The RBC Avion Visa Infinite Privilege Card is the Ultra Premium offering from RBC's suite of Avion credit cards and is currently ranked as the fourth best Ultra Premium Card by Rewards Canada.

The review of the RBC Avion Visa Infinite Privilege Card is broken down into the following sections:

Overview

The RBC Avion Visa Infinite Privilege Card is classified as a "Hybrid Card" by Rewards Canada which means it gives you the best of both worlds for travel rewards in that it offers points that can be used towards any travel or you can chose to convert those points into several frequent flyer programs. It has one of the lowest annual fees for an Ultra Premium card and offers an uncomplicated flat earn rate of 1.25 Avion Points for every eligible dollar spent on the card. The card is unique from the lower tier Avion cards in that it has an option to redeem for business and first class flights at a higher per point value than economy class flights.

Costs & Sign up Features

The RBC Avion Visa Infinite Privilege Card has an annual fee of $399 which is on the lower end of annual fees for ultra premium cards like this one. Many competing cards charge $499 to $799 annually. Additional or supplementary cards are $99 annually per card.

The standard bonus offer on the card offers 35,000 Avion Rewards Points however the card does have limited time increased bonus offers.

Right now the RBC Avion Visa Infinite Privilege Card has an increased bonus offer of up 70,000 Avion Rewards points.

The bonus offer is awarded as follows:

- 35,000 Avion Points on approval*

- 20,000 bonus points when you spend $5,000 in your first 6 months*

- 15,000 one-time anniversary bonus points after 12 months of account opening*

The interest rate

on the card is 20.99% and annual income requirements is $200,000 Household.

Earning

The card earns Avion Rewards points as follows:

- 1.25 Points per dollar spent on all eligible purchases

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Rate of return when booking via the Avion Air Travel Redemption Schedule | Rate of return when booking any travel via Avion Rewards | Rate of return when booking a business or first class flight via Avion Rewards | Rate of return Cash Back | Rate of return when converting to airline programs |

|---|---|---|---|---|---|---|

| All spending | 1.25 | Up to 2.92% | 1.25% | 2.5% | 0.73% | 1.25% to 9% or higher |

Redeeming

The RBC Avion Visa Infinite Privilege Card participates in the Avion Rewards program which provides numerous avenues of redemption.

Avion Air Travel Redemption Schedule

The most famous of all the redemption options is the Avion airline award chart also known as the Avion Air Travel Redemption Schedule. You can also redeem points for any travel you book via Avion Rewards, you can redeem points for any purchase you make on the card, RBC financial products, merchandise, gift cards and also famously you can convert your points to British Airways Executive Club, WestJet Rewards and several other programs.

