The Platinum Card® and Business Platinum Card® from American Express are famous for the benefits they provide to their cardmembers. From having the best airline lounge access to hotel elite status to annual travel credits - the cards are a traveller's dream. However, one of the benefits that can be found on these cards that doesn't seem to get much attention is the International Airline Program. Also known as IAP, this benefit provides discounts for flying on some of the world's best airlines in premium cabins but it also provides discounts for economy class tickets on WestJet!

With the Platinum Card from American Express and the Business Platinum Card from American Express discounts are available on the base fare for qualifying International First, Business, and Premium Economy Class tickets with participating airlines. Those airlines as of April 2025 are as follows:

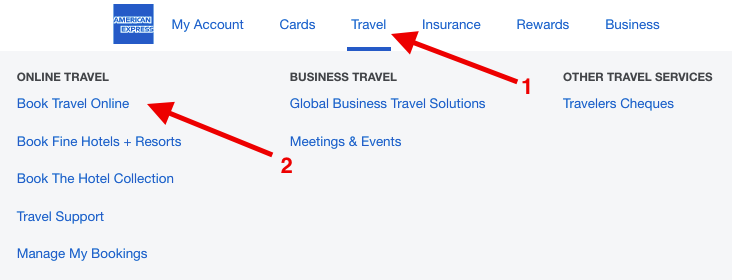

Accessing the International Airline Program or IAP is simple. You can choose to book online at travel.americanexpress.ca/ or you can call the Platinum Travel Service at 1-800-263-1616 to book with an agent. Here we'll look at how you access IAP online. You'll start off by visiting the American Express Travel website at https://travel.americanexpress.ca/ or you can access it from americanexpress.ca by clicking on the Travel tab (1) and then click on Book Travel Online (2):

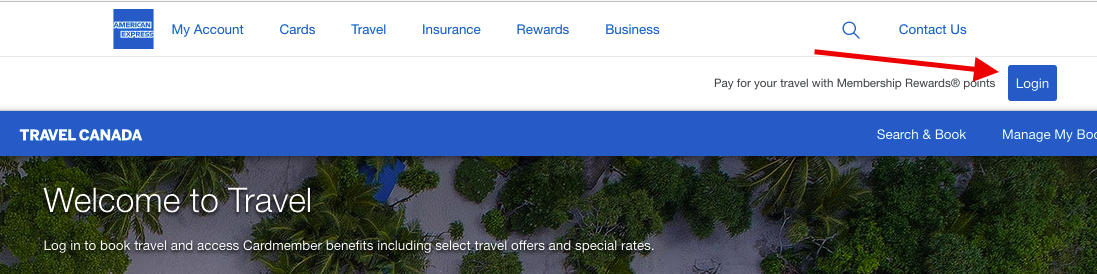

Once at the site you'll want to login with your Amex online credentials so that Amex Travel knows you have a Platinum Card:

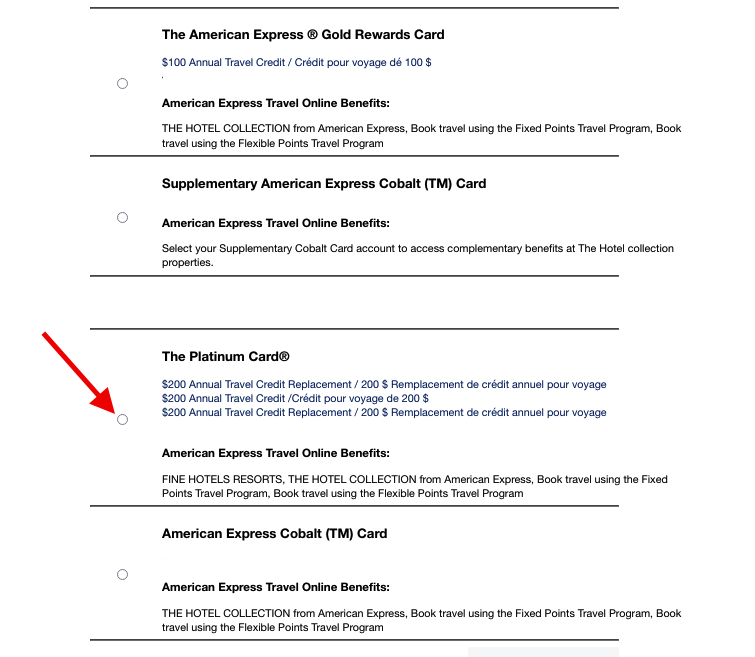

If you have more than one American Express Card you'll be presented with an menu to pick which card you would like to utilize for booking online with Amex Travel. In this case, select the radio button for the Platinum Card or the Business Platinum if you have that card and then click on the "Choose card" button below your card options.

