Clash of the Credit Cards!

BMO AIR MILES®† Mastercard®* (Student) vs.

Scotiabank SCENE®* Visa* Card

First posted on February 4, 2022

This Clash was prompted by seeing AIR MILES tweet that MoneySense had just crowned the BMO AIR MILES Mastercard (Student) as the best credit card for students looking to fly. And right away that got me thinking - is it really? What about the Scotiabank Scene Visa Card which is very popular with students? Shouldn't that be a better travel card for students? Well up until a few months ago it wasn't a travel card so perhaps MoneySense missed that? Or am I wrong and is the BMO card the better choice? Well there's no better way to find out than throwing the two cards into the RC arena to battle it out!

So in this clash we have two popular student cards go head to head! Those cards are the BMO AIR MILES®† Mastercard®* (Student) and the Scotiabank SCENE Visa Card

In this match up we look at over half a dozen criteria to compare the cards against one another along with a head to head detailed table comparison.

Annual Fees

This first round here is easy - both cards have no annual fees so it's a tie!

Welcome Bonus

For the standard sign up bonus there are some slight differences between the cards. The standard bonus on the BMO AIR MILES Mastercard is 500 miles and those are worth $47.50 towards travel. The standard bonus on the Scene+ Visa card is 2,500 points which is worth $25 towards travel. However, we haven't seen these standard welcome bonuses for quite sometime as both cards have limited time increased welcome offers.

Currently the BMO card has an increased welcome bonus offering 800 AIR MILES Reward Miles. You'll earn the 800 miles when you spend $1,000 in the first three months. Those 800 miles are worth $76 when redeemed for travel. The Scotia Scene+ card currently has an increased welcome bonus of 10,000 points when you spend $750 in the first three months. Those 10,000 Scene+ points are worth $100 when redeemed for travel.

It's pretty easy to see who this category goes to and that's the BMO AIR MILES Mastercard.

Rates

Another easy round here as both cards charge the same interest rates of 19.99% on purchases and 22.99% on advances. It's a tie!

Bonus Features & Benefits

Being entry level no annual fee cards there are no additional features or benefits that these cards come with. There are features, earning benefits and offers from each of the card's respective loyalty programs AIR MILES and Scene+ that could be seen as an extra benefit however since they aren't specific to these cards and are available to all members of those programs we won't give them consideration here.

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

Points Earning & Redemption

This is where we get down to the nitty gritty and really the main category where these cards will battle it out. Both cards actually provide one accelerated earn rate level above the base earn rates with the BMO card's accelerator being 3 AIR MILES per $25 spend at select AIR MILES partners. The Scene Visa offers 5 points per dollar spent at Cineplex as their accelerator. For base earn rates, which for both cards cover most spending on these cards the BMO card offers 1 AIR MILE per $25 spent and the Scene card is 1 Scene+ point per dollar spent. We value AIR MILES Reward Miles at 9.5 cents each when redeeming for flights (there are times where you may receive less value and times where you may get more) which translates to a 0.38% to 1.14% return on each dollar spend on the BMO AIR MILES Mastercard. For Scene+ we value the points at 1 cent each when redeeming for flights which means the Scene Visa card provides a 1% to 5% return on each dollar spent. As you can see the Scene Visa almost offers 3x the value on base earn rates and that is the key earn rate in this comparison. The accelerators on both cards are limited, for AIR MILES you have only 14 partners where you can earn 3x the miles and at least a quarter of those will not appeal or provide much opportunity for students. Meanwhile the Scene accelerator is only for Cineplex, again very limited in how much someone will actually earn at this level, though it is appealing to students. Thus the main comparison should be on the base earn rate and the Scene Visa takes the cake for base earn rate and value of those points earned.

