The Best Credit Cards for All Inclusive Vacationers

The Best Credit Cards for All Inclusive Vacationers

Primary tips to take away from this list of credit cards

- You don't need the full amount of points to redeem towards a vacation. You can use them to make your vacation cheaper or make it more luxurious. For example, if you have a $3,000 budget for your vacation and have $1,000 worth of points - you can now buy a $4,000 vacation - perhaps at a 5 star all inclusive resort instead of a 4 star.

- You can buy all inclusive vacations from any travel provider with these cards - it doesn't matter if it is redtag.ca, Expedia, itravel2000, Air Transat, Air Canada Vacations, AIR MILES Travel, your local travel agent or any other travel company selling the vacation package. (this is not applicable to the WestJet card)

- You are not limited by time - you can buy your all inclusive vacation package 6+ months to 6 hours prior to travel and you can still use your points for them.

- You can be on vacation at the all inclusive resort and pay for something with your card (say an excursion) and redeem points for it when you get home (this is not applicable to the WestJet card)

- All of the below cards come with good to excellent insurance benefits such as out of province medical coverage, trip cancellation, flight delay and more.

- The cards below have good to excellent welcome sign up bonuses typically worth up to $500 or more that can be used towards these vacations (not applicable to the Desjardins card as it does not a have standard welcome bonus)

There isn't one credit card in Canada that is all inclusive vacation specific - and you know what? That's a good thing. As Canadians we like to shop around for the best prices on all inclusive vacations so using a proprietary credit card reward program is ideal.

The best proprietary credit card programs aren't tied into one program, they let you book your all inclusive vacation how you want, when you want and with whomever you want. Buying a super cheap package vacation from Expedia? Not a problem. A 5 star package from redtag.ca? Still not a problem.

The way these proprietary programs work is that you buy the vacation you want with your credit card and once the charge shows up on your account you redeem your points towards that charge.

Don't have enough points? Not a problem either. Most of them allow you to redeem whatever amount of points you want. Say you have 100,000 points that are worth $1,000 and you want buy an $1,800 all inclusive package? You can redeem the points for a $1,000 credit and now you have only paid $800 for that vacation. Have 180,000 points to pay for it all? You can do that as well.

An example of American Express' using points slider

And get this - depending on the card you have, you can continue to collect points and use them towards that same vacation charge up to 12 months after it posts! Yes, you buy it in November, travel in February and then you can continue to earn points on all your purchases afterwards and redeem them up until the following November!

All that being said, here are the cards we recommend to All Inclusive Vacations, why we recommend them and the all the details on how and when you can use the points.

American Express Cobalt Card

| Earn rate: | 5 points/$ for eats and drinks 3 points/$ on select streaming services 2 points/$ for gas, daily transit (including taxis and rideshare) 1 point/$ on all other purchases |

| Where can you can redeem your points: | Any Travel Provider |

| Point redemption value for all inclusive vacations: | 1,000 points = $10 |

| Effective rate of return for these redemptions: | 1% to 5% |

| Duration of points redemption period: | 12 months (after the travel charge posts to your account) |

| Annual Fee | $155.88 (Billed as $12.99 per month) |

The American Express Cobalt card is Canada's number one travel rewards credit card due to strong earn rates and having the most flexible and valuable redemption options. It earns an awesome 5 points per dollar spent on grocery store and dining purchases (including food delivery services). Select streaming services will earn 3 points per dollar and it also earns 2 points per dollar on gas and transit (including taxi and ride sharing). All other purchases earn 1 point per dollar spent. The 5x points accelerated rate is capped at $2,500 in eats and drinks spending per month while the 2x and 3x points rates are not capped.

This means, if you are able to maximize the card and spend $2,500 per month in the 5x points category you would end up with 150,000 American Express Membership Rewards points in one year. That 150K of points is worth $1,500 towards any all inclusive vacation package that you book with any travel provider. You also have up to 12 months after the charge posts to redeem points against that specific charge.

Learn more about and apply for the Cobalt card here.

