Launched in March 2025, the BMO VIPorter World Elite Mastercard is the new premium card offering for Porter Airlines and its VIPorter frequent flyer program. It is one of two primary cards in the BMO Porter Airlines suite of cards that is also includes the mid-tier BMO VIPorter Mastercard®* and should you not qualify for the World Elite, the bank does offer a World version as well.

The review of the BMO VIPorter World Elite Mastercard is broken down into the following sections:

Overview

The BMO VIPorter World Elite Mastercard is a premium travel rewards credit card available to residents across Canada including those in Quebec. The card is tied directly into the Porter Airlines VIPorter program as it earns VIPorter points on all purchases. It features some excellent accelerated earn rates on Porter Airlines purchases and other popular everyday spending categories plus it offers automatic elite status in the VIPorter program which provides benefits to enjoy when flying on Porter Airlines.

Costs & Sign up Features

The BMO VIPorter World Elite Mastercard’s annual fee comes in at $199 per year and additional (supplementary) cards are $75 each.

The introductory welcome bonus on the BMO VIPorter World Elite Mastercard offers up to 70,000 VIPorter Points, annual companion pass, up to $1,000 in qualifying spend and no annual fee in the first year. This offer is available until July 1, 2025.

The welcome bonus is broken down as follows:

- 20,000 points earned when you spend $5,000 within 110 days of account opening

- 20,000 points earned when you spend $9,000 within 180 days of account opening

- 30,000 points earned when you spend $18,000 within 365 days of account opening

- One companion pass when you spend a minimum of $9,000 within 180 days of account opening

- $1,000 in Qualifying Spend when you spend a minimum of $9,000 within 180 days of account opening

The interest rate on the card is 19.99% - 26.99% on purchases and 22.99% - 28.99% on cash advances. In Newfoundland and Quebec, the Purchase Credit Rate on the Neo World Elite® Mastercard is 19.99% - 23.99%.

The minimum annual income requirements for this card are $80,000 personal or $150,000 household.

Earning

The card earns VIPorter points and those are earned as follows

- Earn 3 points for every $1 spent on Porter purchases* (Capped at $20,000 of spend annually)

- Earn 2 points for every $1 spent on gas and transportation (Capped at $5,000 of spend annually)

- Earn 2 points for every $1 spent on groceries and dining* (Capped at $10,000 of spend annually)

- Earn 2 points for every $1 spent on hotel accommodations (Capped at $5,000 of spend annually)

- Earn 1 point for every $1 spent everywhere else*

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Effective Rate of return (Travel) * |

|---|---|---|

| Porter Airlines purchases (Capped at $20,000 spend annually) |

3 | 4.5% |

| Groceries & Dining (Capped at $10,000 spend annually) |

2 | 3% |

| Gas & Transportation (Capped at $5,000 spend annually) |

2 | 3% |

| Hotel Accommodations (Capped at $5,000 spend annually) |

2 | 3% |

| All other spending (including post cap spend) |

1 | 1.5% |

| * This is based on an average valuation of 1.5 cents per point. In our limited testing of point redemption value we found values ranging from 0.79 cents per point to 2.1 cents per point |

