its ability to provide huge outsized value and by having some amazing benefits that can be used year after year. We hope with this review that more Canadians can learn about the value that hotel loyalty programs can provide as the last major survey conducted showed only 13% of Canadians participated in hotel loyalty programs

The review of the Marriott Bonvoy American Express Card is broken down into the following sections:

Overview

The Marriott Bonvoy American Express Card is a dream card for points maximizers, luxury travellers and really should be a consideration for many Canadians. It has one of Canada's best everyday earn rates (spending on non bonused categories), it gives you a free night stay each year with your card anniversary, has a welcome bonus that can provide big value and it makes it easier to achieve elite status within the Marriott Bonvoy program. When you take into account that you can redeem points for stays at over 9,000 hotels ranging from a road trip stay in a small Canadian town to a once in a lifetime vacation in the Maldives, you can start to see why this card is a dream!

Costs & Sign up Features

Fees

The Marriott Bonvoy American Express Card comes with a $120 primary card annual fee which used to be the standard for this level of credit card (a premium card) but is more attractive now as many competitors are charging $139 to $150 per year. Supplementary cards are also a great deal here as they don't cost anything!

Welcome Bonus

New Marriott Bonvoy® American Express®* Cardmembers earn 50,000 Marriott Bonvoy® points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership. Subject to change at any time.

Rates & Income Requirements

The interest rate on the card is 21.99% on purchases and 21.99% on cash advances. These rates are equivalent to or below many cards at this level.

Just like all American Express cards there is no minimum income requirement to apply for this card. Approvals will be based upon credit history and other factors.

Earning

The card earns Marriott Bonvoy points on everyday purchases as follows:

- 5 points for every $1 you spend at participating Marriott Bonvoy properties

- 2 points for every $1 you spend on all other eligible everyday purchases

These are pretty amazing earn rates - in fact the 2 points per dollar on all other spending makes this card one of the best in terms of non-category bonus spending. Very few cards award the equivalent of a 2% return on base level spending and in many cases when you redeem via Marriott you should easily be able to get more than 1 cent per point giving you a return of over 2%.

Recommended reading: The top credit cards for everyday non-category bonus spending

Then you have the exclusive 5 points per dollar when you spend at Marriott and you can see that those paid hotel stays will quickly rack up the points for free night awards!

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Effective Rate of return (Travel) * |

|---|---|---|

| Marriott Hotels | 5 | 5+% |

| All other spending | 2 | 2+% |

| * We value Marriott Bonvoy points at a minimum of 1 cent each hence the valuations above - that is a minimum though as we typically see higher value than that, in fact we've seen redemptions in excess of 3 cents per points so you could triple those values seen above. | ||

Redeeming

As it is a hotel card means the points earned go directly into your Marriott Bonvoy account after each statement period. From there you can redeem the points for free night awards at over 9,000 Marriott Hotels worldwide, convert the points into frequent flyer miles/points for nearly 40 global airlines programs including Air Canada Aeroplan, Alaska Airlines Mileage Plan, Cathay Pacific Asia Miles or United MileagePlus. Marriott also has redemption options for gift cards, flight+hotel packages and the very famous Marriott Bonvoy Moments

Free Night Awards

First we'll look at the primary redemption option - free night awards. The main premise of any hotel frequent guest program is to earn points that you can redeem for free night stays at hotels participating in that program. This is where Marriott Bonvoy excels. Being one of the largest hotel chains in the world with over 9,000 hotels there are a lot of locations to choose from to redeem those points.

Marriott used to have a category chart that free night award redemptions would follow however in 2022 they switched to dynamic pricing. Thus, the program no longer publishes set rates and the amount of points required for a free night will somewhat follow what the cash rates are for that hotel. Even though there is no chart anymore the maximum you can expect to spend for one night in a standard room is upwards of 250,000 points at a handful of ultra luxury properties. Most hotels will fall between 5,000 and 120,000 points.