Scotiabank Gold American Express Card

| Earn rate: | 6 points/$ at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op. 5 points/$ for dining, groceries, entertainment 3 points/$ for gas, daily transit and streaming services 1 point/$ on all other purchases |

| Where can you can redeem your points: | Any Travel Provider |

| Point redemption value for all inclusive vacations: | 1,000 points = $10 |

| Effective rate of return for these redemptions: | 1% to 6% |

| Duration of points redemption period: | 12 months (after the travel charge posts to your account) |

| Annual Fee | $120 |

The Scotiabank Gold American Express is one of the best cards in Canada for points earning and benefits. The card has a 6 points/$ earn rate at Scene+ grocery stores (Sobeys, Safeway etc) which is the highest earn rate in Canada for groceries when you redeem for any travel.

After that the card earns an awesome 5 points per dollar spent on other grocery stores, dining (including select food delivery services) & entertainment purchases. It also earns 3 points per dollar on gas, transit (including taxi and ride sharing) and streaming services like Netflix. All other purchases earn 1 point per dollar spent. The accelerated rates are earned until you hit $50,000 annually combined for the 3x, 5x and 6x categories.

This means, if you are able to maximize the card and spend $50,000 in the 6x points category you would end up with 300,000 Scotia Rewards points. That 300K of points are worth $3,000 towards any all inclusive vacation package that you book with any travel provider. You have up to 12 months after the charge posts to redeem points against that charge.

And there's one more benefit to this card that all-inclusive vacations should like - it has no foreign transaction fees, that means on average it saves you 2.5% on all purchases made outside of Canada!

Learn more about and apply for the Scotia Gold Amex card here.

MBNA Rewards World Elite Mastercard

| Earn rate: | 5 points/$ on restaurant, grocery, digital media, membership, and household utility purchases 1 point/$ on all other spending + 10% birthday bonus on all spending (up to 15,000 extra points yearly) |

| Where can you can redeem your points: | MBNA Rewards or Any Travel Provider |

| Point redemption value for all inclusive vacations: | 100 Points = $1 via MBNA Rewards 120 Points = $1 for any other travel provider (redeemed as a cash back statement credit) |

| Effective rate of return for these redemptions: | 1% to 5.5% when redeeming via MBNA Rewards 0.83% to 4.57% when redeeming for travel via any other travel provider |

| Duration of points redemption period: | 9 months after the charge posts to your account for the statement credit option |

| Annual Fee | $120 |

The Mastercard with the highest overall earn rates in Canada, the MBNA Rewards World Elite Mastercard is another great option for the All Inclusive vacationer. To get the best value out of your points for travel redemptions you must book your travel via MBNA which operates as its own travel agency. Basically you book travel through them as if you were booking travel anywhere else and then you redeem points against the charge during the payment process for your travel. This travel includes All Inclusive vacation packages.

You can choose to redeem any amount of points against the charge so it makes it quite flexible. The redemption rate published by MBNA is 10,000 points = $100 however you can choose to redeem less than that or more than that. Word on the street also states MBNA Rewards Travel will price match if you find lower prices for travel elsewhere.

However if you do choose to book travel elsewhere you can use the statement credit redemption to pay for part or all of that charge at a rate of 120 points to $1.

Learn more about and apply for the MBNA World Elite card here.

Desjardins Odyssey World Elite Mastercard

| Earn rate: | 3% on groceries 2% on restaurants, entertainment, alternative transportation 1.5% on all other spending |

| Where can you can redeem your points: | Any Travel Provider |

| Point redemption value for all inclusive vacations: | 1 BONUSDOLLAR = $1 |

| Effective rate of return for these redemptions: | 1.5 to 3% |

| Duration of points redemption period: | 60 days (after the travel charge posts to your account) |

| Annual Fee | $130 |

Desjardins is a brand of card that doesn't get too much attention here on Rewards Canada but their Odyssey World Elite Mastercard is another good option for All Inclusive travellers. You earn Desjardins BONUSDOLLARS ranging from 1.5% to 3% on your spending. One Desjardins BONUSDOLLAR equals $1 towards travel that you can use towards any all inclusive vacation package that you book with any travel provider. You must redeem a minimum of $20 Bonus Dollars at a time and you have up to 60 days after the charge posts to redeem points against it.

Learn more about and apply for the Desjardins Odyssey card here.