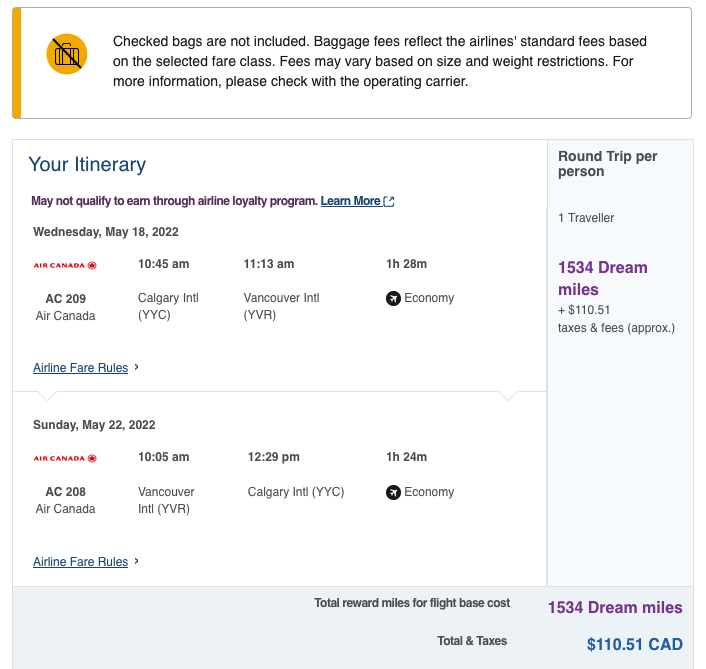

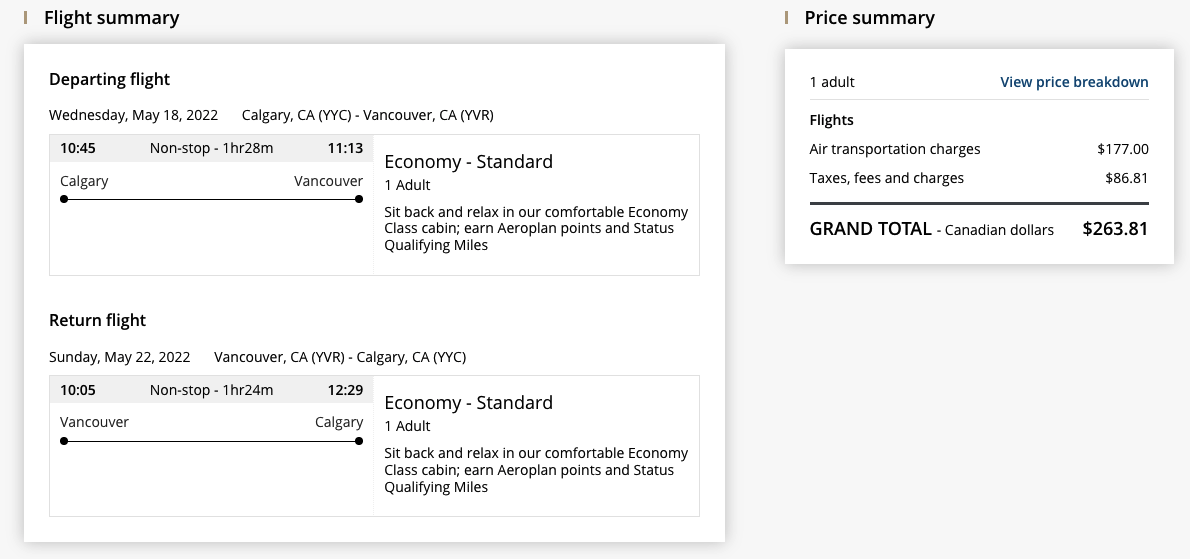

There are some significant differences between the two cards when it comes to redeeming for travel. With the BMO card you have to redeem and book your travel via AIR MILES while the Scotia card allows you to redeem and book travel with whomever you want including Scene+ Travel. The next difference is how many miles or points you will need to redeem, with AIR MILES you can only redeem for a flight if you have enough miles to cover the amount being charged by the program. If you take our example below of a flight between Calgary and Vancouver that requires 1,534 miles, you need to have at least 1,534 miles in your account to redeem for it. On the other hand if you take the equivalent flight booked with Air Canada for $263.81. on the Scotia Scene Visa you can redeem any amount of points against that charge. So if you only have 10,000 points you can redeem that for a $100 credit once the Air Canada charge shows up on your card statement. Even if you have 0 Scene+ points at the time of booking they give you up to 12 months after the charge posts to redeem for it. That leads us to the example we provide as we feel it is the best way to show and compare these two cards when it comes to booking flights.