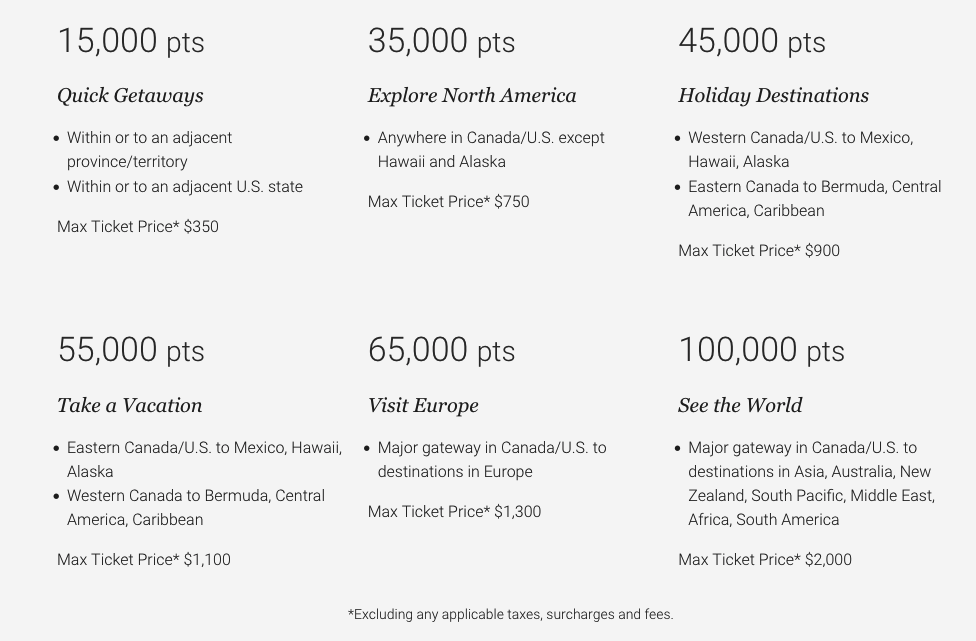

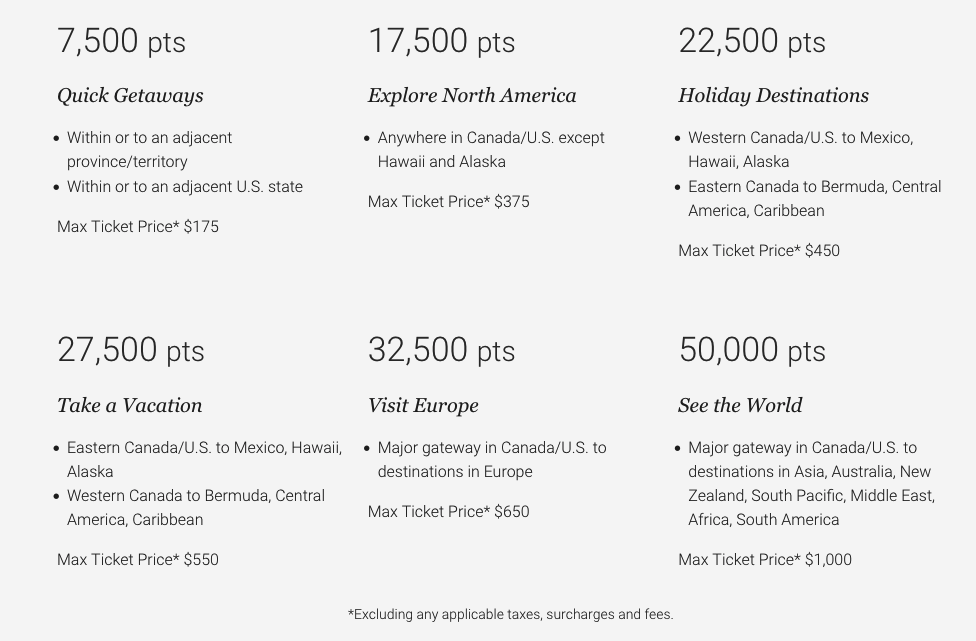

We'll start off by looking at the Air Travel Redemption Schedule which is the most popular redemption feature for this card. In basic terms this schedule is just like your traditional frequent flyer program award chart. You redeem a set number of points for a flight within a specific region or from one region to another. The only difference between this chart and traditional frequent flyer programs is that RBC does have a maximum ticket price for each award level.

Here is the schedule of points required per category and the maximum ticket price for each round trip ticket:

Recently Avion Rewards enhanced this reward option by adding one way reward options. They are exactly 1/2 the cost of the round trip options. Here is the one way Air Travel Redemption Schedule:

Recommended reading: How to maximize value out of the RBC Avion Airline Award Chart

As you can see from the schedules you have set points requirements for the various travel regions. For example you can redeem for a short haul flight with only 15,000 points. The maximum ticket value for that short haul flights is $350 before taxes and fees. If you redeem in this category it doesn't matter if the ticket is $225 or $350 before taxes and fees it will require 15,000 points. Same goes for all the categories. Thus if you are someone looking to maximize the value of your points you'll essentially want to get as close as you can to each of those maximum ticket values to ensure you are getting the best value out of the points. While we do still believe in our mantra that any redemption is a good redemption as long as you are happy (see our piece on The True Value in Reward Redemptions) so for some of you, you won't care what the ticket price is, however if you are all about getting the most value out of your credit card rewards you'll want to try to push to that maximum limit

For the fees and taxes portion you can chose to just charge it to your card (basically paying cash for it) or you can choose to redeem points at a rate of 100 points to $1 towards those fees.

In general as well you'll most likely not use the chart for flights to Europe due to low base fares and high surcharges. You can learn more in our Loyalty Lesson: Why credit card reward charts rarely provide good value for economy class flights to Europe

If the ticket you are purchasing has a base value higher than the set maximum you can still use a combination of points or points and cash to buy the ticket. Let's take the short haul example, if the base ticket price is $380 before taxes and fees you can redeem the 15,000 points to cover $350 of the ticket and the additional $30 (plus all the taxes and fees) can be paid with cash or points at that 100 points to $1 ratio.