National Bank of Canada World Elite Mastercard

| Earn rate: | 5 points per dollar spent on grocery and restaurant purchases (until a total of $2,500 in gross monthly purchases is charged to the account regardless of the purchase category) |

| Where can you can redeem your points: | À la carte Travel or Any Travel Provider |

| Point redemption value for all inclusive vacations: | 1 À la carte rewards points = 1 cent (À la carte Travel) 1 À la carte rewards points = 0.83 cents (any travel provider) |

| Effective rate of return for these redemptions: | 1 to 5% (À la carte Travel) 0.83 to 4.55% (any travel provider) |

| Duration of points redemption period: | 60 days (after the travel charge posts to your account) |

| Annual Fee | $150 |

The National Bank of Canada World Elite Mastercard is another great option for the All Inclusive vacationer. The card has the potential to earn a lot points if you mind the $2,500 overall spending cap and really only use the card to pay for groceries and dining.

To get the best value out of your points for travel redemptions you must book your travel via National Bank's À la carte Travel. Basically you book travel through them as if you were booking travel anywhere else and then you redeem points against the charge during the payment process for your travel. This travel includes All Inclusive vacation packages.

You can choose to redeem any amount of points against the charge so it makes it quite flexible with a minimum redemption of 10,000 points for a $100 credit.

However if you do choose to book travel elsewhere you can use their redeem points for any travel option as follows:

- If you redeem 55,000 or less points in one transaction you will receive a $100 credit for every 12,000 points redeemed

- If you redeem 55,000 or more points in one transaction you will receive a $100 credit for every 11,000 points redeemed.

For the less than 55,000 points redemption this works out to a 0.83% to 4.16% return on your spending. Over 55,000 it works out to a 0.91% to 4.55% return.

Learn more about and apply for the National Bank World Elite card here.

WestJet RBC World Elite Mastercard

| Earn rate: | 2% for WestJet & WestJet Vacations purchases 1.5% for all other spending |

| Where can you can redeem your points: | WestJet Vacations |

| Point redemption value for all inclusive vacations: | 1 WestJet dollar = $1 |

| Effective rate of return for these redemptions: | 1.5% to 2% |

| Duration of points redemption period: | You must have the dollars in account at time of purchase - partial redemption is allowed |

| Annual Fee | $119 |

The WestJet RBC World Elite Mastercard is the only card in this list that can't be used towards booking any all inclusive vacation. It can only be used for WestJet Vacation packages or Sunwing Vacation packages. This is not a bad thing as WestJet Vacations combined with Sunwing Vacations are the largest vacations provider in Canada and they have most all inclusive destinations covered!

Much like the above cards you don't have to have the full amount of WestJet Points to be able to redeem. As long as you have 50 WestJet Points in your account you can redeem them towards WestJet un Sunwing Vacation packages. Note that you cannot use WestJet Points towards the taxes and fees on the vacation packages.

The card also has its famous no checked bag fee which saves you some more cash on those vacations!

Learn more about and apply for the WestJet RBC World Elite card here

TD First Class Travel® Visa Infinite* Card

| Earn rate: | 8 points/$ on Expedia for TD purchases 6 points/$ on Groceries and Restaurants† 4 points/$ on regularly recurring bill payments s 2 points/$ on all other purchases |

| Where can you can redeem your points: | Expedia For TD or any travel provider |

| Point redemption value for all inclusive vacations: | 200 Points = $1 via Expedia for TD 250 Points = $1 for any other travel provider up to $1,200 then 200 points = $1 for any of the dollar value above $1,200 |

| Effective rate of return for these redemptions: | 1% to 4% when redeeming via Expedia For TD 0.8% to 3.2% when redeeming via any other travel provider |

| Duration of points redemption period: | 90 days (after the travel charge posts to your account) |

| Annual Fee | $139 |

The final card in our list of best cards for all inclusive vacationers is the TD First Class Travel Visa Infinite Card. The card is really good if you are a fan of Expedia and use it for your all inclusive or other travel needs. The reason why is the card's earn rate of 8 points per dollar when you make Expedia for TD purchases . That translates to a 4% return when you redeem those points for travel booked via Expedia for TD.