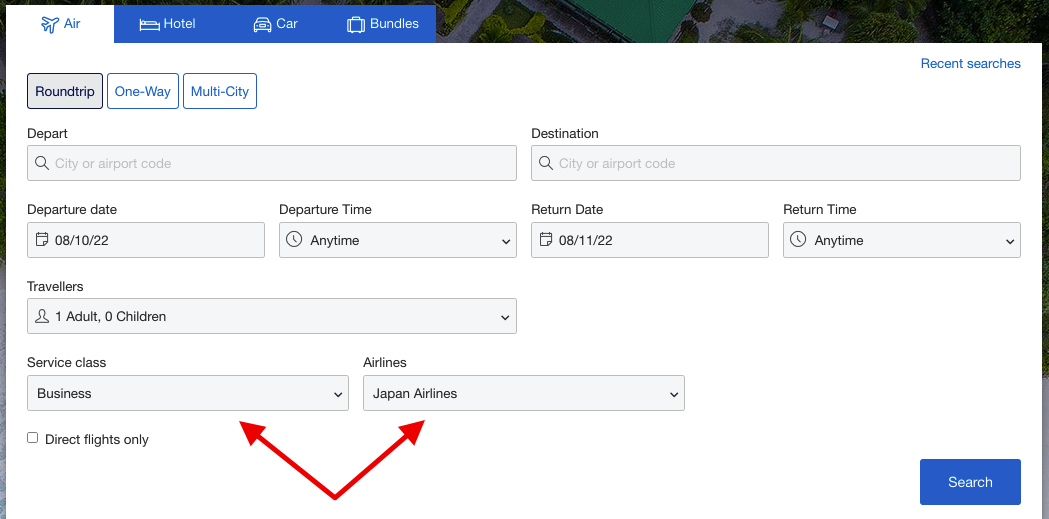

And now you'll be brought back to the book travel homepage! Simply search for flights as you would normally do with any booking engine. However so that you are not searching needlessly over a ton of flights you can narrow down the results by selecting a premium class (unless you're booking WestJet) and the airline you are interested in the from the IAP program:

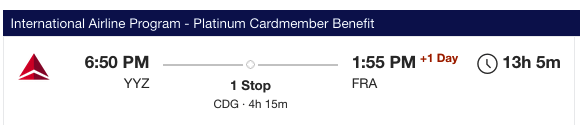

And voila! Once you click search the results will come up and you'll want to keep your eye out for "International Airline Program - Platinum Cardmember Benefit" above the flight result(s). Flight results that do not show this are not discounted.

Once you select your flights you go through a standard online booking process however Amex does allow you to apply their Fixed Points for Travel or Use Points for Purchases options to pay for these flights as well. So not only do you get the discount but you can use your points to pay for a portion or all of the cost of the ticket(s).

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

Let's look at some examples of the savings IAP provides on business class flights with some global airlines as well as economy and business class with WestJet:

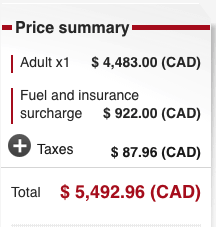

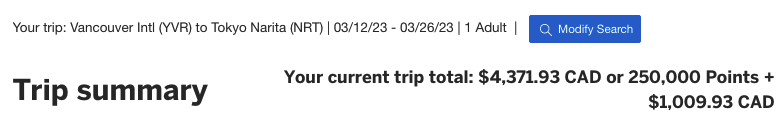

Japan Airlines Business Class

Here we have a flight in business class on Japan Airlines from Vancouver to Tokyo departing March 13, 2023 and returning March 26, 2023. This is the pricing directly from JAL:

and the same flights with Amex's IAP:

As you can see there are some huge savings to be had with the IAP program! This example alone the savings amount to $1,121.03!

