If you are just starting out in the points and miles world you are going to learn there are lots of abbreviations, phrases and calculations used by our community that may have you scratching your head! Two of the most common abbreviations you'll come across are CPP and CPM. These refer to Cents Per Point and Cents Per Mile and they are used to determine the value of a reward redemption.

In this RWRDS Canada Loyalty Lesson we'll get down to the nitty gritty of CPP and CPM so that you have a good grasp of the concept, how to calculate them and more importantly, how to properly use them for evaluating rewards and/or comparing loyalty programs.

What are CPP and CPM

Cents Per Point (CPP) and Cents Per Mile (CPM) are values assigned to a singular point or mile that are being redeemed for an award or reward (award and reward are interchangeable - some programs like to use award while others use reward)

When used properly, CPP and CPM are the go to benchmark for comparing awards within a program and when you include additional factors, they help in comparing one loyalty program against another loyalty program(s).

Calculating CPP and CPM

To be able to calculate CPP or CPM you need to the know the cash value of the award or reward you are redeeming for.

For flights this is comparing the cash price of the flight to the amount of points redeemed (while also taking into account taxes and fees paid on the award flight).

For hotels this is almost always comparing the all in cost (that is the room rate including all taxes and fees) to the amount of points redeemed for that stay (while taking into account any fees that may not be included on award nights)

For merchandise this is taking the cash price of the item (which may vary depending on which retailer you take the pricing from) including what it may cost to ship that item plus any taxes and comparing it to the amount of points or miles redeemed for that item (most merchandise rewards are shipped for free and do not have any taxes charged on them)

Here are some examples on how to calculate CPP/CPM:

Flights

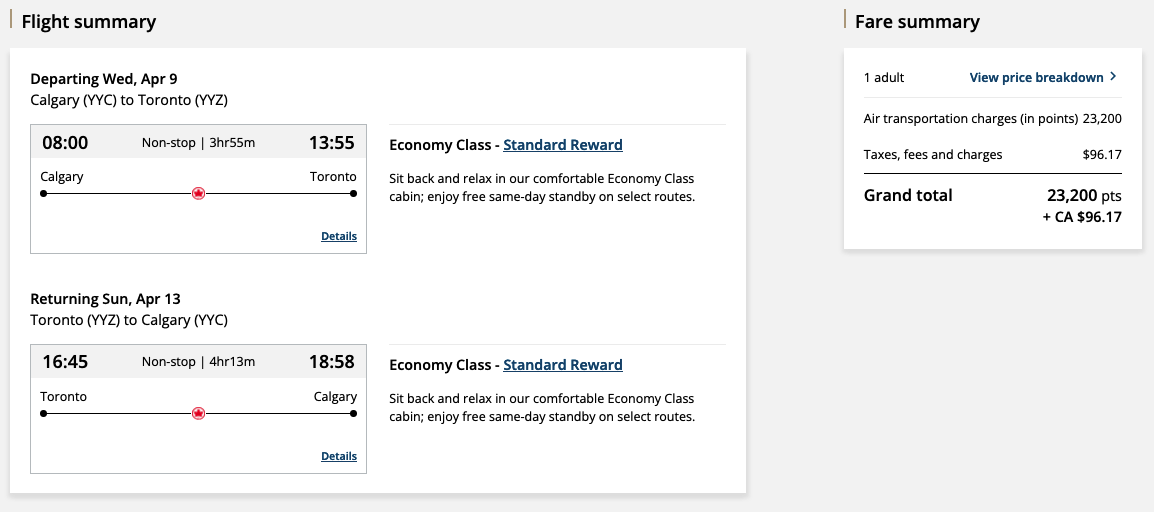

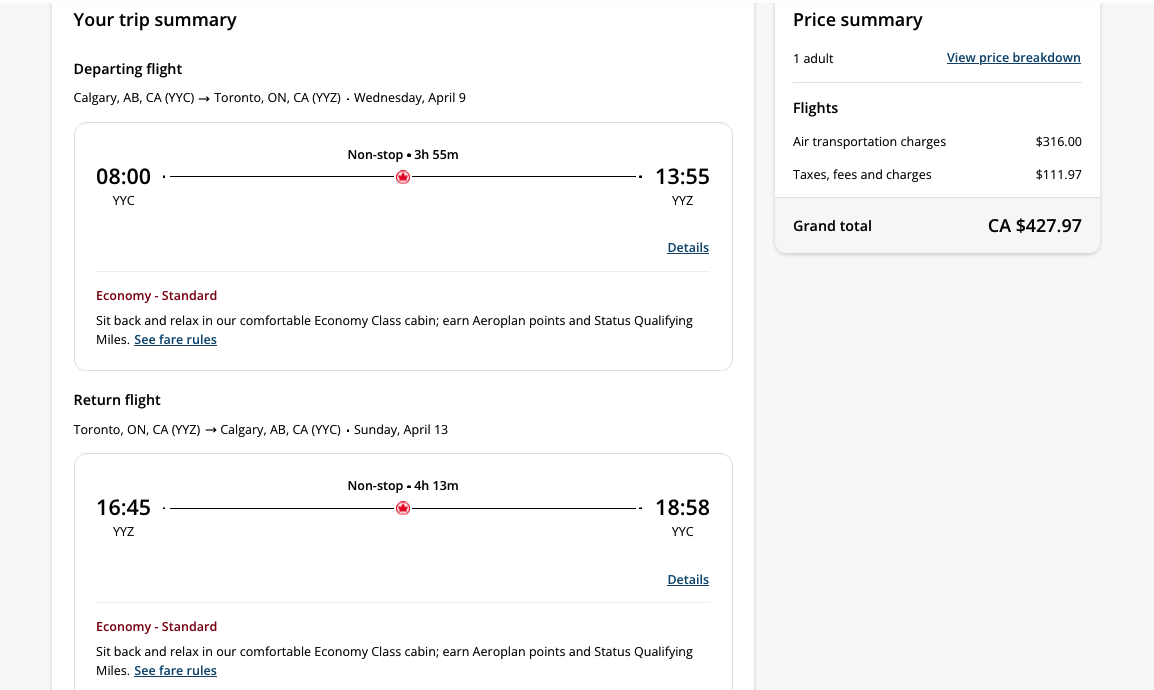

In this example we'll calculate the Cents Per Point for an Aeroplan round trip economy class award flight on Air Canada between Calgary and Toronto.

What you will require is the amount of points and any taxes and fees required for the award and also the cash price for the exact same flights at the same or nearest fare class level - in this example we have the "Economy Standard" fare class.

(we do not choose the one listed as "Popular" by Aeroplan as it is typically not the best option)

Recommended reading: Loyalty Lesson - Selecting the right Aeroplan flight award option to maximize the value of your points

To calculate the Cents Per Point for award flights, like the one above, you simply have to follow these steps:

- Take the total cash price of the ticket (make sure you have the same ticket level as the award flight) and subtract the amount of taxes and fees required as the cash co-pay portion on the award ticket.

For the example above that would be: $427.97 - $96.17 = $330.80 - Next take the dollar amount from the equation in step 1 and divide it by the number of points redeemed for the award

For the example above that would be: $330.80 / 23,200 = $0.01425 per point - Multiply the answer from step 2 by 100 and voila! You have a value of 1.43 CPP