All other purchases on the card earn 2 to 6 points per dollar spent which translates to a 1% to 3% return for those same Expedia for TD redemptions.

The TD First Class Travel Visa Infinite Card also has the option to redeem points for travel booked via any other travel provider which is less lucrative than the Expedia redemption, but it is still great to have the option on this card. You should also note that since Expedia is an American company you cannot book all inclusive vacations to Cuba with them.

Learn more about and apply for the TD First Class card here.

Other cards

Now you may be asking about some more popular cards like the RBC Avion Visa Infinite or the CIBC Aventura® Visa Infinite* cards. You can redeem the points earned on these cards for package vacations but your redemption value is low, typically only 1%. In most cases with these two cards you are better off redeeming for flights via their specified reward chart options.

Save up to 25% on Travel Insurance

The majority of All Inclusive Vacation providers will offer travel insurance that you can purchase during the check out process. Before you book, check out the pricing from RWRDS Canada partner soNomad who are committed to providing the most competitive prices for travel insurance in Canada. Word on the street is many insurance providers will be increasing prices in December so lock in now if you can!

Click here to learn morePractical Loyalty Programs for All Inclusive Vacationers

While not typically associated with traditional travel loyalty programs, the all inclusive vacation has become a much more integral part of many program thanks to Canadian's thirst for them!

For some of the programs, the value of redeeming points or miles for an all inclusive vacation may not be as good as redeeming for flights only but it is always good to know you have the option to do so. There are lots of us who don't collect enough miles or points in these programs to redeem for a flight but the fact they allow partial redemptions for all inclusive vacation packages make them a viable option.

Primary tips to take away from the list of loyalty programs

- For programs like Aeroplan you will typically get better value out of your points when you redeem for flights only - however you may never be in position to earn enough points to redeem for the flights you dream of, so redeeming for vacation packages can make a lot of sense. Same for people on the other end of the spectrum - those with more points than what the know what to do with, if that's the case, first off, lucky you, but using up some points for vacation packages may only make a small dent in your balance so it can be worth it for you to redeem so you can save some cash.

- For many of you, these programs can be your secondary, tertiary or even lower programs so by making partial redemptions for vacation packages will allow you to use up those miles or points you may have not known what to do with.

- In most cases you can combine using the programs listed below with the credit cards listed above to provide even more savings on the purchases of all inclusive vacation packages.

Aeroplan

Air Canada's Aeroplan is one of Canada's best known loyalty programs and is most famous for flight award options. However since it grew into a coalition program model years ago they expanded the catalog of awards to include many options, one of which is for Air Canada Vacations packages.

They've come full circle back to more of a frequent flyer program model instead of a coalition model but you can still redeem your Aeroplan points for Air Canada Vacation packages! This is one of the programs we allude to where the value may not be the best when comparing to flight awards but it's great to have this vacation package option.

The beauty of using Aeroplan points towards Air Canada Vacations packages is that it works in the same manner as many of the proprietary credit card programs listed above in that you don't have to have the full amount of points. You can redeem as little as 5,000 points right up to 500,000 points.

The value of the redemption is basically $10 per 1,000 points redeemed or 1 cent per point. Compare this to flights where you can get 1.5 cents to well over 10 cents per point. But as we said, maybe you'll never earn enough points to get to a flight you like so being able to redeem, say 10,000 points for a $100 credit on an Air Canada Vacations package may be ideal for you.

And it gets even better, once you redeem the points you still have to pay the rest of the vacation on a credit card, so why not use one of those listed above (sans the WestJet card) and then use those points against the charge from Air Canada Vacations once it posts? Now are seeing the big picture here? You don't have to limit yourself to just one program to help bring down the costs of an all inclusive vacation! Learn more about using Aeroplan points for Air Canada Vacations packages here.