||

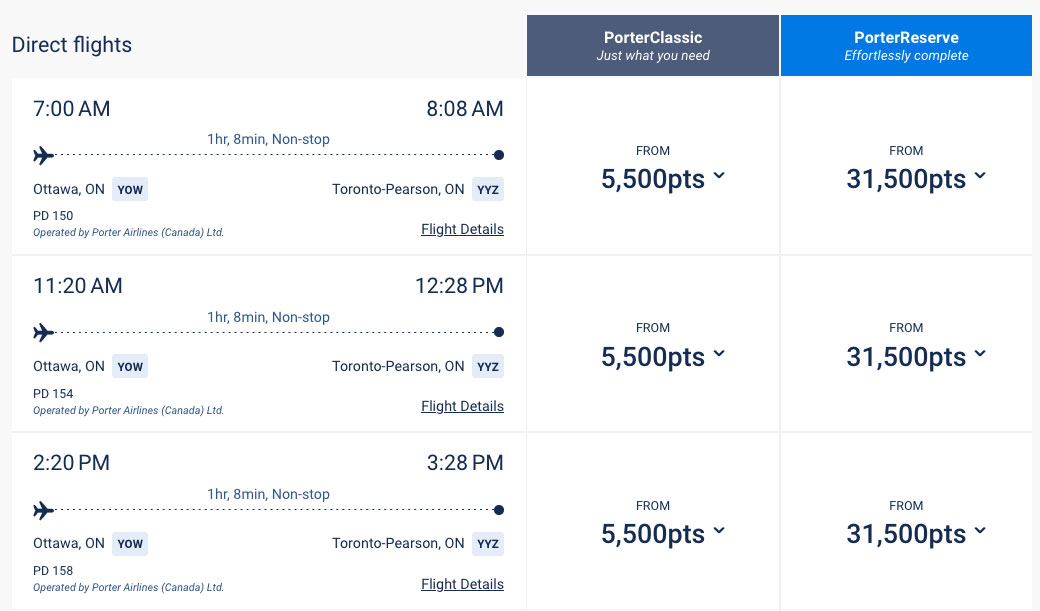

Redeeming

Redeeming points in the Porter VIPorter program is very simple and on average each point is worth 1.5 cents each. That’s an average though, it can be more than that or it can be less than that (See below*)

The points earned on the card and in the program can be used towards Porter Airlines flights for either 100% of your base fare, or a portion of your base fare, in which case the balance of the fare must be paid by credit card or other forms of payment as accepted by Porter Airlines. At this time there is no option to use VIPorter points towards taxes and fees levied on the airfares.

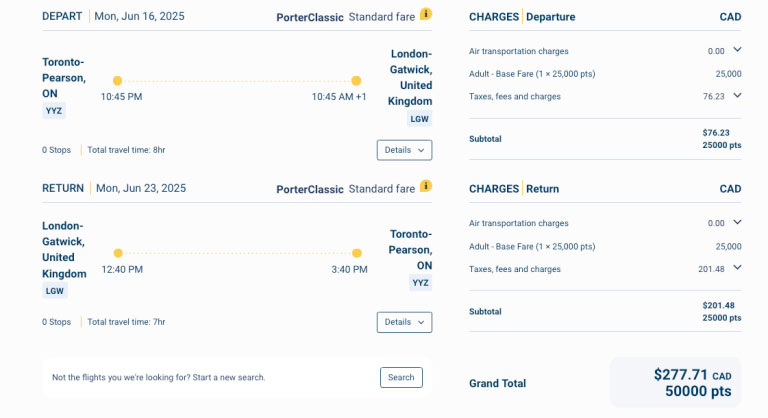

An example of a VIPorter redemption for an Air Transat flight

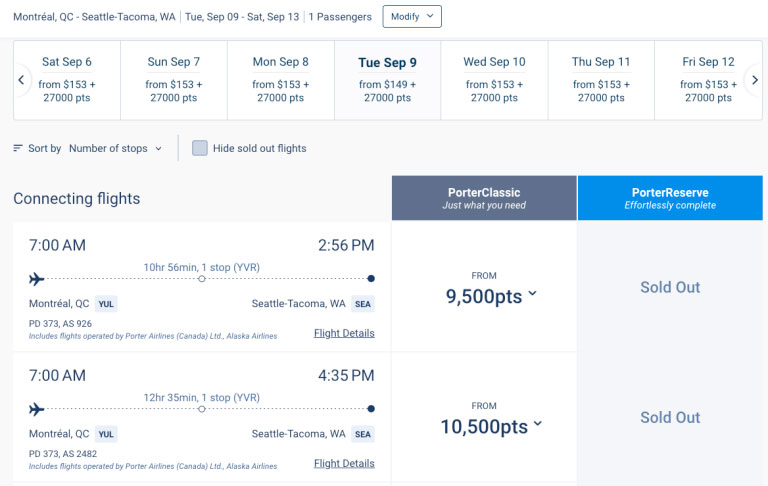

In addition to being able to use the points on Porter Airlines flights, they can also be redeemed for flights on Air Transat or a combination of Porter+Alaska Airlines flights. In fact, this card is ideal for any semi-frequent to frequent Air Transat flyers who may not even set foot on a Porter airplane. The good thing with VIPorter is that they don't pass along the hefty carrier surcharges sometimes found on Air Transat flights.