Hotels

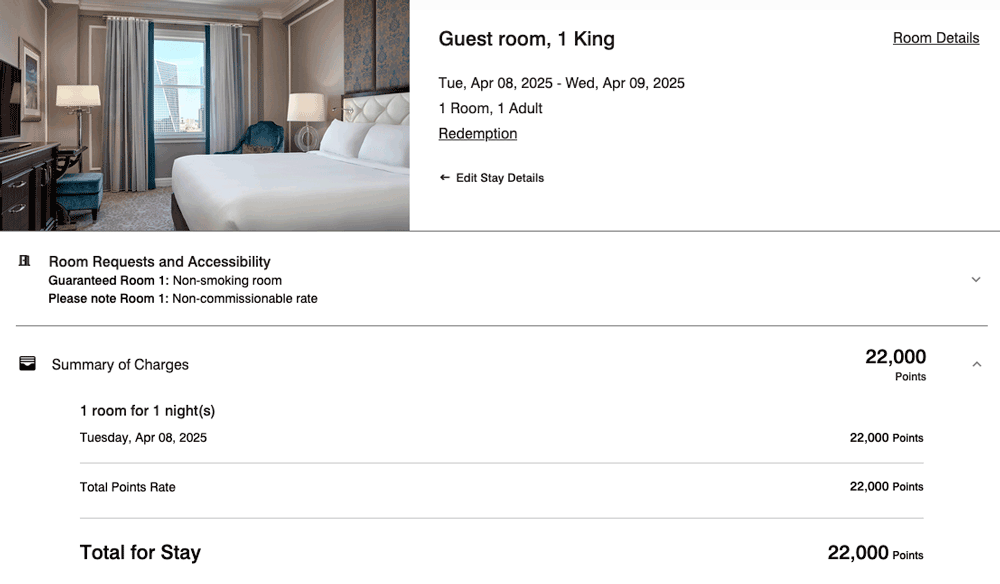

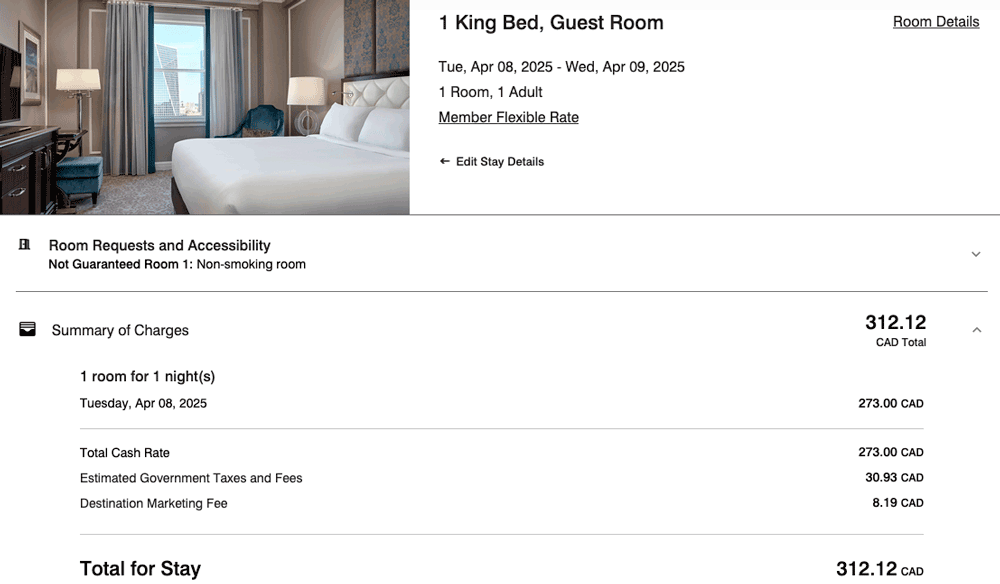

In this example we'll calculate the Cents Per Point for a Marriott Bonvoy free night award at the Hotel Saskatchewan, Autograph Collection Regina.

What you will require is the amount of points plus any taxes and fees required for the free night award and also the cash price for the same room type using the best flexible rate for program members.

Note: You do not want to choose the cheapest pre-paid non refundable rate to use for your comparison as the free night awards from virtually all hotel loyalty programs are cancellable and usually follow the same cancellation policy as the best flexible rate.

Recommended reading: Marriott Bonvoy provides great value for everyday hotel stays in Canada

To calculate the Cents Per Point for an award night like the one above, you simply have to follow these steps:

- Take the total cash price of the stay and subtract the amount of taxes and fees required as the cash co-pay portion on the award night (If there are any - many hotel award nights do not have them)

For the example above that would be: $312.12 - $0 = $312.12 - Next take the dollar amount from the equation in step 1 and divide it by the number of points redeemed for the award

For the example above that would be: $312.12 / 22,000 = $0.01419 per point - Multiply the answer from step 2 by 100 and voila! You have a value of 1.42 CPP