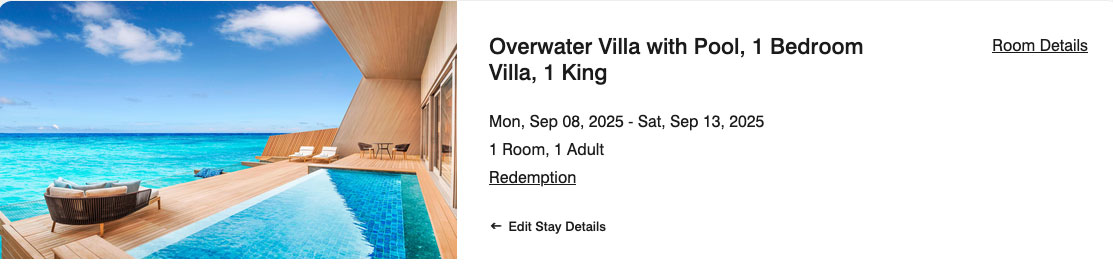

For a lot of us the highlight is being able to use the points at the higher end hotels. So ultimately you are looking at being able to use points to redeem for a stay at a place like The St. Regis Maldives Vommuli Resort or The Gritti Palace, a Luxury Collection Hotel, Venice just to name a few of the hundreds of experiential locations the Marriott Bonvoy program has under its umbrella!

