RBC British Airways Visa Infinite Card Review

Last Updated on July 31, 2025

The card that British Airways flyers should have in their wallet

The RBC British Airways Visa Infinite Card is ranked as the 5th best airline card in Canada overall but if you are someone who flies British Airways it is the #1 card to have. Thanks to benefits that provide significant cash and/or Avios savings this card should be in the wallet of Canadians who fly with the airline at least once or twice per year.

The review of the RBC British Airways Visa Infinite Card is broken down into the following sections:

Overview

The RBC British Airways Visa Infinite Card is a card targeted towards Canadians who fly with British Airways. It has an amazing discount benefit for tickets purchased with British Airways that can easily pay for the annual fee or more in just one booking. Add in an companion award voucher for those who can spend $30,000 or more on this card annually and you have a card that is perfect for Canadian British Airways flyers

Costs & Sign up Features

The RBC British Airways Visa Infinite Card has an annual fee of $165. This is the highest annual fee found on a Visa Infinite Card in Canada not including Infinite Privilege cards. You can add additional cardholders for $75 annually per card.

Right now the card comes with a welcome bonus of up to 60,000 Avios (the currency of The British Airways Club) . The bonus is awarded as follows:

- Collect a 30,000 Avios Welcome Bonus when you spend $5,000 CAD in the first three months of account opening.

- Collect a further 30,000 bonus Avios when you spend $5,000 CAD in months 4-6 of account opening.

If you do not meet the $5,000 CAD spend in the first three months, you can still collect 30,000 bonus Avios if you meet the spend requirement in months 4-6.

Income requirements for the card are $60,000 annual personal income or $100,000 annual household income.

Earning

The card earns Avios as follows:

- 2 Avios per dollar spent on British Airways and BA Holidays purchases

- 1 Avios per dollar spent on all other eligible purchases

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Effective Rate of return (Travel) * |

|---|---|---|

| British Airways, BA Holidays | 2 | 3% to 10+% |

| All other spending | 1 | 1% to 5+% |

| * This is a very low minimum valuation. In most cases you should be able to easily pull more value than this especially if you redeem for business class or first class flights. | ||

Redeeming

As with any airline co-brand credit card this is where the strength lies as frequent flyer programs can and do provide an opportunity to receive outsized value per point, well, in this case per Avios. This is particularly the case when redeeming for business or first class flights but you may even find economy class flights where the value is better than proprietary credit card reward programs.

British Airways Executive Club (BAEC) offers numerous redemption options but being a frequent flyer program the primary redemption option is for flights. You can redeem Avios to travel to thousands of destinations Worldwide and you don't actually have to travel to or via the UK to take advantage of the program.

BAEC allows you to redeem Avios for economy, premium economy, business and first class flights on British Airways and 15 other airlines from around the globe. For us Canadians the most popular partner airlines are Aer Lingus, Alaska Airlines, American, Cathay Pacific, Japan Airlines and Qatar Airways. Of course you are not limited to redeeming on just those airlines however!

On average you can expect to receive a value of 1.5 to 2 cents per Avios when redeeming for economy class flights and 2 cents or more for the premium classes. In fact, it isn't unheard of to be able to get a value of 5 cents, 8 cents or more per Avios for business and first class flights. Those are the outsized values that we mentioned at the start of this section.

It also good to know the program has Peak and Off Peak award flight pricing. More days than not the program actually prices with Off Peak pricing, and a lot of those are very competitive with other popular programs for Canadians. In fact, with Off-Peak pricing you can fly to Ireland and the UK from Eastern Canada for as little as 13,000 Avios one way. Toronto to Dublin on Aer Lingus is quite possibly the most famous international economy class award redemption for Canadians as it does not incur as high of fees as going Toronto to London on British Airways.

More recently the program introduced Reward Flight Savers where you pay a lot less in fees on those British Airways awards but you do have to redeem a higher amount of Avios. We ran some comparisons and these new Reward Flight Savers still provide some great value - especially when compared to a program like Aeroplan. You can read more about this new option here:

Recommended reading: New British Airways Reward Flight Saver option offers lower surcharges!

Another cool feature with British Airways Executive Club is being able to connect your account to other Avios earning programs. Those are Aer Lingus Aer Club, Iberia Plus, Qatar Airways Privilege Club and Vueling Club. When you have accounts with some or all these airlines you can move Avios between them to take advantage of some of the individual intricacies each program has. For example Iberia tends to charge less Avios for long haul business class flights than British Airways, Qatar Airways has earning and redeeming partners you won't find with British Airways and so forth.