Merchandise

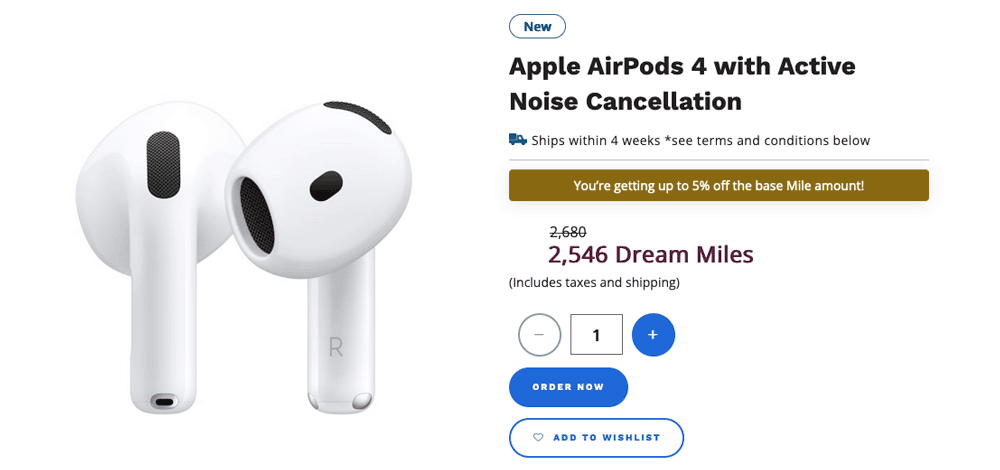

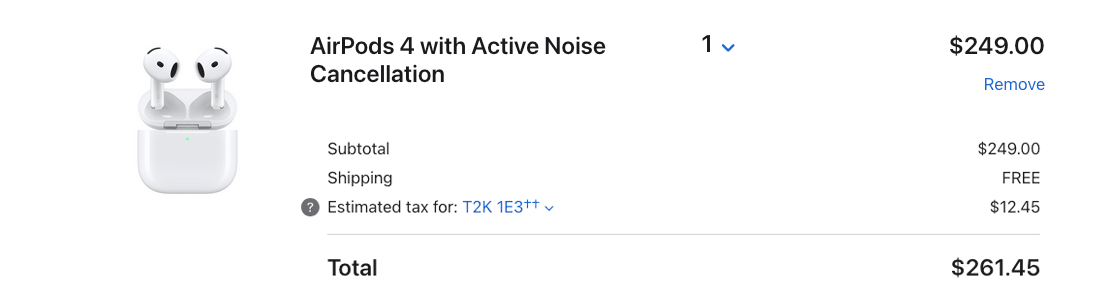

In this example we'll calculate the Cents Per Mile value when redeeming for Apple AirPods from AIR MILES.

What you will require is the amount of miles required for the reward and also the cash price for the exact same item including any taxes and shipping costs.

To calculate the Cents Per Mile for merchandise as shown above, you simply have to follow these steps:

- Take the total cash price of the merchandise and divide it by the number of miles redeemed for the award

For the example above that would be: $261.45 / 2,546 miles = $0.1027 per mile - Multiply the answer from step 1 by 100 and voila! You have a value of 10.27 CPM

** I will refrain from explaining why AIR MILES CPM valuations tend to be much higher than other programs as the rest of this lesson will clarify how to compare CPP/CPM across programs. Your homework from this lesson can be to figure out how AIR MLES reward options compare to other programs and leave that in the comments ;-).

How to use CPP and CPM

There are two methodologies for properly using CPP and CPM values. They can be used on their own to compare potential redemption options within the same program or they can be used with additional metrics to compare the value of potential redemption options between different programs.

Using CPP and CPM on their own

On their own, Cents Per Points and Cents Per Mile values should only be used to compare various redemption options within a single program. For example, it is perfectly fine to only use CPP when comparing using Aeroplan points for an economy class flight redemption versus redeeming points for a toaster. The flight may come in at 2 cents per point and the toaster may be 0.8 cents per points - thus it gives you a quick snapshot of which reward provides more value for your points.

However, you cannot compare the CPP value of a toaster reward from Aeroplan to a toaster reward from Delta SkyMiles. That same toaster from Delta may work out to 1 cent per mile so at first glance it might seem like the better redemption option but that's where trouble can arise. The toasters from the two programs are not being redeemed from the same pool of points. They are from different pools of points that have been earned at different rates and values. To properly compare the two and to see which redemption is actually better, you need to know how much it cost to earn the points or miles used for the redemption. This is what we'll cover in the next section.

There is one other circumstance where you can utilize CPP and CPM on their own and that is for credit cards that have transferable points options. In Canada the only programs with these options are American Express Membership Rewards and RBC Avion Rewards. For example, you can compare the CPP/CPM you may get for a flight on British Airways redeemed via the RBC Avion Rewards Air Redemption Schedule against converting those Avion Rewards points to Avios in The British Airways Club program and then redeeming them for the same British Airways flight.

How to properly use CPP and CPM to conduct comparisons between programs

When someone says X's points are better because they are worth 2.1 cents versus Y's which are 1.9 cents, is it really the case that X's are better? No, not necessarily.