When you redeem Aeroplan points for Air Canada Vacations you'll find two different redemption options. One is a drop down menu used for Mexico, the Caribbean, Hawaii, Las Vegas, Los Angeles or Orlando packages. If you are booking a Canada, Europe, or cities in the United States not listed above package you'll be presented with a points redemption slider:

You can redeem 5,000 Points and up towards an Air Canada Vacations vacation

For European and some other vacation packages you'll be presented with this slider as your points redemption option

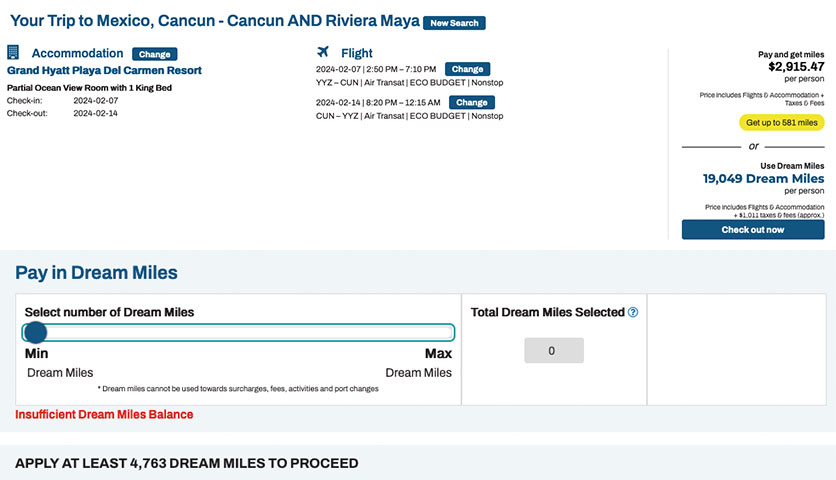

AIR MILES

Just like Aeroplan, AIR MILES is one of the best known travel rewards loyalty programs in Canada and is one of the largest of all loyalty programs in our great nation! After being purchased by BMO, AIR MILES brought their vacation packages back in-house to AIR MILES Travel and the program allows you to earn AIR MILES on the cash portion of any booking you make.

Just as we se with Aeroplan, AIR MILES redemptions for package vacations work in the same manner as many of the proprietary credit card programs listed above in that you don't have to have the full amount of miles. You can redeem as little as 25% of the required miles towards your booking or if you have Onyx status it can be any percentage.

The value of the redemption is roughly 10 cents per AIR MILES Reward Mile. Again, once you redeem the miles you still have to pay the rest of the vacation on a credit card (including taxes and fees), so why not use one of those listed above (sans the WestJet card) and then use those points against the charge from AIR MILES after it posts? Learn more about using AIR MILES for vacation packages here

You need to have at least 25% of Air MILES Dream Miles to use them for a vacation package (unless you have Onyx status)

Scene+

Scene+ isn't just for movies anymore. After joining forces with Scotia Rewards the program is a coalition type program much like AIR MILES. A major part of the program that was inherited from Scotia Rewards is travel.

You can redeem your Scene+ points for virtually any type of travel making it one of the most flexible travel rewards programs in Canada. It is also one of the most valuable of the flexible travel programs if you have one of the Scene+ credit cards.

You can earn Scene+ points via Scotia credit cards and debit cards, with Cineplex, a host of restaurants, Empire Company grocery stores like Sobeys, Safeway, Freshco etc. and most recently at Home Hardware. You can also earn points for shopping online via Rakuten and booking travel via Scene+ Travel.

For all Scene+ members, the points can be redeemed for flight, hotel and car rental bookings made via Scene+ Travel powered by Expedia. However, they do not have all inclusive packages available via their booking portal. What you can do is book flights and an all inclusive hotels separately via their portal, essentially building your own all inclusive vacation package. What this may not provide you is the transportation and vacation packager support that is typically associated with true all inclusive vacations packages They do allow for partial redemptions start as low as 1 point for 1 cent via Scene+ travel and then you can pay for the rest of your travel with a credit card.

Your other option with Scene+, that is a much better option, is that if you do have a Scotiabank credit or debit card that earns Scene+ points is that you can purchase any all inclusive vacation with any provider and then when the charge shows up on your account you can redeem points against the charge.

Thus you can go to itravel2000, Air Canada Vacations, WestJet Vacations - you name it - book your travel with them and then redeem your points. Points redemptions via this method start at only 1,000 points for a $10 credit towards the travel purchase and you have up to 12 months after the charge posts to redeem towards it.