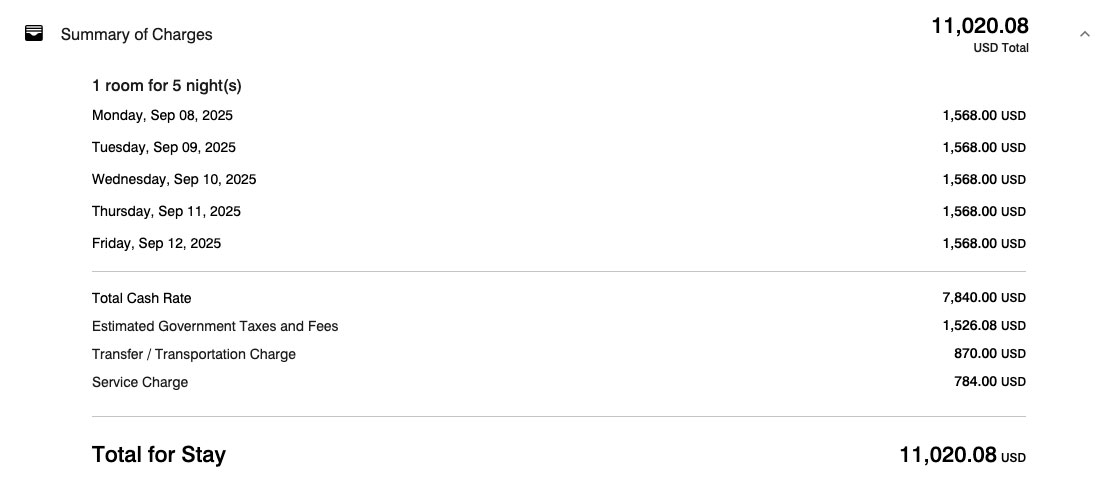

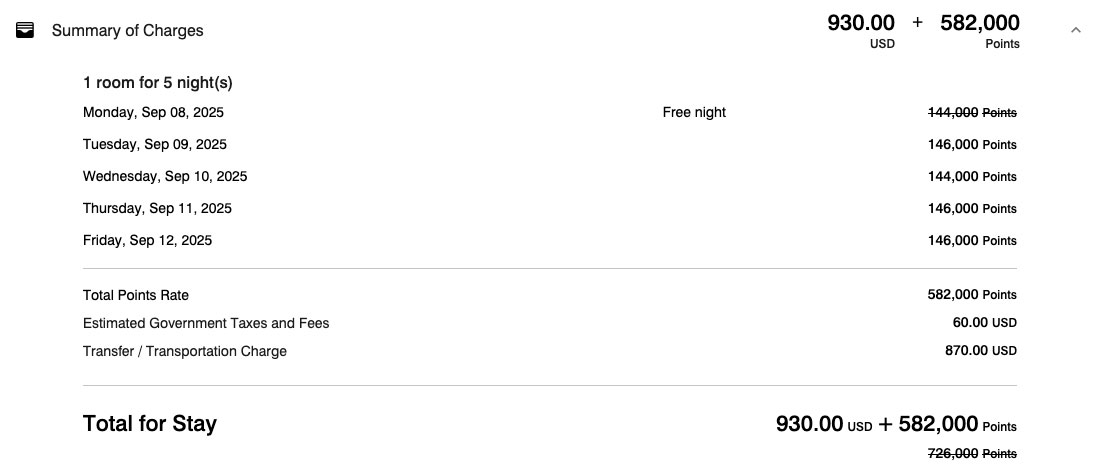

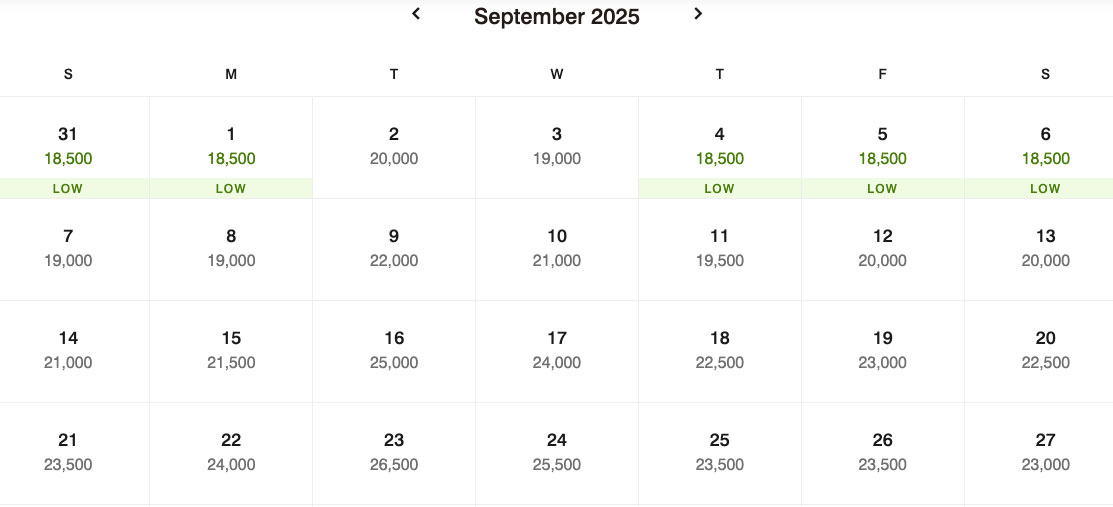

For example here's a five night stay at The St. Regis Maldives:

We picked an upgraded room - an Overwater Villa for five nights in September for this example. The nights ranged in price from 144,000 to 146,000 points, which might have you asking why is it only 582,000 points and not 726,000? Well, that brings us the one of the best features of the Marriott Bonvoy program - when you book 5 award nights you get one free. This benefit is applied to he night that costs the least and in this example it is one of those at 144,000 points. So if we go back to our example - you are redeeming 582,000 points for the equivalent of US$10,090.08. This works out to a value of 1.73 cents per point in USD or roughly 2.45 cents per point Canadian (Using a mid-February 2025 exchange rate of 1.42). That means the 2 points per dollar earned on this card provides a 4.9% return and 5 points works out to 12.25% - yes, a 12.25% return on any Marriott spending you have!

Ultimately your rate of return will be different as hotel prices are constantly changing and a portion of that amazing return counts on getting that 5th night free. The high returns don't have to hinge on that fifth night free however! The next example provides even better returns and is much closer to home.