To properly compare redemption values between programs, you need to ask yourself what did it take to earn these points and/or miles. And then use it with the CPP or CPM value you have calculated for the reward you are redeeming for. In other words, looking at both sides of equation (earning and redeeming) which we also refer to as the earn to burn ratio.

If you don't ask this and you don't calculate it, you cannot make a proper comparison of the programs and in fact in some cases it can lead people to making poor decisions in selecting the right program for themselves.

Quite possibly the most egregious case of this that I came across was an article on another points and miles resource that stated the RBC Avion Air Redemption Schedule was the best out of the three credit card issuers that have airline award charts in Canada. They made this claim based solely on the RBC chart providing the highest Cents Per Point rate.

And the site wasn't wrong - the RBC Avion Air Redemption Schedule does provide the highest CPP when compared to American Express' Fixed Points for Travel and CIBC's Aventura Airline Rewards Chart.

But where the site was wrong and misleading for consumers, was in claiming it is the best out three. What the article failed to take into account was how many points are earned from each of the bank's credit cards. And when you do this, you end up finding that out of the three programs, the RBC Avion Air Redemption Schedule is actually the worst of them!

Take a look at this chart which does take into account both the earn and the burn to give you the actual return (Sounds like something Snoop might say?)

| Rank | Credit Card Reward Program | Details | Minimum Earn Rate / $ | Maximum Earn Rate / $ | Maximum value per point when redeemed via the flight reward chart | Maximum possible return |

|---|---|---|---|---|---|---|

| 1 | American Express Membership Rewards Fixed Points for Travel |

Cards earn 1, 2, 3, and 5 points per dollar spent |

1 point | 5 points | 2 cents per point | 10% |

| 2 | CIBC Rewards Aventura Airline Rewards chart |

Cards earn 1, 1.5, 2 and 3 points per dollar spent |

1 point | 3 points | 2.28 cents per point | 6.84% |

| 3 | RBC Avion Rewards Avion Air Travel Redemption Schedule |

Cards earn 1 and 1.25 points per dollar spent | 1 points | 1.25 points | 2.33 cents per point | 2.91% |

As you can see from the chart, RBC does have the highest CPP at 2.33 cents but with RBC cards only offering a maximum of 1.25 points per dollar spent you can only achieve a maximum return on spending of 2.91%.

If we take the American Express' Fixed Points for Travel chart, its maximum CPP valuation of only 2 cents is lower than RBC's. However, American Express cards have earn rates that range from 1 to 5 points per dollar, which means you can get an actual maximum return on spending of 10%.

Meanwhile CIBC has cards that earn up 3 points per dollar and their maximum CPP from their chart is 2.28 which gives a maximum possible return of 6.84%.

Both of those are way better than RBC despite having lower CPPs! This is a great example of why you need to take valuations in articles that are based on CPP/CPM with a grain of salt unless you can see that all factors have been taken into account.

Editor's note: The chart above does not show the RBC Avion card plus the RBC ION+ card combo that allows members to extract more value out of RBC's chart. While easily done, the onus should not be on the consumer to have to run with two cards in the same program to extract maximum potential value - in fact, no other program in Canada does that. Just in case you are wondering though, if you do combine those two cards you can extract up to a 7% return from RBC's chart which would place it in 2nd.

Recommended reading: Loyalty Lesson - How to extract more value from Avion Rewards

The same goes for our toaster example from the previous section. Let's say the cash price of the toaster is $100 and you need 10,000 miles to redeem through Delta or 12,000 points from Aeroplan. That gives us the 1 cent per point and 0.8 cents per point values from above (0.833 to be exact) Hypothetically speaking, let's say you earned the 10,000 Delta SkyMiles after buying a $1,300 flight with them and you earned 12,000 points after spending $1,100 on an Air Canada flight. So even though Delta's Cents Per Mile looks better than Air Canada's Cents Per Point, you would actually achieve a 9% return on what your Aeroplan points cost you versus a 7.6% return with Delta.

CPP and CPM do not equal rate of return

What the previous section basically described is that you need to determine your Rate of Return for a proper comparison. A common mistake made by people is equating CPP and CPM as their rate of return, which it is not. CPP and CPM are strictly a redemption value and are only one part of the equation for determining your real reward value (they are the burn side of the equation). The other part of the equation is how much it cost to earn those points or miles and using that with the CPP/CPM gives us the earn to burn ratio which ends up being your Rate of Return.