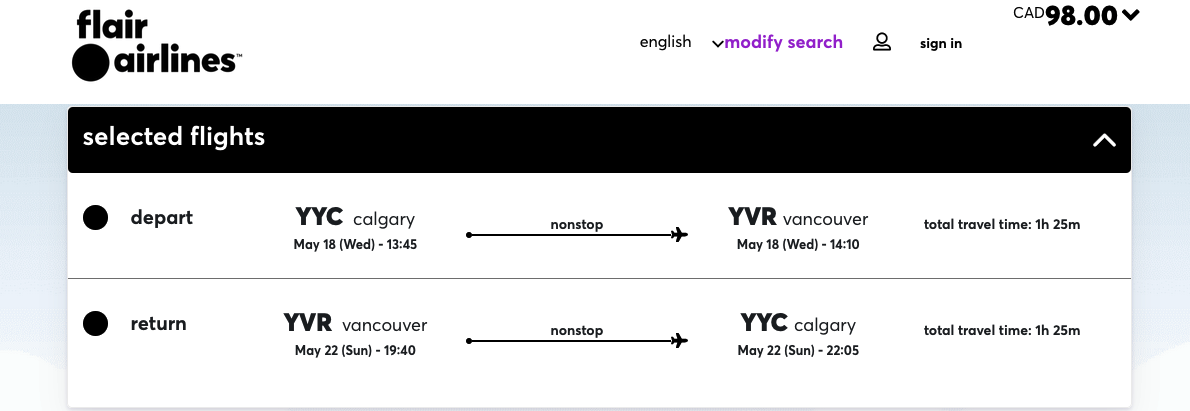

In this example we looked at a student who may be going to school in Calgary and wanting to fly home to Vancouver for a weekend. The dates we looked at are May 18 to 22, 2022 and we started by looking at what AIR MILES had available and then picked the exact same flights with Air Canada to see what they would cost cash wise for the Scene Visa card. We also added in flying on the same days with Flair Airlines and will explain after the example why we also added in this option.

AIR MILES

Screenshot of the AIR MILES Redemption (Priced as a Gold Elite member)

Air Canada

Screenshot of Air Canada purchase with the Scene Visa

Flair Airlines

Screenshot of Flair purchase with the Scene Visa

The flights redemption options and required spend compared:

| BMO AIR MILES Mastercard (Student) Air Canada Option |

Scotiabank Scene Visa Air Canada option (Same as AIR MILES) |

Scotia Scene Visa Flair Airlines option |

|

|---|---|---|---|

| Cost of flight | 1,534 AIR MILES Reward Miles + $110.51 | $263.81 or 26,381 Scene+ Points | $98.00 or 9,800 Scene+ Points |

| Credit card spend required when you include the card welcome bonus | $7,116.67 to $18,350 ( + $110.51 for taxes and fees) | $4,276.20 to $21,381 | $960 to $4,800 |

| Credit card spend required to redeem/pay for the entire flight | $12,783.33 to $38,350 (+ $110.51 for taxes and fees) | $5,276.20 to $26,381 | $1,960 to $9,800 |

| Partial redemption possible? | No | Yes | Yes |

You do have to note the AIR MILES redemption amount shown is for a Gold Elite member, if you don't have Gold status you will have to redeem even more miles thus bringing the spend required on the BMO card even higher. That being said having the BMO card and receiving 800 miles as your welcome bonus the student is 80% of the way to gold status and could achieve it quite easily.

Scenario 1: Credit card spend required when you include the card welcome bonus

The first scenario of comparing these cards includes using the welcome bonus towards that first flight redemption. That bonus is key and makes a huge difference in getting your first flight with the BMO card. In fact in this case that 800 mile bonus on the BMO card accounts for more than half of the miles required for this Calgary-Vancouver round trip flight. That means you only need to earn 734 more miles to be able to redeem for the flight. In terms of card spend you would need an outlay of $7,117 to $18,350 to get to that 1,534 miles required. For the Scene Visa card the welcome bonus doesn't make as big of a dent in the leftover spending required to earn enough points required to redeem for the full flight. You would need to spend between $4,277 to $21,381 on the card to pay off this entire flight when you include the welcome bonus. As we are looking more at base earn rates for these cards BMO's $18,350 looks better than Scotia's $21,381 but therein also lies an issue.

I don't know of many students who can or will be spending $18,350 to $21,381 on their cards. Sure, maybe over the course of a few years of university they may get close to that but who wants to wait that long to redeem? Well, with the BMO AIR MILES card you would have to wait but the Scotia Scene Visa you do not thanks to the aforementioned partial redemption option. You can redeem as little as 100 points for $1 off your travel so with the Scene Visa you can use your points to discount your travel at anytime. Just as we mentioned above, if you have 10,000 points you can redeem for $100 towards your Air Canada flight making the final cost only $163.81 (NOTE: Due to technical issues arising from the switch to Scene+ in November they do have issues with partial redemption online but you can call in to complete it at this time)

Scenario 2: Credit card spend required to redeem/pay for the entire flight

What happens after you've used up the welcome bonus and want to redeem for flights? If we use the same flights example, the chart above shows that you need to spend at least $12,783.33 on the BMO AIR MILES Mastercard to redeem for this flight however it will more likely be closer to the $38,350 as the $12,783.33 in spending would need to be completed at the select few AIR MILES partners where you earn 3x miles. The exact same flight with the Scene Visa card will require at least $5,276.20 in spend but just like the BMO card will more likely be closer to the $26,381 needed from the base level earn rate. As most of the earn on these cards will be at that base level when you compare these two cards you are better off with the Scene card as you would have to spend nearly $12,000 more with the BMO card and still pay an additional $110 in taxes and fees. However just like the first scenario I don't know of many students who can or will be spending $26,000 to $38,000 on their cards so once again being able to redeem what you have available rather than having to wait until you get to the full amount really comes in handy for the budget strapped student.