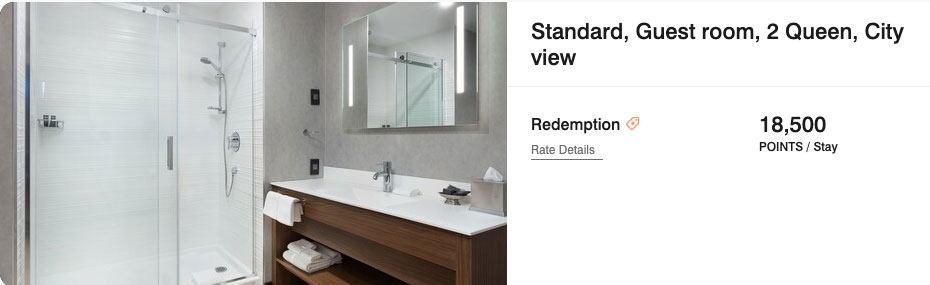

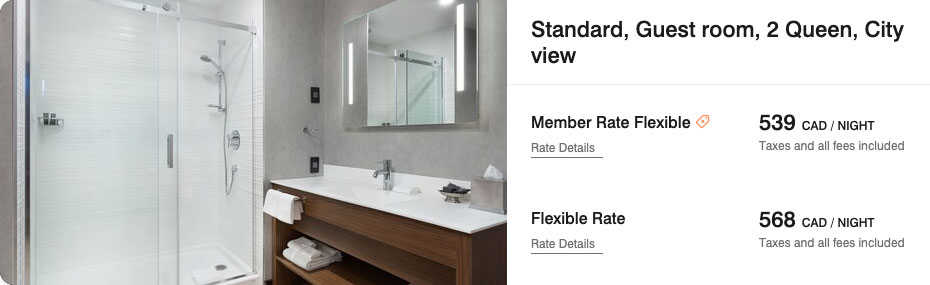

How about a night in the nation's capital? Here's what the AC Hotel Ottawa Downtown looks like:

In this example you can redeem 18,500 points for a stay that runs $539 including all taxes and fees. That's the equivalent of 2.91 cents per point or nearly a 6% return on your 2 points per dollar base spending and nearly a 15% return on your 5 points per dollar earning. Again, an amazing value and it shows the potential outsized value and versatility of a program like Marriott Bonvoy when it has an excellent credit card option available like the Marriott Bonvoy™ American Express®* Card.

Convert to airline miles/points

The next best redemption option from the Marriott Bonvoy program is the transfer option to nearly 40 airline frequent flyer programs. It is well known in the points and miles circle that these are the only hotel points that have a meaningful conversion rate to airlines. The reason why is that Marriott has a very good conversion ratio and they also provide a bonus when redeeming 60,000 points at a time.

The conversion ratio for most of their airline partners is 3 to 1 with several exceptions like Air New Zealand and JetBlue. Those two are different due to how their points systems work.

Ideally, you only want to convert to airlines in 60,000 Marriott Bonvoy point increments and that's because Marriott will kick in an additional 5,000 miles or points from the partner program. For example if you convert 60,000 Bonvoy Points to Air Canada Aeroplan you'll receive 20,000 points from the 3:1 conversion ratio plus an extra 5,000 for a total of 25,000 Aeroplan Points. This bonus works for most of their frequent flyer partners. United MileagePlus is unique as they have an enhanced partnership with Marriott so you'll actually receive 10,000 bonus miles with every 60,000 points converted.

For many Canadian points and miles enthusiasts this conversion option is the primary route to earning points and miles for airlines that have no other options in Canada. These include the likes of Alaska Airlines Mileage Plan, ANA Mileage Club, Turkish Airlines Miles&Smiles and Virgin Atlantic Flying Club.