Learn more about using Scene+ Points for travel here

Scene+ Travel Redemption Options

More Rewards

More Rewards is a mini-coalition program in the likes of AIR MILES and Scene+ though smaller and better suited for those living out west. Most points in this program are earned at grocery stores like Save-On Foods and Urban Fare, all of which are only in Western Canada. You earn points for shopping at these groceries stores and other More Rewards partners.

You can then redeem the points via More Rewards Travel for flights, hotels and of course, all inclusive vacation packages. More Rewards Travel is also powered by Expedia. Redemptions work in the same manner as many of the proprietary credit card programs listed above in that you don't have to have the full amount of points. You can redeem as little as 100 points for a $0.43 credit towards your booking.

Like many of the other programs, once you redeem the points you still have to pay the rest of the vacation on a credit card, so why not use one of those listed above (sans the WestJet card) and then use those points against the charge from More Rewards Travel once it posts? Learn more about using More Rewards for vacation packages here

A sample booking from More Rewards Travel

Petro-Points

Petro-Points is not a program that would come to people's minds when it comes to redeeming points for travel let alone all inclusive vacation packages but you can! Other than the obvious option of Petro-Canada, the program has a partnership where you can earn and burn points with itravel2000.

itravel2000 is a full fledged travel agency that is most famous for selling all inclusive vacation packages. Redemptions work in the same manner as many of the proprietary credit card programs listed above in that you don't have to have the full amount of points. You can redeem as little as 10,000 points for a $10 credit towards your booking and must redeem in increments of 10,000 points after that.

Again, once you redeem the points you still have to pay the rest of the vacation on a credit card, so why not use one of those listed above (sans the WestJet card) and then use those points against the charge from itravel200 after it posts? Plus you'll also earn Petro-Points on the vacation package purchase! Learn more about using Petro-Points for itravel2000 vacation packages here

You'll find this box to select the amount of points you want to redeem

on the right hand side of itravel2000 Petro-Points booking page during the booking process

Expedia Rewards

While better suited for hotel stays the Expedia Rewards program can also be utilized for all inclusive vacation packages. The program allows you to redeem Expedia Rewards points towards a package voucher that then can be used towards a vacation.

They allow you to redeem points for up to a C$300 voucher that can be applied towards your all inclusive vacation package.

And just as stated with all of the other loyalty programs above, once you redeem the voucher you still have to pay the rest of the vacation on a credit card, so you can use one of the credit cards listed above (sans the WestJet card) and then use those points against the charge from Expedia once it posts? Plus you'll also earn Expedia Rewards points on the vacation package purchase! Learn more about using Expedia Rewards points for vacation packages here.

Directions on how to use Expedia Rewards points towards a package vacation

WestJet Rewards

The final loyalty program we look at is WestJet Rewards. We won't delve into too much since we've already discussed it for the WestJet credit card above.

Essentially WestJet Points are earned from flying on WestJet, buying WestJet Vacation packages, spending on their credit cards and for booking cars or hotels via WestJet. You can then use the WestJet Points you have earned to redeem for WestJet or Sunwing Vacation packages as long as you have a minimum balance of 50 WestJet Points.

You can redeem anywhere from 50 WestJet Points to as much as the vacation package(s) cost before taxes and fees as WestJet Points cannot be redeemed for the taxes and fees.

The remainder of the vacation package cost can be paid for with any of the above cards listed and if you choose to use the WestJet RBC World Elite Mastercard you'll earn 2% back of whatever amount is charged to the card. Learn more about using WestJet Points for WestJet Vacations here.

There you have it!

With the variety of loyalty programs we have in Canada you can be happy to know that you are not limited to flights or hotels with travel rewards programs. The all inclusive vacation package is synonymous with Canadians and these type of vacations can and are readily available in the points and miles world.

You just have to know which are best for package vacations and we hope we did a good job of explaining them all to you in this guide!

As always with any information provided on Rewards Canada it may change at anytime and we do our best to update these features as much as possible but we recommend double checking with the programs to see what they offer or feel free to contact us anytime for further information or for advice and help with the programs!

This feature was first posted on October 29, 2019 and is updated on a regular basis

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!