WestJet RBC Mastercard Review

Last Updated on May 1, 2025

A very good entry level travel rewards card

The WestJet RBC Mastercard is a great option for individuals who like to fly with WestJet and are looking to earn extra WestJet Points but may not meet the income requirements for the WestJet RBC World Elite Mastercard.

The review of the WestJet RBC Mastercard is broken down into the following sections:

Overview

The WestJet RBC Mastercard is the entry level co-brand credit card for the WestJet Rewards frequent flyer program. This low annual fee card offers attractive WestJet points earn rates and an annual companion voucher that can be used on WestJet flights.

Costs & Sign up Features

The WestJet RBC Mastercard comes with a $39 annual fee. Additional (supplementary) cards are $19 each per year.

The current welcome bonus for this card offers up to 10,000 WestJet Points. The bonus is awarded as 5,000 WestJet Points upon first purchase and an additional 5,000 WestJet Points when you spend $1,000 on the card within the first three months.

There is no minimum annual income requirement for this card. Purchase interest rate is 20.99% and the cash advance interest rate is 22.99%.

Earning

The card earns WestJet Points as follows:

- 1.5 WestJet Points per dollar spent on flights or packages with WestJet or WestJet Vacations

- 1 WestJet Point per dollar spent on all other eligible purchases

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Effective Rate of return (Travel) |

|---|---|---|

| WestJet & WestJet Vacations | 1.5 | 1.5% |

| All other spending | 1 | 1% |

Redeeming

As this is a co-brand airline card you guessed it, the points you earn on this card are redeem for flights on WestJet through the WestJet Rewards program. WestJet's program works more like a cash back program rather than your traditional frequent flyer programs which have or had set mileage award charts. 100 WestJet points are equivalent to one Canadian dollar and you can redeem them when you have as little as 2,500 WestJet Points in your account.

When you redeem you are buying an actual ticket from WestJet (not an award ticket like your traditional frequent flyer programs) for cash and then applying WestJet Points towards that ticket as a discount. So if you buy a ticket for $450 and have 12,500 WestJet Points you can apply that amount to the ticket and end up paying $325 plus any taxes and fees.

WestJet Rewards also has a flight redemption option called Member Exclusive Fares. These are sort like WestJet's take on the traditional frequent flyer reward chart as you need to have the full amount of points to redeem for them. When they were first introduced they provided excellent value (such as $99 one way in Canada) and you could also redeem for flights on partner airlines like Qantas. However more recently WestJet revamped this redemption option and the potential outsized value it provided has disappeared.

The new incarnation of Member Exclusives Fares is akin to a small discount on the fare you would normally pay if you were just using cash. Sure a discount is great but the competitiveness of this option when compared to other programs is no longer there. At the time these were changed WestJet also removed the option to redeem for travel on their partner airlines. There are still ways you can use WestJet Points on airlines like Air France, Delta and Qantas and that is to book a WestJet codeshare on those airlines, in those cases you can redeem WestJet Points towards the fare.

Finally you can also redeem your WestJet Points for vacation packages booked via WestJet Vacations.

Features and Benefits

The primary benefit that is provided on the WestJet RBC Mastercard is s a pretty good and that is an annual companion voucher! This is a recurring benefit that you will receive each year when you pay your annual fee on the card and it can provide some amazing value.

The way it works is that when you purchase a ticket for a WestJet flight in Canada or to the continental U.S. you can buy a companion ticket on that same flight for $199+taxes/fees.

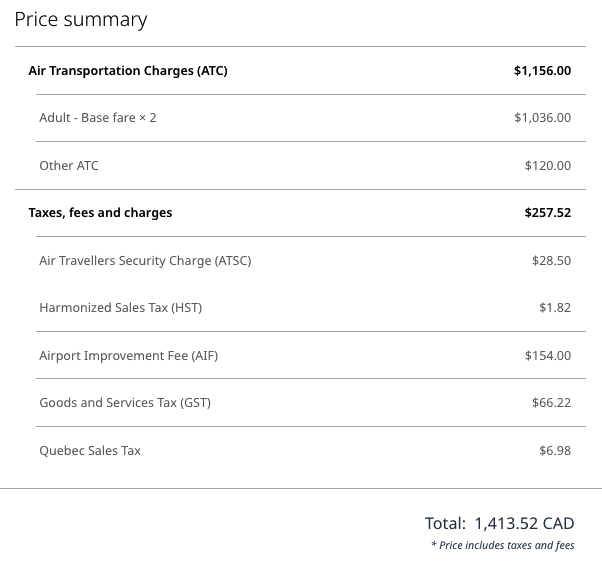

Here is an example of economy class flights between Edmonton and Montreal during the busy summer season in May 2024

In the above example the base fare is $518 per ticket so if you applied the companion voucher to this reservation the second ticket would only be $199. That would amount to a savings of $319! The amount of savings alone pays for this card's annual fee eight times over. In all the two tickets would cost $1094.52 instead of $1413.52

The voucher can potentially save you even more than that as you can also use it on premium economy fare classes! It can also provide huge savings on last minute travel when fares tend to skyrocket. This is typically when I have used them as a lot of the Rewards Canada family travel is not planned very far in advance.