Marriott Bonvoy Moments

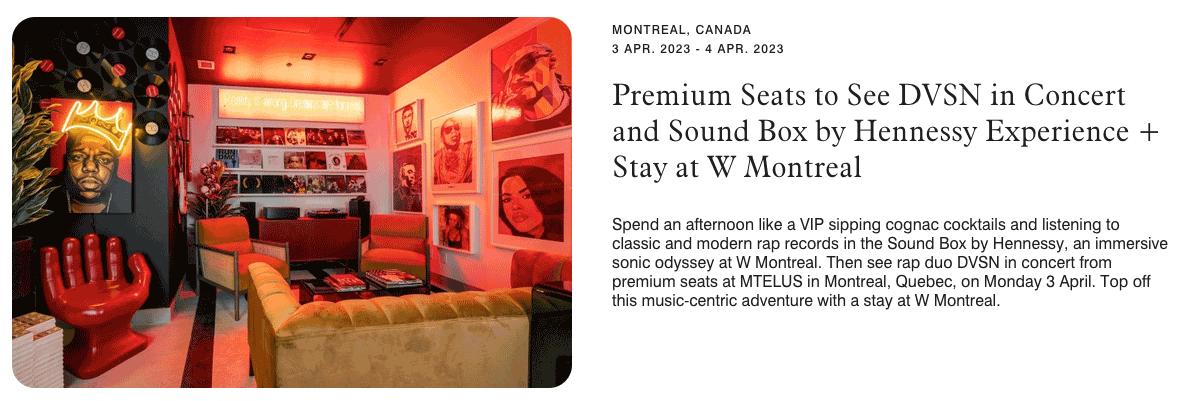

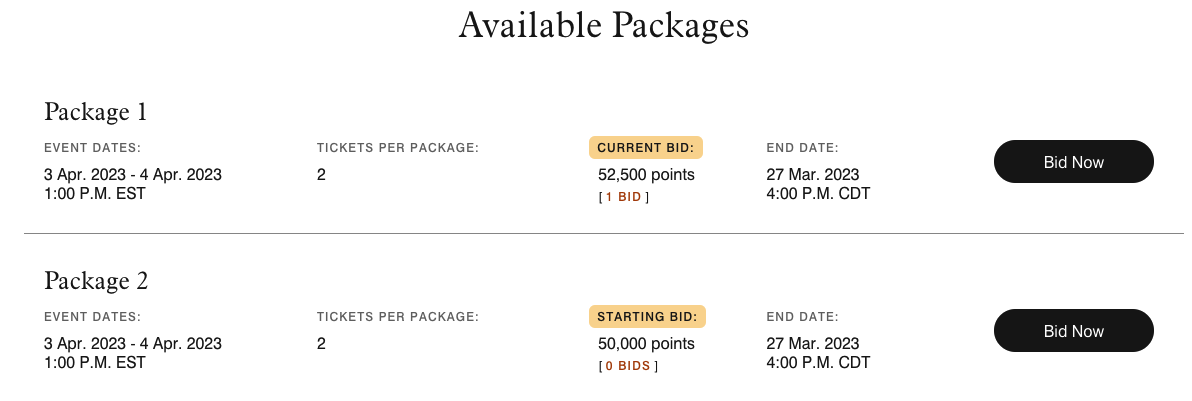

Marriott Bonvoy Moments are another great option to redeem your points for. These are one of a kind experiences that you can't typically purchase with cash. Some are auction based whereas some others a flat rate redemptions and you're redeeming points for things like tickets to premium seats and suite access at the U.S. Open tennis, exclusive access to concerts, VIP access to car racing events and so much more.

Here is an example of Marriott Bonvoy Moments package in Montreal:

Considering a free night on April 3 is 48,000 points alone, this package that starts at 50,000 is a deal!

Other redemption options

You can also redeem points for flights, car rentals and gift cards - all of which provide less value than redeeming for actual hotel award nights. There is also an option to donate your points to various global charities.