The program also allows you can also choose to do partial payment for award flights. That is, Cash + Avios to pay for tickets which is a great option when you don't have enough Avios to pay for an entire award flight.

Finally, you are also able to redeem Avios for upgrades and to pay for fight extras like seats and baggage. You can also redeem for hotel stays, car rentals, experiences or donate them to charity.

Features and Benefits

The RBC British Airways Visa Infinite Card provides several benefits and additional features that complement the earning of Avios with the card

10% discount on British Airways flights

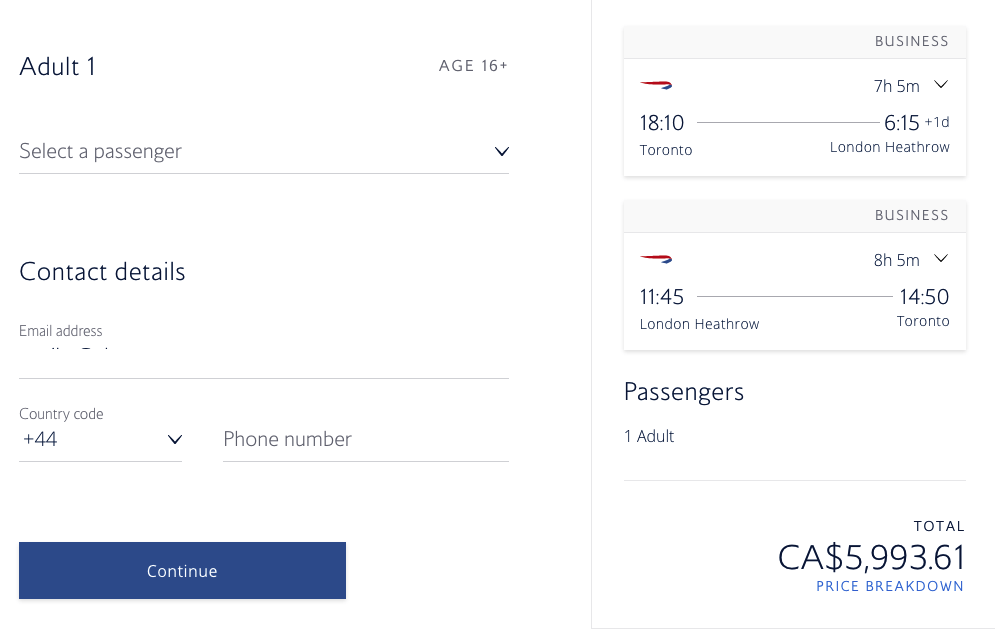

The 10% off British Airways flights is the benefit that provides the most value and is the primary reason that people get this card. The discount is off the total cost of the fare (including taxes, fees, and carrier charges) for travel in any cabin from economy (World Traveler) to premium economy (World Traveler Plus) for business (Club World) or even First Class. So if you buy several British Airways tickets a year, that 10% off can provide big savings – especially if it is for business or first class. Think about a business class flight between Toronto and London that can run $5,000 or more. Ten percent of that is $500 and that alone pays for the $165 annual fee a few times over! Click here to learn more about the 10% discount

Here's an example of using the discount for business class flight between Toronto and London:

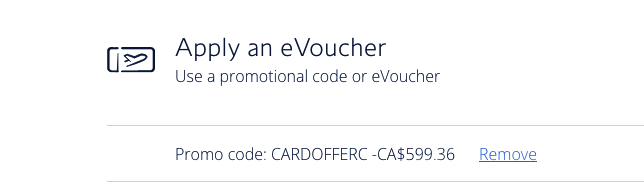

Annual award flight companion voucher (Can also be used for 50% off for solo travellers)

The second benefit to this card is the annual Companion Award eVoucher. Little known fact - this card was actually one of the first cards in Canada to offer a Companion Voucher! You'll receive the voucher when you spend $30,000 or more on the card in any calendar year. This voucher is used when you make an award booking which means it can save you a lot of Avios! What this means is that when you book an award ticket departing from Canada you can use the voucher when to redeem for second award ticket on the same reservation to take a companion along. All you pay are the taxes and fees for the companion fare. Just like the 10% discount this is benefit is available on all fare classes. Thinking about a business class reward that is 100,000 Avios per person? Well, with this voucher it basically becomes 50,000 Avios per person - plus taxes and fees of course!