An example of a VIPorter redemption for an Air Transat flight

An example of a VIPorter redemptions for Porter+Alaska Airlines flights

Recommended reading: How Porter Airlines VIPorter represents one of the better options for booking Air, Transat flights with points

* “Value is based on VIPorter members receiving an average value of $0.015/points when redeeming for a flight as of January 1, 2024. Redemption calculation is based on a aggregate view of actual flight bookings made between the period of January 1 – October 31, 2024.”

TIP: The one thing I have found in doing numerous points vs. cash searches to determine a value for VIPorter Points cents per point value is that the points tend to provide better value when redeemed for Porter Classic fares over Porter Reserve fares.

Features and Benefits

The BMO VIPorter World Elite Mastercard comes with benefits that make flying with Porter Airlines even more enjoyable, namely automatic elite status! The card also comes with the standard benefits that are provided on most World Elite Mastercards in Canada.

Automatic VIPorter Venture Avid Traveller elite status

Cardholders are automatically granted VIPorter Venture Avid Traveller membership benefits. The key benefits provided to Venture level members are:

- 6 points per dollar on Porter flights

- Dedicated airport check-in

- Priority security screening

- Early boarding

- Priority re-accommodation for flight delays

- One complimentary checked bag

- Carry-on bag, free of charge, with PorterClassic Basic fare

- Complimentary PorterClassic seat selection

- Priority call centre service

For anyone flying Porter Airlines several times per year the value of these benefits can more than pay for the $199 annual fee!

Avid Traveller Qualifying Spend

All World Elite cardholders will also earn $1 of Avid Traveller Qualifying Spend for every $25 in eligible credit card spend.

Annual round-trip Porter companion pass

This card features an annual round-trip Porter companion pass that gives an additional passenger flying on the same booking 100% off the base fare of any Porter flight when spending at least $50,000 annually on the card.

This is a great benefit to have especially when purchasing more expensive fares but that’s quite a big spend requirement to earn it, in fact it is the highest out of any cards in Canada that offer a similar benefit.

No VIPorter Points Expiry

By having the card it exempts the member from airline’s rule requiring members to fly with Porter or redeem some points at least once every 24 months

World Elite Mastercard benefits

- Mastercard Travel Pass provided by DragonPass Complimentary membership to Mastercard Travel Pass provided by DragonPass gives access to over 1,300 airport lounges worldwide at discounted rate of $32 USD per person per visit

- FlexiRoam Global Data Roaming Stay connected around the world without a SIM card and get up to 15% off a Global Data Roaming plan plus up to 3GB of data, free.

- Fubo Discount Access 50+ live-stream sports channels and save $30 on your first three months of Fubo

- H&R Block Discount Save up to 30% when you pay for your tax preparation services using your eligible Mastercard

- Booking.com Discount Up to 7% off prepaid stays and save as you explore

Insurance

The BMO VIPorter World Elite Mastercard comes with quite a very good insurance package . The insurance coverage includes the following:

- Out of Province/Country Emergency Medical Insurance (21 days under age 65)

- Trip Cancellation Insurance: up to $1,500 per person ($5,000 total per trip)

- Trip Interruption Insurance: up to $2,000 per person ($10,000 total per trip)

- Flight Delay Insurance: 4 hours $500 in total

- Car Rental Theft and Damage Insurance: 48 Days up to C$65,000 MSRP

- Delayed Baggage Insurance: 6 hours up to $500 per person ($1,000 total per trip)