Features and Benefits

Not only does the Marriott Bonvoy American Express Card card shine when it comes to value on the earn and burn side it is a bright light when it comes to extra benefits:

Anniversary Free Night Award

The first benefit is one of the best from any credit card in the Canadian market. And that benefit is the Annual Free Night Award that is provided each year on your card anniversary date. This voucher provides a free night at any Marriott hotel worldwide up to a value of 35,000 points. This can be used to cover hotels up to Category 5 (sometimes Category 6) however now that Marriott moved to dynamic pricing you have to do some digging to find hotels you can use it at - but there are a lot! This voucher alone can typically provide more value than the annual fee on the card! In fact, we consistently find hotels that charge $200-$500+ per night that you can use this free night award at.

Recommended Reading: 10 great hotels in Canada to use your Marriott Amex free night award at

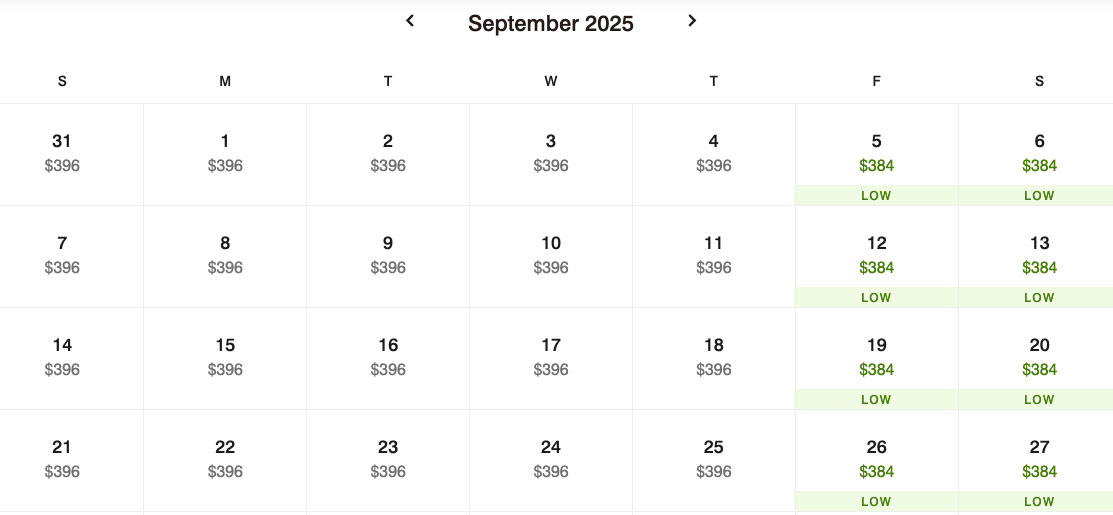

Going back to the AC Hotel Ottawa Downtown where you would be able to use the Free Night Award all throughout September (This is just an example of the potential value as you will get your first voucher after having the card for one year and then every year after that)

You can see from the above example this free night award voucher can save you anywhere up to $384 before taxes. As the voucher actually covers taxes and fees as well, the overall value is even higher than this! Not a bad deal to spend $120 on the card to get value that can exceed three times the fee!

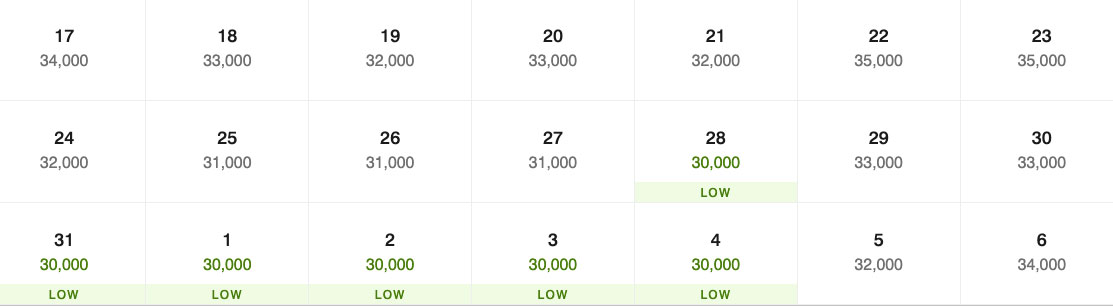

Or how about a quick getaway to cottage country at the Fairfield Inn & Suites Gravenhurst Muskoka? Here's an example in late August and early September that shows availability under the 35,000 points requirement for the voucher:

You can see from the above example this free night award voucher can save you anywhere from $264 to $281 before taxes. All in the price is probably close to $300 or just over - so once again, a pretty good deal for a card that only costs you $120 per year.