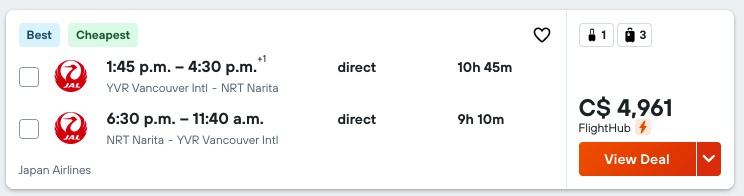

For these flights we also conducted a search on Kayak.com to see if you could buy the same flights cheaper anywhere else:

The closest was $4,961 which is almost $600 more than Amex's IAP pricing.

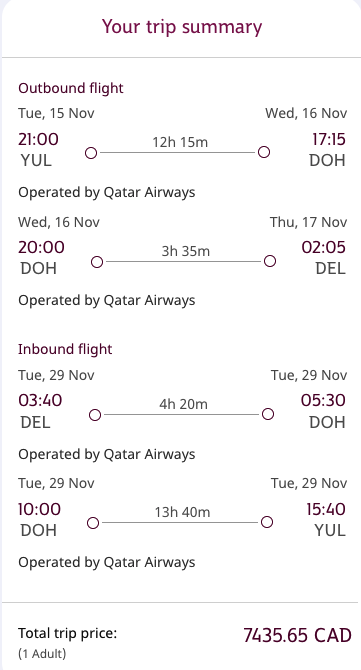

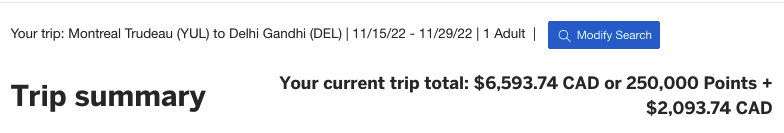

Qatar Airways Business Class

Montreal to Delhi in business class for two weeks in November. Here is the pricing from Qatar Airways:

and those same flights with Amex's IAP:

Another example of some big savings as the Platinum Cards with IAP prices out $841.91 lower than buying direct with Qatar Airways.

WestJet Economy Class

Even though it is stated the International Airline Program is only for Premium Economy tickets and higher, the program does provide discounts on all WestJet economy class tickets except for their lowest basic fare. Thus if you are planning on purchasing Econo or higher tickets with WestJet you definitely would want to consider booking via Amex Travel with your Platinum Card to receive some savings.

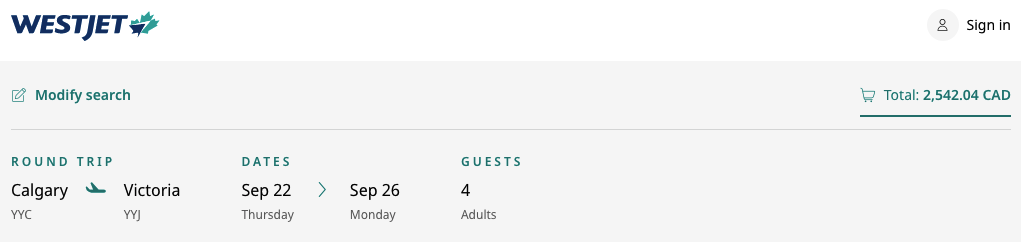

Here's an example of a family of four flying to Victoria from Calgary for a weekend in September. WestJet did not have an basic fares available so it made this comparison easy to do.

The price of four tickets from WestJet:

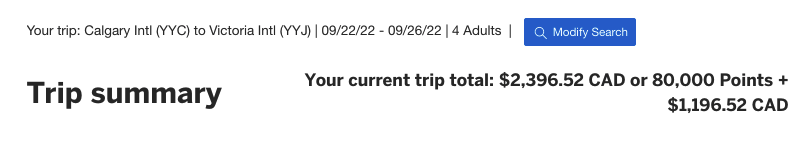

Those same four tickets with Amex's IAP:

For this short haul flight for four people the Platinum Card's International Airline Program provides a savings of $145.52. Not a huge difference but it's a savings nonetheless and you'll still earn and receive all your WestJet benefits if you have elite status and/or the WestJet RBC World Elite Mastercard. If you fly multiple times per year with your family on WestJet the savings could mount up by using one of the Platinum Cards.