Redeem for any travel - great value for business & first class flights

The next travel redemption option is being able to redeem points for any travel you book via Avion Rewards. That is you don't have to use the above schedules to book flights. You can simply go online or call up Avion Rewards travel and book flights, hotels, car rentals and other travel. The you simply redeem your points towards that travel at a rate of 100 points to $1. This is a good option for flights that may be coming in super cheap where it wouldn't make sense to use the air travel redemption schedule and of course for any non-air travel requirements like hotels, car rentals, vacation packages and more.

It is with this redeem points for any travel you book via Avion Rewards where this card is a gem and shines when it's for business or first class! When you have the RBC Avion Visa Infinite Privilege Card, it provides two times the value when you redeem your Avion points for business or first class flights booked with this any travel option. That means instead of 100 points providing $1 in value, you get $2 in value - and it includes redeeming the points towards the taxes and fees on those tickets. With a $2 value per 100 points and the card's flat earn rate of 1.25 points, it means you are receiving a 2.5% return on your card spending when you choose this option.

You can boost that even higher by getting yourself an RBC ION+ Visa Card in addition to your Visa Infinite Privilege card. The ION+ card earns up to 3 points per dollar spent and you can transfer those points to your Avion Elite account from the Infinite Privilege which means you can get yourself as high as a 6% return on spending if you redeem those points for those business or first class flights.

Convert points to airline frequent flyer programs

The third redemption option that falls under travel and is a favourite of points and miles enthusiasts is converting your Avion Rewards points to a frequent flyer program. A lot of enthusiasts will strictly get this card for the welcome bonus offer and then convert those Avion points over to one of the partner programs. Those partners are American AAdvantage, British Airways Executive Club, Cathay Pacific Asia Miles and WestJet Rewards.

The most popular are British Airways and WestJet and those two also happen to be ones that Avion Rewards will sometimes offer an extra limited time bonus when converting your points. Typically seen once or twice per year, RBC offers a 30% bonus when converting to British Airways Executive Club while WestJet Rewards usually sees a 10% to 15% bonus. It is this bonus, especially the 30% to British Airways that has made this card so popular in the points and miles community.

The conversion to an airline like British Airways or Cathay Pacific opens up possibilities for you to use the points you earned on your credit card spend for business class or first class flights at a potentially better value than if booked those same flights via Avion Rewards Travel and redeemed points at that 100:2 ratio. Likewise you may be able to get better value for economy class flights as well, especially with British Airways only requiring 26,000 Avios + ~$300 in surcharges, fees & taxes for flights between Toronto and Dublin or 50,000 Avios + $200 in surcharges, fees & taxes for flights between Eastern Canada and London.

Current Avion Rewards Transfer partners and the transfer ratio:

- American AAdvantage - 10 points to 7 AAdvantage Miles

- British Airways Executive Club - 1 points to 1 Avios

- Cathay Pacific Asia Miles - 1 points to 1 Asia Miles

- WestJet Rewards - 100 points to 1 WestJet dollar

Other redemption options

After travel you have several other redemption options via Avion Rewards. One of the more popular ones is to redeem points for RBC Financial Products at a rate of 12,000 points to $100 for RRSP contributions, TFSA contributions or other financial options. You can also choose to pay your credit card with points (this is basically a cash back option) which requires 17,200 points for a $100 statement credit.

You can also redeem points for merchandise via the Avion Rewards' merchandise catalog as well as with Apple or Best Buy or you can redeem for over 100 different gift card options.

Features and Benefits

For being an Ultra Premium card you would think the card would provide a lot of bells and whistles. But it doesn't offer very much beyond what is provided to all Visa Infinite Privilege Cards in Canada. Then again it also has one of the lowest annual fees for an Ultra Premium card - so there is a bit of give and take here.

Airport Lounge Access

The card provides access to over 1,200 business class lounges in over 130 countries around the world. It also provides discounts on airport dining around the world.

The lounge access benefits are as follows

- Visa Airport Companion Program hosted by DragonPass - Includes six (6) free visits annually. After you use up the 6 free visit you can pay US$32 per person to access lounges. At US$99 per year for the membership and US$32 per visit this benefit alone is worth nearly C$400 on its own if you do use up all six of your passes.