As of July 4, 2023 the voucher can also be used by a single traveller to receive a 50% discount on the amount of Avios required for a reward flights (+ applicable taxes and fees) If we take the same 100,000 Avios business class example but only book one for a single traveller it means you would only have to redeem 50,000 Avios plus the taxes and fees. This is a great development for this card's voucher as this benefit didn't really appeal to single travellers prior to this!

Visa Infinite benefits

- Visa Infinite Luxury Hotel Collection provides benefits like room upgrades, complimentary Wi-Fi and breakfast, late checkout, and so much more at over 900 Visa Infinite Luxury Hotel Collection properties around the world.

- Visa Infinite Dining Series - Each event includes multi-course meals, drink pairings and an interactive experience. You'll get to taste dishes from some of the country's top chefs and restaurants as they guide you through each course.

- Wine country benefit from wineries across Ontario and British Columbia including complimentary tastings and tours. You can also get access to online offers like complimentary shipping and savings on wine purchases.

- Get golf perks with Troon Rewards® through your Visa Infinite card and automatically receive Silver Status. You’ll save 10% on golf fees, merchandise, and lessons at over 150 courses around the world.

- Access to private movie events and at-home offers as part of the Visa Infinite Screening Series. In the fall, get special perks at the Toronto International Film Festival®.

- Visa Infinite card includes a Complimentary Concierge service that can offer help with anything like the perfect travel itinerary, restaurant recommendations, finding the perfect birthday gift, and more

RBC offers

As with all RBC cards the RBC British Airways Visa Infinite Card receives RBC Offers. These exclusive limited time offers are sent out to cardmembers to receive statement credits, discounts or bonus points for using their card at select merchants. Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to RBC Royal Bank 'RBC Offers'

Partner benefits

RBC offers some exclusive benefits for all their credit cardholders with select retail partners in Canada. For the RBC British Airways Visa Infinite Card those benefits are:

Link your Petro-Points card to your new RBC credit or debit card and use it to pay for purchases at Petro-Canada to always:

Save 3 ¢/L on gas with every fill-up

Earn 20% more Petro-Points

Earn more Be Well points at Rexall

Get 50 Be Well points for every $1 spent on eligible purchases when you shop at Rexall with your linked RBC® card

Enjoy $0 delivery fees with DoorDash

Get a complimentary DashPass subscription for up to 12 months with an eligible RBC credit card – a value of almost $120

Insurance

The RBC British Airways Visa Infinite Card comes with a decent insurance package however Trip Interruption and Trip Cancellation coverage are noticeably absent.

- Out of Province/Country Emergency Medical Insurance (31 days under 65, 7 days 65+)

- Flight Delay Insurance

- Baggage Delay Insurance

- Lost or Stolen Baggage Insurance

- Car Rental Theft and Damage Insurance

- Hotel Burglary Insurance

- $500,000 Travel Accident Insurance

- Purchase Protection Plan

- Buyer's Assurance Protection Plan

What is good about this card

The best thing about this card is the 10% off benefit on paid British Airways flights and the fact the discount is provided on the entire ticket amount including taxes and fees. Whether your are buying a rock bottom $600 economy class fare or a pricey $5,000 business class fare, the savings can be significant.

Next you have the companion award voucher and again this can provide significant savings if you ever plan on redeeming for award flights for 1, 2 or more people. The fact it can be used in any fare class and provides a 50% discount for single travellers or a 100% discount for a companion traveller is a good thing with this card.

The 2 Avios per dollar earned on British Airways flights. This is another good thing about the card as that earn rate matches what you would earn on select American Express cards. It is only beaten out by the HSBC World Elite Mastercard which offers the equivalent of 2.4 Avios per dollar spent but then you wouldn't be receiving the 10% discount on the price of the flights.

Being a Visa card you can count on the card being accepted almost everywhere - the only big name merchant not accepting Visa in Canada is Costco. Outside of that you should be golden having this card accepted!

What is not so good about this card

The base earn rate of 1 Avios per dollar spent isn't a terribly attractive earn rate. Not that it's bad - seeing the value of Avios ranging from 1.5 to 5 cents or more means a really decent return compared to other 1 point per dollar cards. However, when you compare this to earn rates on other cards that can convert points to British Airways - it is low. There are cards in the market that can earn you more Avios. Namely the American Express Cobalt Card and ideally if you want an awesome card combo for flying with British Airways and earning the most Avios possible you would get the Cobalt Card in addition to the RBC British Airways Visa Infinite Card.