RBC offers

As with all RBC cards the WestJet RBC Mastercard receives RBC Offers. These exclusive limited time offers are sent out to cardmembers to receive statement credits, discounts or bonus points for using their card at select merchants. Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to RBC Royal Bank 'RBC Offers'

Partner benefits

RBC offers some exclusive benefits for all their credit cardholders with select retail partners in Canada. For the RBC British Airways Visa Infinite Card those benefits are:

Link your Petro-Points card to your new RBC credit or debit card and use it to pay for purchases at Petro-Canada to always:

Save 3 ¢/L on gas with every fill-up

Earn 20% more Petro-Points

Earn more Be Well points at Rexall

Get 50 Be Well points for every $1 spent on eligible purchases when you shop at Rexall with your linked RBC® card

Enjoy $0 delivery fees with DoorDash

Get a complimentary DashPass subscription for up to 3 months with an eligible RBC credit card – a value of almost $30

Insurance

The WestJet RBC Mastercard provides a really good insurance package for a low annual fee entry level credit card. The coverage is as follows:

- Flight Delay Insurance

- Baggage Delay Insurance

- Car Rental Theft and Damage Insurance

- Hotel Burglary Insurance

- $500,000 Travel Accident Insurance

- Purchase Protection Plan

- Buyer's Assurance Protection Plan

What is good about this card

The companion voucher is great as it can provide some amazing savings when you travel with two or more people. With record numbers of people travelling by air, airfares are rising to levels not seen before so consumers need to look for ways they can save some extra cash and this voucher is one of those ways.

The insurance coverage is really good for a low annual fee and low income requirement card. There are not many entry level cards that offer flight delay, baggage delay and hotel burglary insurance.

The 1 to 1.5 points earn rates are pretty good for an entry level card and comparable or better than many of this card's competitors.

What is not so good about this card

The main issue we have with the card is more so with the WestJet Rewards program and not the card itself but as it is a co-brand card they go hand in hand! This is an inherent issue with all co-brand cards as you are limited by the attached reward program. And with WestJet Rewards you are limited in your redemption options in terms of where and whom you can fly with. With this program you can only redeem for WestJet flights or WestJet code-share flights on partner airlines. This limits the number of destinations you can get to and there is no potential for outsized value like you can find with competing airline programs (such as Aeroplan business class rewards).

There are not a lot of extra features or benefits. Yes, the companion voucher is great but it would be nice to see something extra to make the card even more appealing to WestJet flyers. For example, the premium version the WestJet RBC World Elite Mastercard has the first checked bag free benefit and they could offer something similar. While they wouldn't want to give the exact same benefit as it would just cannibalize members from the World Elite card, perhaps they could offer a 50% discount on baggage fees by having this entry level card.

Who should get this card

- Consumers who fly with WestJet and want to earn additional WestJet Points but do not meet the income requirements of the World Elite Card

- Consumers who book two or more WestJet tickets on the same reservation at least once per year so they can use the companion voucher to save some money

- Consumers looking for good travel insurance coverage who do not meet the income requirements of many of the premium cards that offer travel insurance coverage as well.

Conclusion

Overall this card makes great sense for a lot of Canadians who don't meet the income requirements for the WestJet RBC World Elite Mastercard and foresee themselves travelling on WestJet with a companion at least once per year. The companion voucher alone can pay for the card many times over. Add in decent earn rates plus above average insurance coverage and you have yourself an excellent entry level travel rewards credit card.

Latest card details:

WestJet RBC Mastercard

Earn up to $100 in WestJet points1 (with minimum $1,000 spend in the first 3 months).

Annual Fee $39 | Additional Cards: $19 | Annual interest rate 20.99% on purchases and 22.99% on funds advances

- Get an annual credit card companion voucher for round-trip travel within Canada or the U.S. for $199 CAD (plus taxes, fees and charges)1

- 1.0% earn on your everyday spending

- 1.5% earn for WestJet & WestJet Vacations purchases

Other cards to consider if you are looking at this card:

- American Express® Green Card

- BMO AIR MILES®† MasterCard®*

- CIBC Aeroplan® Visa* Card

- CIBC Aventura® Visa* Card

- MBNA Rewards Platinum Plus® Mastercard®

- RBC ION+ Visa Card

- Scotiabank American Express Card

- Scotiabank Scene+ Visa Card

- TD® Aeroplan® Visa Platinum* Card

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!