Visa Infinite Privilege benefits

- Visa Infinite Privilege Airport Benefits Receive exclusive perks at Toronto City Airport Terminal, Vancouver Airport, Ottawa Airport and Montreal-Trudeau International Airport

- Priority Security Lanes at International and Domestic checkpoints (Toronto, Vancouver, Ottawa, Montreal-Trudeau)

- Priority airport taxi and limo lane (Vancouver) - Access to dedicated premium parking spots (Vancouver, Ottawa)

- Up to 20% off parking (Ottawa, Vancouver, Montreal-Trudeau) - Visa Infinite Luxury Hotel Collection provides benefits like room upgrades, complimentary Wi-Fi and breakfast, late checkout, and so much more at over 900 Visa Infinite Luxury Hotel Collection properties around the world.

- Visa Infinite Dining Series - Each event includes multi-course meals, drink pairings and an interactive experience. You'll get to taste dishes from some of the country's top chefs and restaurants as they guide you through each course.

- Wine country benefit from wineries across Ontario and British Columbia including complimentary tastings and tours. You can also get access to online offers like complimentary shipping and savings on wine purchases.

- Get golf perks with Troon Rewards® through your Visa Infinite card and automatically receive Silver Status. You’ll save 10% on golf fees, merchandise, and lessons at over 150 courses around the world.

- Access to private movie events and at-home offers as part of the Visa Infinite Screening Series. In the fall, get special perks at the Toronto International Film Festival®.

- Visa Infinite Privilege cards include a Complimentary Concierge service that can offer help with anything like the perfect travel itinerary, restaurant recommendations, finding the perfect birthday gift, and more

- RSVP Rewards Diamond Status: Enroll in the Visa RSVP Rewards Benefit and automatically receive Diamond status delivering benefits at 60+ participating Sandman, Sandman Signature and Sutton Place Hotels from coast-to-coast in Canada and beyond.

RBC Offers

As with all RBC cards the RBC Avion Visa Infinite Privilege Card receives RBC Offers. These exclusive limited time offers are sent out to cardmembers to receive statement credits, discounts or bonus points for using their card at select merchants. Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to RBC Royal Bank 'RBC Offers'

Partner benefits

RBC offers some exclusive benefits for all their credit cardholders with select retail partners in Canada. For the RBC Avion Visa Infinite Privilege Card those benefits are:

Link your Petro-Points card to your new RBC credit or debit card and use it to pay for purchases at Petro-Canada to always:

Save 3 ¢/L on gas with every fill-up

Earn 20% more Petro-Points

Earn more Be Well points at Rexall

Get 50 Be Well points for every $1 spent on eligible purchases when you shop at Rexall with your linked RBC® card

Enjoy $0 delivery fees with DoorDash

Get a complimentary DashPass subscription for up to 12 months with an eligible RBC credit card – a value of almost $120

Insurance

The RBC Avion Visa Infinite Privilege Card comes with a very strong insurance package that includes the following:

- Out of Province/Country Emergency Medical Insurance (31 days under age 65, 7 days for 65+)

- Trip Cancellation Insurance

- Trip Interruption Insurance

- Flight Delay Insurance

- Baggage Delay Insurance

- Lost or Stolen Baggage Insurance

- Car Rental Theft and Damage Insurance

- Hotel Burglary Insurance

- $500,000 Travel Accident Insurance

- Purchase Security Insurance

- Extended Warranty Insurance

- Mobile Device Insurance

What is good about this card

The bonus offer of up to 70,000 points is the highest ever seen on an RBC Avion card. Plus, the initial 35,000 points awarded on approval are the easiest to achieve welcome bonus points on any card in Canada (it shares this claim this with other Avion products)

The special any travel redemption rate for business and first class flights! Being able to receive double the value for your points (100 points = $2) is one of the best things about this card.

The airline conversion options are what most points and miles enthusiasts get Avion cards for. Plus if you convert when they have a transfer bonus in place it provides that much more value for you.

The additional partner benefits, if you can utilize them, are great. The savings and extra points at Petro-Canada, the free Door Dash membership and extra Be Well points are welcome benefits with this card.

The $399 annual fee is worth a mention in the good category as most other Ultra Premium credit cards in Canada charge anywhere from $499 to $799 per year.