The easiest way to calculate Rate of Return is to take how many points or miles you earn per dollar spent, multiply that by the CPP/CPM (which will have to be converted to dollars since you are looking at points earned per dollar, so 2 cents per point = $0.02) and then multiply it by 100 to get your rate of return percentage.

Here's an example of calculating some 5x points cards Rate of Returns with their guaranteed* CPP values (not potential values):

The American Express Cobalt Card earns up to 5 points per dollar spent with a guaranteed* value of 1 cent per point.

- 5 points x 0.01 cents per point x 100 = 5% return

The BMO eclipse Visa Infinite Card and BMO eclipse Visa Infinite Privilege Card both earn up to 5x points per dollar spent with a guaranteed* value of 0.67 cents per point

- 5 points x 0.0067 cents per point x 100 = 3.33% return

And if you want one of the most confusing rate of return calculations let's look at the BMO eclipse Rise Visa Card. It earns 5 points per $2 spent which means to get the Rate of Return you need to first divide that earn rate by 2 to get it to the same $1 earn rate level. Thus it earns 2.5 points per $1 spent and has a guaranteed* value of 0.67 cents per point"

- 2.5 points x 0.0067 cents per point x 100 = 1.67% return

* We use the term "guaranteed" very loosely here - more so to designate a known constant value that you will get for redeeming your points. Since programs can change their redemption rates at any time they are actually never guaranteed by the loyalty programs or by RWRDS Canada.

Rate of Return is the best metric for comparing programs

If you are able to calculate your rate of return, it is the best metric for comparing the value of rewards across programs. Without Rate of Return it is very difficult to make a truly accurate comparison since programs have such widely varying earn rates and redemption rates.

Side note: Why a high Rate of Return may not matter

A program or a reward with a high Rate of Return may not matter if it's hard to redeem those points or miles and/or the program does not make sense for the individual. Let's take Air France KLM Flying Blue as an example, the program is highly lauded and loved here on RWRDS Canada as they offer some of the best CPM values and rates of return when redeeming for reward flights across the Atlantic. But that won't matter if you are in a Canadian town or city that isn't served by Air France, KLM or their partner airlines, or if you have no need to fly across the Atlantic. Notwithstanding the points and miles game of positioning flights of course!

This is just another reason why you also need to take program point and mile valuations with a grain of salt!

Using CPP and CPM as the go/no-go benchmark for redemptions

CPP and CPM values can also be used to determine if it is worth redeeming points for a reward based on your own set benchmark. That is, if you have decided that you will only redeem points for an Aeroplan award flight if you are receiving 2 or more cents per point then 2 CPP is your benchmark. If an award only comes in at 1.5 cents you may then choose to pay cash instead and wait to redeem your points for when you do find an award at 2 CPP or higher.

I stress that you should use your own set CPP and CPM benchmarks that you have come up with. Yes, you can use resources like RWRDS Canada's valuations to guide you (see next section as well as to why you should set your own) but every individual has their sights set on different rewards and each person has different "happiness levels" so it's best to set your own value.

In the end some of you don't care at all what value you get and that's great, RWRDS Canada has always stressed that any redemption which you are happy with, is a great redemption regardless of the value. Some of you on the other hand do care about value and as such you can set the CPP and CPM benchmarks that will make you happy.

Should you trust published CPP and CPM rates?

Yes and no. The only cents per point valuations you can definitively trust are for fixed value programs like Scene+, BMO Rewards, and WestJet Rewards - just to name a few. For other programs it can be a real toss up as to whether they can be trusted or not. We here at RWRDS Canada like to provide more realistic valuations (on the lower end of the spectrum) for programs such as Air Canada Aeroplan so consumers don't end up being disappointed like we have witnessed many times when they can't achieve the higher values published on other resources. Consumers need to be aware of inflated valuations used by some to make a program look good (or better than others) which in turn will hopefully sell the reader on credit cards for that said program.

In general, you'll find published CPP and CPM rates tend to vary, sometimes widely, between resources, forums, blogs etc. The reason for the differences is how their respective CPP and CPM valuations are calculated and averaged out. You'll find many of them are more heavily skewed towards business class flight redemptions and hotel award nights for over the water bungalows while only a few will take a more conservative approach. Given that a much greater percentage of the Canadian population does not redeem for premium rewards, caution needs to be taken with those higher valuations as it can lead to consumer disappointment.