There is a lack of actual benefits when flying with British Airways. Unlike some other airline cards in Canada the RBC BA card doesn't provide things like your first checked bag free, priority boarding or lounge access. If they really want to card to appeal to more BA flyers adding some of those type of benefits would make this card shine!

The annual fee isn't great - at $165 it is the highest of any Visa Infinite card in Canada. True, it can be quickly offset with that 10% discount but you have to know your are going to utilize that discount and/or companion voucher to get the value out of paying that fee.

Who should get this card

- People who purchase British Airways economy class tickets at least several times per year or even just one premium economy or business class round trip flight annually. The 10% discount on those ticket purchases will provide more savings than the annual cost of the card.

- British Airways Executive Club members who redeem for two or more award tickets on a single reservation to utilize the significant savings from the companion award evoucher

Conclusion

If you are someone who flies with British Airways on a regular basis - even perhaps once per year but more so several times per year and are paying for those flights out of pocket then the RBC British Airways Visa Infinite card should be in your wallet. That 10% discount alone makes this card worth having and since you need to use the card for the purchase you'll be rewarded with the 2 Avios per dollar earn rate. Then if you are someone who can and will spend $30,000 on the card annually you have the icing on the cake and that is that annual companion award voucher. The Avios savings it can provide are very substantial especially if you are someone who will redeeming for premium class flights. Overall, you have a card here that very nicely fits a niche space in Canadian market and that's for those who like to fly with British Airways.

Latest card details:

RBC British Airways Visa Infinite Card

Get Up To 60,000 Aviosˆ with the RBC® British Airways Visa Infinite

Annual Fee: $165 | Additional Card Fee: $75 | 20.99% on purchases 22.99%* on cash advances and balance transfers *21.99% if you reside in Quebec.

- Collect a 30,000 Avios Welcome Bonus when you spend $5,000 CAD in the first three months of account opening.

- Collect a further 30,000 bonus Avios when you spend $5,000 CAD in months 4-6 of account opening.

If you do not meet the $5,000 CAD spend in the first three months, you can still collect 30,000 bonus Avios if you meet the spend requirement in months 4-6.

- Collect 1 Avios for every $1 CAD spent on qualifying net purchases*

- Collect double Avios when you shop with British Airways and BA Holidays*

- Earn a companion voucher when you spend $30,000 CAD annually. You can either take a companion with you or fly solo instead for a 50% Avios discount on the cost of one reward seat ticket. Plus, you'll have the flexibility to pay a lower, flat fee to cover taxes, fees and carrier charges and a fixed Avios amount when you make a Reward Flight booking.˜

- 10% off British Airways flights when you book and pay with your card∞

- Redeem for flights and more - you can spend your Avios on all of the travel things you love, including cabin upgrades with British Airways or reward flights with British Airways and any of the oneworld partner airlines to almost 1,000 destinations worldwide**

- Comprehensive Insurances including 31–day out of country/province emergency medical insurance1, flight delay insurance2, hotel burglary3 and rental car4 insurance. Even eligible purchases you make with the card are protected4.

- Luxury Visa Infinite benefits5 such as first in line service for exclusive events and hotel and dining exclusives via www.visainfinite.ca

- Complimentary 24/7 Concierge Service5

- Link your RBC card with a Petro-Points membership to instantly save 3₵ per litre on fuel at Petro-Canada stations and earn 20% more Petro-Points and 20% more Avion points

- Get $0 delivery fees for 12 months from DoorDash

- Link your RBC British Airways Visa Infinite card with a Rexall Be Well account and get 50 Be Well points for every $1 spent on eligible products at Rexall. Redeem Be Well points faster for savings in store on eligible purchases where 25,000 Be Well points = $10

Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

This post contains affiliate links. Please read our disclaimer for more info.

Other cards to consider if you are looking at this card:

- Air France KLM World Elite MasterCard® powered by Brim Financial

- American Express Cobalt® Card

- American Express® Gold Rewards Card

- HSBC World Elite® Mastercard®

- RBC Avion Visa Infinite Card

- TD® Aeroplan® Visa Infinite* Card

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!