- Lost / Stolen Baggage Insurance: up to $500 per person ($1,000 total per trip)

- Damaged Baggage Insurance: up to $500 per person ($1,000 total per trip)

- Hotel/Motel Burglary Insurance: Up to $1,000

- $500,000 Travel Accident Insurance

- Purchase Protection Insurance: 90 days

- Extended Warranty Insurance: Up to 1 extra year

What is good about this card

The welcome bonus combined with no annual fee in the first year provide excellent value! 70,000 points in total at an average value of 1.5 cents per point means that bonus is worth $1,050 but you will need to pay the annual fee in the 2nd year to get the entire bonus which puts the baseline value of the welcome bonus offer at $851. This is one of highest value bonuses in all of Canada. The $18,000 spend requirement is on the higher end of the market but should be easily achieved as that only works out to $1,500 per month.

The earn rates are quite good^ and competitive with similar cards in the market. The three points per dollar on Porter purchases is extremely valuable to the semi-frequent/frequent Porter travellers especially when combined with the everyday accelerated earn rates of 2 points per dollar on gas, transportation, dining, groceries and hotels. The base earn rate of 1 point per dollar which has an average rate of return of 1.5% makes it a strong card for "everything else" spending, namely Costco where this 1.5% return has the card tying other cards in the Top 5 Mastercards to use at Costco.

^ Note the spending caps on these earn rates do get mentioned in "What is not so good about this card"

The automatic Avid Venture Traveller Elite status is what this card is really all about. This by far the #1 best thing about the card. All the benefits afforded to this status like dedicated airport check-in, priority security screening, and one complimentary checked bag make it worth getting this card if you fly with Porter Airlines - even perhaps just once per year and check bags! The checked bag savings alone could be worth more than you pay for this card.

The World Elite Mastercard benefits are always a great addition. The Mastercard TravelPass by DragonPass pays your annual membership fee for an airport lounge access program and then you get a discounted entry rate of US$32 per visit. (Most lounges now charge $50 to $60 or more if you don't have any of these membership programs to use)

What is not so good about this card

While we think the earn rates on the card are great the annual spending caps placed on the accelerated categories are not. while not as bad as some cards in market, they are significantly lower than this card’s main competitors such as the TD Aeroplan Visa Infinite Card. The $10,000 cap on dining and groceries combined is quite low. Remember the average grocery spend for a family of 4 is estimated to be over $16,000 annually and that’s groceries only, no dining included.

The high spend requirement of $50,000 annually to earn the companion vouchers after the one you earn with introductory welcome offer is not so good. We are surprised BMO and Porter set the bar that high considering the vouchers from the WestJet cards do not require any card spend at all, Air Canada cards only requiring $25,000 in spend (yes, these Aeroplan cards have higher annual fees) and the RBC British Airways card requiring $30,000 in spend. Even with WestJet having a co-pay requirement for their companion vouchers you know you will always get one every year so it is way more accessible than Porter’s. For many it’s easier to swallow a $119 to $499 co-pay with WestJet than trying to spend $50K on a card.

The high annual fee may not be so good for some who are on the fence about this card. With most of this card's competitors running between $120 and $155 per year (and some with no fees on additional) cards that higher fee may keep some people away from the card.

Another potential item that is not so good is the limited reach of Porter Airlines and its partner airlines. Right now the card is very Eastern Canada-centric and will only have limited appeal Porter frequent flyers outside of Ontario and Quebec. This should be alleviated in the future as the airline continues to grow by adding new planes, new routes and potential new frequent flyer program partnerships.

Who should get this card

- Consumers who fly semi-frequently or frequently with Porter Airlines should definitely get this card

- Consumers who like toe fly with Air Transat should also consider getting this card

- Individuals, couples or families who fly with Porter and check luggage on those flights to take advantage of the first bag free benefit

- Consumers who want a better cash back in their wallet than what is offered by one of the Big 5 Banks (and most other issuers in Canada)

Conclusion

The new BMO VIPorter World Elite®* Mastercard®* is an excellent option for consumers looking to earn more VIPorter points and to receive some pretty good benefits when flying with Porter Airlines.