Whether it's from emails that I frequently receive or being approached by the media for interviews on numerous occasions, I always seem to find myself having to answer the question from Canadian consumers as to why they can never find rewards with the CPP and CPM values that are published on websites, blogs and forums. In the end those consumers end up being upset, disappointed and regretting their credit card choice(s) because they chose it over a different card thinking they would be getting those inflated CPP and CPM values.

What the consumer needs to know is that most published CPP and CPM values are strictly potential values that are averaged across a variety of redemption options. For example, there are resources and individuals that value American Express Membership Rewards points at 1.7 cents, 2 cents, 2.2 cents and so forth because they are taking into account conversion options and then redeeming thsoe points for business class awards. Ultimately those are only potential values and the fact of the matter is there is only one guaranteed* CPP value for Membership Rewards points and that is 1 cent per point. Any other amount is a potential value that will vary by member and by redemption.

Same goes for Aeroplan points, lots of resources and individuals give Aeroplan points a 2 CPP or higher valuation while here at RWRDS Canada we give them a 1.5 CPP value (and we are actively considering lowering it) In reality, the only guaranteed* value for Aeroplan points is 1 cent per point which you can get when redeeming for Air Canada Vacations packages. All others are only potential value - and when it comes to flights it can actually fall below the 1 CPP guaranteed* value. Many members complain that they can't even find 1 cent per point for award flights while others seem to have no issue finding 2 or more cents. in value.

* We use the term "guaranteed" very loosely here - more so to designate a known constant value that you will get for redeeming your points. Since programs can change their redemption rates at any time they are never actually guaranteed by the loyalty programs or by RWRDS Canada.