The Marriott Bonvoy program also allows members to top off the certificates with up to 15,000 points. This means if you find a hotel that runs up to 50,000 points for a free night you can combine your Free Night Award voucher and up to 15,000 points to cover that night.

Complimentary Marriott Bonvoy Silver Elite status + Receive 15 Elite Night Credits

The next feature or benefit that comes with the card is 15 elite night credits that are awarded each and every year you have the card. Those 15 nights count towards your Marriott Bonvoy elite status qualification and with Silver status only requiring 10 nights that means you automatically receive Silver status by having this card. Gold elite status requires 25 nights so you only have to complete 10 actual nights to earn Gold Status (or see the next benefit), 35 nights to achieve Platinum status or 60 nights to earn Titanium status.

Spend to earn Gold Elite Status

If you spend $30,000 or more on your Marriott Bonvoy American Express Card each year you'll receive an upgrade to Gold elite status so this is your other option to reach this level if you can't complete the 10 additional nights as mentioned above.

Amex ExperiencesTM

The Marriott Bonvoy American Express Card comes with Amex ExperiencesTM which includes Front Of The Line® Advance Access, Front Of The Line® Reserved Tickets, Front Of The Line® E-Updates, Special Offers & Experiences for all Cardmembers and Social Access for all Cardmembers.

Amex offers

As with all American Express Cards this card receives Amex Offers. These are exclusive limited time offers sent out to cardmembers to receive statement credits or bonus points for using their card at select merchants. Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to American Express Canada 'Amex Offers'

Insurance

The Marriott Bonvoy American Express Card comes with an average insurance coverage package for a travel based card. The coverage is as follows:

- Common Carrier Travel Accident Insurance: Up to $500,000

- Flight Delay Insurance: 4 hours $500 in total

- Delayed Baggage Insurance: 6 hours $500 in total

- Lost / Stolen Baggage Insurance: $500 in total

- Damaged Baggage Insurance: $500 in total

- Car Rental Theft and Damage Insurance: 48 Days up to C$85,000 MSRP

- Hotel/Motel Burglary Insurance: Up to $500

- Purchase Protection: 90 days

- Extended Warranty: Up to 1 extra year

What is good about this card

The first thing that is good about this card is the welcome bonus - 50,000 Marriott Bonvoy points are worth at least $500 in our books but if you take some of our examples above it can be easily be worth up to $1,500 or more!

Keeping on the topic of points the earn rates are also great - 2 points per dollar on base spending and 5 points per dollar at Marriott properties provides big time value for your spending.

No fee on supplementary cards! This makes the card $50 - $75 cheaper per card when compared to many of its competitors.

Next are the the benefits - the annual free night alone makes it worth it to pay the annual fee! The elite night credits and Gold status after spending $30,000 are also great benefits that come from this card.

The ability to use points for hotel stays or convert to so many different airlines. In fact for many of the airline partners in the Marriott Bonvoy program the only way to earn points or miles on everyday spending in Canada is with a Marriott Bonvoy credit card.

The Amex related benefits, mainly Amex Offers also add to the list of good things about this card as that can provide some much appreciated savings for cardholders.

What is not so good about this

card

As many of you know American Express has lower acceptance than Visa or Mastercard so there will be occasions where you cannot use this card to pay for items. Depending on where you live or travel, American Express does state that they are accepted at roughly between 80 and 90% of locations that take the other two brands of cards. South of the border, the most recent data from American Express has them at a 100% merchant acceptance rate of Visa and Mastercard in the United States.