The value proposition seen on the card of accelerated earn rates on Porter flights and automatic elite status point towards a focus of the cards being developed for those who fly with Porter Airlines on a semi-frequent to frequent basis and less so for everyday Canadians. This makes a lot of sense for Porter as the airline doesn’t have the reach of Air Canada or WestJet just yet in terms of cities served and overall flight options. So it is better to appeal to those using the airline rather than going after the general Canadian populace like Aeroplan does and to a lesser extent, like WestJet does.

Overall, this is the card to go for if you meet the income requirements as it has healthy returns on spending, provides first checked bag free, free carry-on bags for the cheapest fares, complimentary seat selection and more. It is the ideal card offering for people who fly with Porter and it is also an ideal card for Air Transat flyers!

Latest card details:

BMO VIPorter World Elite®* Mastercard®*

Welcome offer: Get up to $2,400 in value* including 70,000 VIPorter points and a round-trip companion pass.* Plus receive $1,000 in Qualifying Spend.*

Annual Fee: $199 Primary Card (Waived in first year) | $75 Secondary Card | Interest Rate: Purchases 21.99% Cash Advances & Balance Transfers 23.99% (21.99% for Quebec residents) | Minimum $80,000 (individual) or $150,000 (household) annual income required.

- Get up to $2,400 in value* including 70,000 VIPorter points and a round-trip companion pass.* Plus receive $1,000 in Qualifying Spend.*

Bonus offer awarded as follows:

- 20,000 points earned when you spend $5,000 within 110 days of account opening

- 20,000 points earned when you spend $9,000 within 180 days of account opening

- 30,000 points earned when you spend $18,000 within 365 days of account opening

- One companion pass when you spend a minimum of $9,000 within 180 days of account opening

- $1,000 in Qualifying Spend when you spend a minimum of $9,000 within 180 days of account opening

- Earn 3 points for every $1 spent on Porter purchases* (Capped at $20,000 of spend annually)

- Earn 2 points for every $1 spent on gas and transportation (Capped at $5,000 of spend annually)

- Earn 2 points for every $1 spent on groceries and dining* (Capped at $10,000 of spend annually)

- Earn 2 points for every $1 spent on hotel accommodations (Capped at $5,000 of spend annually)

- Earn 1 point for every $1 spent everywhere else*

- A round-trip companion pass per year* ($50,000 annual spend required)

- 1 complimentary checked bag*,

- 1 complimentary carry-on bag on all Porter fare types*,

- Free PorterClassic seat selection*,

- Priority re-accommodation for flight delays*,

- Priority check-in, security, and early boarding*,

- No VIPorter points expiry*,

- Earn $1 of qualifying spend for every $25 spent*,

- Complimentary membership in Mastercard Travel Pass provided by DragonPass. As a member enjoy lounge access for a fee of just US$32 per person, per visit.*

Comprehensive insurance coverage

- Click here to apply for the BMO VIPorter World Elite®* Mastercard®*

*Terms and conditions apply

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information

Other cards to consider if you are looking at this card:

- American Express Cobalt Card

- American Express® Aeroplan®* Card

- BMO AIR MILES World Elite Mastercard

- CIBC Aeroplan® Visa Infinite* Card

- RBC Avion Visa Infinite Card

- TD Aeroplan Visa Infinite Card

- WestJet RBC World Elite Mastercard

This review was first posted on April 22, 2025 and is updated on a regular basis

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

About the author

Patrick Sojka

Patrick is one of Canada's foremost leading experts on loyalty programs and credit cards. Having founded Rewards Canada in 2001 he brings nearly 24 years of experience to the forefront of helping Canadians make the most of their rewards. He has also provided consulting to credit card companies, airlines, hotels and is regularly featured in the media for his expertise on loyalty programs and credit cards.

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!