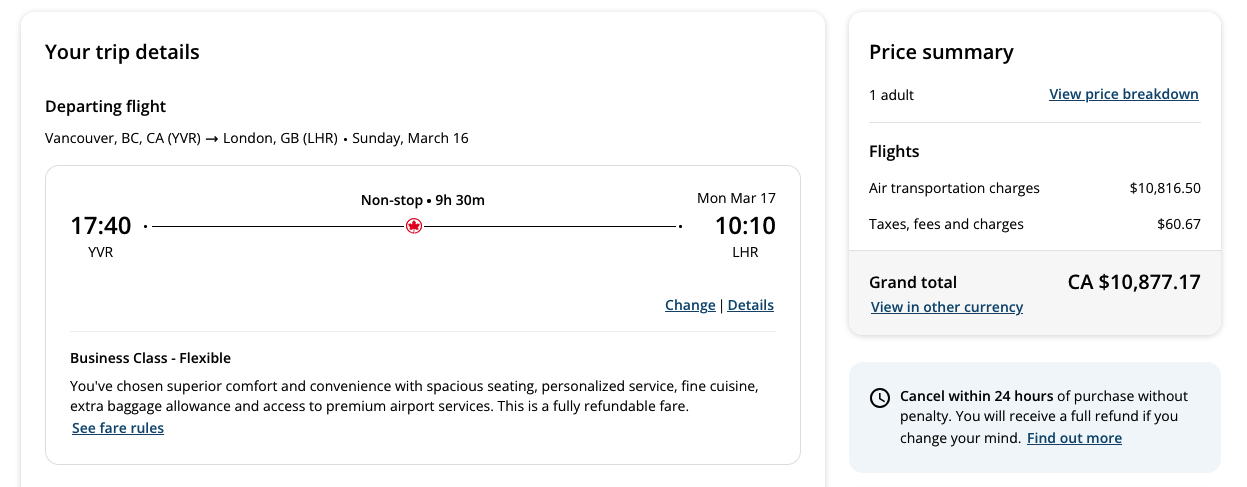

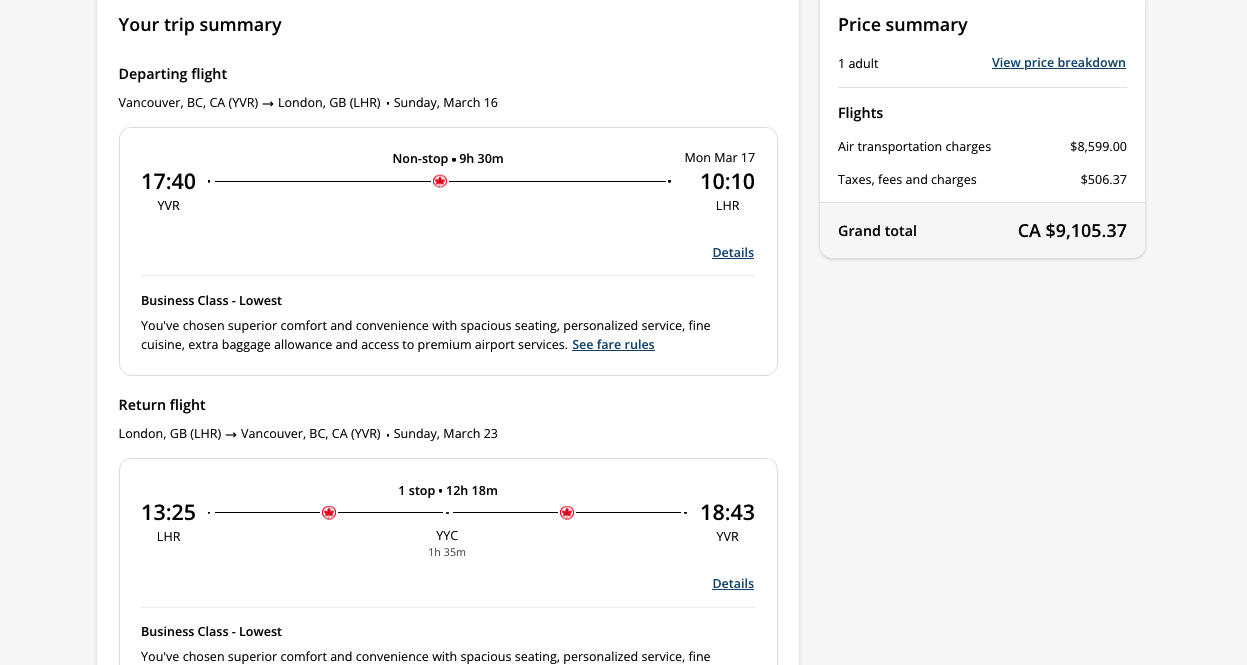

Don't fall for the one way international business class CPP and CPM valuations

There is another CPP and CPM rate that is frequently found on blogs, forums or places like Reddit and those are the extremely inflated values from redeeming for a one way international business class ticket. (RWRDS Canada has even made this mistake in the past)

What happens here is that sometimes you'll see people rave about getting 15, 20 or even 30 CPP/CPM on an award flight between North America and Asia or North America and Europe. And what they have done is compare the miles/points redeemed for a one way business or first class award to the cash price for that same one way flight.

Technically speaking, there is nothing wrong with that calculation as it follows the steps we have outlined above. However, what the person either doesn't know or has failed to disclose, is that one way business class tickets for international travel paid for with cash are almost always outrageously priced! So much so that in most cases you can buy a round trip business class ticket for less than the cost of the one way ticket!

Thus the better comparison to provide a more accurate CPP/CPM value is to take half of the cash cost of the round trip business class flight and use that to calculate the true value of that one way business class or first class award flight.

** As a side note, now that you know this and if you are ever in need of one way international travel in business class, nine times out of ten you'll be better off buying the round trip ticket and not using the return flight. Do be aware airlines frown upon throw away ticketing such as this and it could lead to being banned from the airline or loyalty program **

Wrapping it up

Cents Per Point (CPP) and Cents Per Mile (CPM) are a common and powerful valuation tool used by the points and miles community that you will find in many articles, forums, Reddit, you name it, and also here on RWRDS Canada. However, care must be taken in how they are used and applied. CPP and CPM on their own should never be used to compare redemptions across different programs unless you know how much it cost to earn the points and miles in each of the programs.

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

Check out some of our other loyalty lessons:

- Why credit card reward charts rarely provide good value for economy class flights to Europe

- When earning 5x points isn't the same as earning 5x points - a loyalty lesson

- There is one very popular travel rewards credit card in Canada that is due for a major overhaul

- Loyalty Lesson: How a card with 4.16% cash back can be better than one offering 5%

- Loyalty Lesson: When a credit card first checked bag free benefit isn’t free

This article was first posted on January 1, 2025 and is updated on a regular basis

Image by Mohamed Hassan from Pixabay

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation in our Facebook Group or on Twitter!