The insurance coverage on this card is weaker than many of the competitors. There is no out of province emergency medical coverage nor is there any trip cancellation or trip interruption insurance which can be a deal breaker for some.

The lack of an increased earn rate on select spend categories. For example the business version of the card has 3 points per dollar for gas, dining and travel. It would be nice to see something like that on this card, even it meant a higher annual fee.

While amazing - your redemption options are more limited than some other cards. If you are someone who doesn't like to be tied into one program or that program's partners you'll be better off with a card that has more flexible travel reward options.

The lack of No Foreign Transaction fees - this is a card that would stand to benefit immensely from offering a 0% foreign transaction fee seeing that over 9,000 of the hotels where you can earn your 5x points are not in Canada, To have that extra little savings on Marriott stays would be huge!

Who should get this card

- Marriott Bonvoy point collectors - the fact that you can have this card and the business card in your wallet at the same time you'll make sure your Bonvoy points earning is supercharged

- People who are interesting in receiving great value out of each dollar they spend on their credit card

- People who know they will use the annual free night award each and every year - even if it is just for a one night staycation!

- Members of one of Marriott Bonvoy's partner airlines that have no other method of collecting points or miles in that airline program

- People who want to stay at luxurious hotels but can not typically afford paying the cash rates for those hotels

Conclusion

There's a reason why the this card has been one of the best travel rewards credit cards in Canada for years on end. It has the potential to give the cardholder huge outsized value for each dollar spent on it. Plus hotel programs are often overlooked in Canada and they can be the ideal type of reward program for single travellers and families alike. Think about - how much spending would you have to put on a credit card to get business class tickets for a family of four versus how much spending you need to get a luxurious hotel room for a week for four people? And would you rather have 7-14 hours of luxury or 7 days of luxury? Ideally you'd want both but for many Canadians that's just not feasible.

Ultimately what you have with this card are a lot of travel options with great benefits and great value for every dollar you spend on the card. That's why the Rewards Canada family has the Marriott Bonvoy™ American Express®* Card in our wallets! We use it for our Marriott purchases and any of our non category bonus spending!

Latest card details:

Marriott Bonvoy™ American Express®* Card

New Marriott Bonvoy® American Express®* Cardmembers earn 50,000 Marriott Bonvoy® points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership. Subject to change at any time

Annual Fee: $120 | Additional Card Fee: $0 | Annual interest rate 21.99% on purchases

New Marriott Bonvoy® American Express®* Cardmembers earn 50,000 Marriott Bonvoy® points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership. Subject to change at any time

- Earn 5 points for every dollar in eligible Card purchases at hotels participating in Marriott Bonvoy®

- Earn 2 points for every $1 in all other Card purchases

- Receive an Annual Free Night Award for up to 35,000 points at eligible hotels and resorts worldwide every year after your first anniversary

- No annual fee on Additional Cards

- Redeem points for free nights with no blackout dates at over 7,000 of the world’s most desired hotels

- Automatic Marriott Bonvoy Silver Elite status membership

- Receive 15 Elite Night Credits each calendar year with your Marriott Bonvoy® American Express®* Card. These can be used towards attaining the next level of Elite status in the Marriott Bonvoy program

- Enjoy an automatic upgrade to Marriott Bonvoy Gold Elite status when you reach $30,000 in purchases on the Card each year or when you combine 10 qualifying paid nights within one calendar year with the 15 Elite Night Credits from your card

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment.

- Click here to apply for the Marriott Bonvoy American Express Card

Other cards to consider if you are looking at this card:

- American Express Cobalt® Card

- American Express® Gold Rewards Card

- Marriott Bonvoy Business American Express Card

- The Platinum Card from American Express

This review was first posted on March 19, 2021 and is updated on a regular basis

Talk to us!

Tell us what you think of this card in the comments section below or join the conversation on Facebook and Twitter!