I recommend reading Redemption Stories: Saving $3,800 on last minute flights with the Platinum Card from American Express. This article is about how the Rewards Canada family utilized IAP to save us some cash on some last minute WestJet flights and still receive all of our WestJet benefits etc.

WestJet Business Class

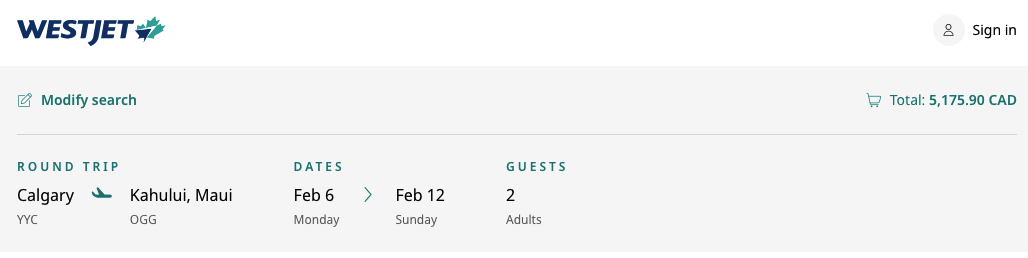

How about a trip for two from Calgary to Maui on WestJet's Boeing 787 Dreamliner in Business Class for May 2024.

The price of the two tickets from WestJet:

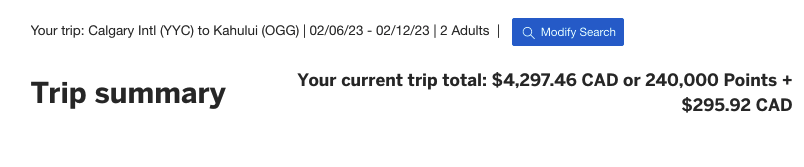

Those same two tickets with Amex's IAP:

In this case the IAP provides $878.44 in savings over booking those flights with WestJet. Right here with this one booking the savings more than pays for the $799 annual fee on either of the cards! And you still get all the other benefits from the cards!

Wrapping it up

The International Airline Program is just one of many valuable benefits that come on the Platinum and Business Platinum Cards from American Express. If you purchase economy class tickets with WestJet and/or are in a position where you buy premium class tickets on any of the airlines in the International Airline Program then paying the annual fee on one or both of these Platinum cards is a no-brainer. The savings alone from the program can more than cover the annual fee and then you have all the additional benefits from the cards on top of this to take advantage of!

Recommended reading:

- The Platinum Card® from American Express Review

- Business Platinum Card® from American Express Review

If you don't have either of these cards now is the time to grab one or both them as they are being offered with some really big welcome bonus offers. See the next section for details

The Platinum Card®

2025 Top Ultra Premium Credit Card in Canada

Earn up to 100,000 Membership Rewards® points - that’s up to $1,000 towards a weekend away

Annual Fee: $799 | Additional Card Fee: $250 for Platinum, $0 for Gold (First 2 Cards) then $50 each

- New Platinum® Cardmembers, earn 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership

- Plus, earn 30,000 points when you make a purchase between 15 and 17 months of Cardmembership

- Earn 2 points for every $1 in Card purchases on eligible dining and food delivery in Canada, 2 points for every $1 in Card purchases on eligible travel, and 1 point for every $1 in all other Card purchases

- Access a $200 Annual Travel Credit through American Express Travel Online or Platinum® Card Travel Service

- Enjoy a $200 Annual Dining Credit at some of Canada’s best restaurants

- Unlock $200 or more in additional value with Member extras. You can earn statement credits for qualifying purchases with participating brands

- Take full advantage of The American Express Global Lounge CollectionTM which unlocks access to over 1,400 airport lounges worldwide. This includes The Centurion® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience

- Enjoy flexible ways to use your points such as statement credits for any eligible purchase charged to your Card, new travel purchases booked on American Express Travel Online through the Flexible Points Travel Program, and eligible flights through the Fixed Points Travel Program

- Transfer points 1:1 to several frequent flyer and other loyalty programs

- Enjoy complimentary benefits that offer an average value of $550 USD at over 1,600 extraordinary properties worldwide when you book Fine Hotels + Resorts

- Platinum Cardmembers can enjoy access to special events and unique opportunities