What is not so good about this card

The amount you have to spend to be rewarded in comparison to other cards in the market. The flat 1.25 points earn rate on the card is low compared to competitors in the market that provide 2, 3, 4, 5 or even 6 points per dollar spent. As with all RBC cards, once you earn the welcome bonus and have redeemed those welcome bonus points it is going to cost you more (that is, it will take more spending) for your travel rewards compared to those other cards. For example, you need to spend $28,000 on your Avion Visa Infinite Privilege Card to earn enough points for the reward chart long haul flight in North America that requires 35,000 Avion points. Some cards in our market can achieve that same reward in their respective programs with as little as $8,000 in spending! That's a huge difference that must be considered.

Recommend reading: Loyalty Lesson: How to extract more value from Avion Rewards

In this lesson we discuss how you can increase your Avion Rewards points earn rates so that you don't have to spend as much!

The limited flexibility of the Air Travel Redemption schedule is another potential drawback with this card. While you can virtually book any flight, you can lose value if the price goes over or is well under the maximum ticket price. The issue of taxes and fees also comes up as you can only redeem points at a 100 to $1 ratio (a 1% return) thus eroding value again when compared to the competition.

No option to go book travel yourself and redeem points against the charge without losing value. Technically speaking you can go book any travel you like outside of Avion Rewards Travel but then you have to redeem with the Pay Your Credit Card ratio of 17,200 points to $100. That's a big reduction in the value of your points and again there are competing cards that allow you to do the same but do not reduce the value of your points for such a redemption.

Who should get this card

- Consumers who want quick access to being able to redeem for an award (Thanks to the easily earned welcome bonus!)

- Consumers who bank at RBC and want to keep all financial products with one bank (especially if your accounts give you a discount on your annual fee)

- Consumers who like having multiple redemption options with their points

- Consumers who are members of the Avion card's frequent flyer transfer partners and want a credit card to be able to earn more points or miles in those programs.

Conclusion

The RBC Avion Visa Infinite Privilege Card makes for a decent Ultra Premium card option - especially if you don't need a whole slew of benefits you'll never use or if you don't want to fork over the higher annual fees found on competing cards. Overall, it is well rounded and provides lots of redemption options from their reward chart to any travel options and of course the conversion to other programs. On its own, the card does struggle on the earn side of the equation but the simple trick of adding the RBC ION+ Visa Card into the mix to accelerate earning makes the Avion Visa Infinite Privilege Card a very competitive card option.

Latest card details:

RBC Avion Visa Infinite Privilege Card

Get up to 70,000 Avion points* (a travel value of up to $1,500†).

70,000 Avion points* is enough for two roundtrip tickets to almost anywhere in Canada & the US (Alaska and Hawaii require more points). Taxes and fees extra.†

Annual Fee: $399 | Additional Card Fee: $99

- Get up to 70,000 Avion points* (a travel value of up to $1,500†). 70,000 Avion points* is enough for two roundtrip tickets to almost anywhere in Canada & the US (Alaska and Hawaii require more points). Taxes and fees extra.†

• 35,000 Avion Points on approval*

• 20,000 bonus points when you spend $5,000 in your first 6 months*

• 15,000 one-time anniversary bonus points after 12 months of account opening* - Earn 1.25 RBC Rewards points for every dollar you spend

- Book flights, hotel stays, cruises, vacation packages, car rentals with Avion Rewards, powered by Expedia

- Transfer your Avion points towards other eligible loyalty programs (WestJet Rewards, British Airways Club, American AAdvantage, Cathay Pacific Cathay. Look for the transfer bonuses to the airlines several times per year!)

- Premium suite of insurances including trip cancellation, trip interruption, travel medical, car rental insurance

- Visa Airport Companion membership and 6 lounge pass visits

- Redeem your points toward your credit card balance using Payback with Points

- Get a complimentary DashPass subscription from DoorDash for up to 12 months and enjoy unlimited deliveries from qualifying restaurants you love—with $0 delivery fees on orders of $12+ when you pay with an eligible RBC credit card!*

- Instantly save 3₵ per litre on fuel & earn 20% more Petro-Points§ and RBC Rewards points when you link your Petro-Points card to any RBC Card online.

- Up to a 2.31% return on your spending depending on which reward ticket you book

- Receive 2x value when redeeming points for business or first class flights (100 points = $2)

- Click here to apply for RBC Avion Visa Infinite Privilege Card

Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

Other cards to consider if you are looking at this card:

- The Platinum Card from American Express

- TD® Aeroplan® Visa Infinite* Privilege Card

- American Express® Aeroplan®* Reserve Card

- Scotiabank Platinum American Express Card

This review was first posted on May 27, 2024 and is updated on a regular basis.

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!