- Enjoy premium benefits at the Toronto Pearson Airport

- You will also have access to many leading hotel and car rental companies’ loyalty programs. Our partners include Marriott International, Hilton Hotels and Resorts, Hertz and Avis

- Interest applies in accordance with your Cardmember Agreement, Information Box, and Disclosure statement if the total New Balance is not paid by the Payment Due Date each month. All payments must be received by the Payment Due Date shown on the monthly statement

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment

- Click here to apply for The Platinum Card from American Express

Business Platinum Card® from American Express

Earn up to 120,000 bonus Membership Rewards® points

Annual Fee: $799 | Additional Card Fee: $250 annually for Business Platinum Cards; $0 for Business Gold Cards | Purchase Interest: 21.99-29.99% on Flexible Payment Option limit and 30% on Due In Full balance

Earn up to 120,000 bonus Membership Rewards® points

- Earn 80,000 Membership Rewards® points after you charge $15,000 in net purchases to your Card in your first 3 months of Cardmembership

- Plus, earn 40,000 points when you make a purchase between 15 and 17 months of Cardmembership

- That’s up to $1,200 in statement credit that can be reinvested in your business

Earn points that you can redeem in a variety of ways.

- Earn 1.25 Membership Rewards points for virtually every $1 in purchases and get the most out of your business expenses

- Enjoy an exceptional line-up of rewards redemption options for you and your business, including travel, dining, entertainment, gift cards, merchandise, and more with Membership Rewards program.

- Transfer points to frequent flyer and hotel programs, including one-to-one to Aeroplan®* and Avios.

- Bolster your business with up to $820 in annual business and travel statement credit

- Enroll your eligible Card and earn up to $500 in business statement credits on qualifying purchases with Dell and Indeed.

- Enroll and earn up to $120 in eligible Wireless Credits each year.

- Access a $200 Annual Travel Credit each year of your Cardmembership

Unlock spending power and payment flexibility with a full suite of business management tools that give you more control over your business - anytime and anywhere

- Enjoy financial flexibility with no pre-set spending limit on purchases. With this Card, your purchasing power adjusts dynamically with your Card usage, and can grow over time, as long as you make your payments on time and maintain a good credit history.

- Maximize your cash flow with up to 55 interest free days so you can keep more cash on hand when you need it most.

- Pay for business expenses over time with Flexible Payment Option.

- This charge Card has both Due in Full and Flexible Payment Option balances. All Due in Full balances must be paid each month. Interest rate of 30% applies to each delinquent Due in Full Charge. This rate is effective from the day the account is opened. The Preferred rate of 21.99% applies to your Flexible Payment Option balance. If you have 2 separate Missed Payments in a 12 month period, the Flexible Payment Option rate for your account will be 25.99%. If you have 3 or more separate Missed Payments in a 12 month period, the Flexible Payment Option rate will be 29.99%. These rates are effective from the day the Flexible Payment Option is first available on your account.

Enjoy exclusive benefits for you and your business.

- Take full advantage of the American Express Global Lounge Collection which unlocks access to over 1400 airport lounges worldwide. This includes The Centurion® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience.

- Enjoy premium benefits at the Toronto Pearson Airport, including access to the Pearson Priority Security Lane and discount on parking.

- Get access to discounted base fares for you and your travel companions when you book through the International Airline Program.

- Enjoy Fine Hotels + Resorts benefits at over 1,600 properties worldwide like guaranteed late check-out, complimentary breakfast for two, and more with Business Platinum.

- Upgrade your stay with premium status at leading hotel brands like Hilton Honors and Marriott Bonvoy

- Enjoy access to specialty services and events, preferential treatment, and a dedicated Concierge team.

- Access a $100 CAD credit for NEXUS every 4 years with your Cardmembership

- Access comprehensive insurance coverage for your travel needs.

- Equip your business with Mobile Device Insurance

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

About the author

Patrick Sojka

Patrick is one of Canada's foremost leading experts on loyalty programs and credit cards. Having founded Rewards Canada in 2001 he brings nearly 24 years of experience to the forefront of helping Canadians make the most of their rewards. He has also provided consulting to credit card companies, airlines, hotels and is regularly featured in the media for his expertise on loyalty programs and credit cards.

This feature was first posted on August 9, 2022 and is updated on a regular basis

All images via American Express or the respective airlines