That's where the Flair Airlines flight comes in - we're talking students here. They have limited budgets and will look at any option to save as much money as possible thus Ultra Low Cost Carriers greatly appeal to them. Airlines like Flair, Lynx, Swoop and so on have extremely low fares that can fit a student's budget so that is why we include it here. These are airlines you can't book with AIR MILES but since Scene+ lets you book with whomever you want these airlines become an option, and a very realistic option at that. If you take the above Flair flight and continue with our example of only having 10,000 points, well that flight is covered and you still have 200 points left over. In Scenario 1 you could earn the flight with $960 to $4,800 in spending and Scenario 2 is $1,960 to $9,800. In fact if we are only looking at base earn rates in Scenario 2, the amount you would have to spend on the BMO card to get the one flight is almost the same as four Flair flights via Scene ($38,460 vs. $39,200)

Which brings me back to one more point with Scene+ and that's them allowing you to redeem up to 12 months after the charge hits your account. Say you did book that cheapest Flair Airlines flight with absolutely no frills attached but then at the last minute decide you will need to check a bag. You show up at the airport and pay for the luggage fee on your Scene Visa card and since it's a charge from Flair it counts as travel. That means you can then redeem points against the charge once it shows up on your statement. This is something you cannot do with an AIR MILES credit card.

Some might argue well you can also double dip and earn AIR MILES at other retailers with your AIR MILES Card (not the credit card) so you don't have to spend as much on the card. Well, the same goes for Scene+ albeit with a smaller amount of retailers but they do have Cineplex, restaurants like Harvey's and Montana's that are popular with students, which AIR MILES does not have, plus SCENE has the partnership with Rakuten for online shopping, so they're pretty equal. In fact from the perspective of a student, the Scene+ program actually appears to have more relevant partners than AIR MILES does.

Both cards also offer cash back redemption options. With BMO and AIR MILES it is the Cash Miles option, which you have to set in your AIR MILES account and provides $10 for every 95 mile redeemed at select partners. This works out to a 0.4% to 1.26% return per dollar spent. For the Scene Visa card they have a tiered cash back option ranging from 3,000 points for a $20 credit to 71,500 points for a $500 credit which works out to a 0.667% to 3.5% return per dollar spent. BMO is more limiting in their cash back redemption as you can only redeem for cash at AIR MILES Cash Miles partners such as Sobeys and Shell. As well you have to set your account to which miles you want to earn beforehand, you don't get an option afterwards to choose to redeem for travel or cash. Again, Scotia is more flexible as you redeem for a statement credit that covers any purchase and you get to choose whether you want to redeem for cash or travel.

In this, the most important category of the Clash of these student cards, the clear winner is the Scene Visa Card.

Insurance

On the insurance side there is no comparison here as the BMO card provides purchase protection and extended warranty coverage. The Scene+ card provides no insurance coverage at all. BMO takes this category.

Conclusion

While the BMO Air Miles Mastercard (Student) may have a slightly better welcome bonus and includes a couple of insurance benefits, when it comes down to the initial premise of this Clash, which is the best student card for flights, it's not the BMO card. In this case the Scotia Scene Visa card is definitely the better option for providing more value out of its base earn rates and the sheer flexibility in redemption options. If you don't have enough AIR MILES to redeem for a flight, you can't redeem. Such is not the case with the Scene Visa card - if you have 100 points, you can redeem for a $1 discount on your flight. Simple as that. Plus you can choose the cheapest flights in the market from carriers like Flair, AIR MILES doesn't give you that option. So in this Clash, which card is better for a student looking to fly? The Scotia Scene Visa card. (Sorry MoneySense).

The winner of this clash is: Scotia Scene Visa Card

Key factors in Scotia's win:

- More flexible travel booking/redemption options

- Higher base earn rate value

- Program partners that are more relevant for students

Here is a direct side by side comparison of the two cards in this clash!

Basics |

BMO AIR MILES®† Mastercard®* |

Scotia SCENE®* Visa* Card |

|---|---|---|

| Card Type | Travel Points | Travel Points |

| Annual Fee | $0 | $0 |

| Additional Card Fee | $0 | $0 |

| Interest Rate | 19.99% Purchase 22.99% Cash Advance |

19.9% Purchase 22.99% Cash Advance |

| Foreign Transaction Fee | 2.5% | 2.5% |

| Income Requirements | Not applicable | Not applicable |

Points Earning |

BMO AIR MILES®† Mastercard®* |

Scotia SCENE®* Visa* Card |

|---|---|---|

| Standard Welcome Bonus | 500 AIR MILES | 2,500 Scene+ Points |

| Welcome Bonus Value* | $47.50 | $25 |

| Limited Time Welcome Bonus | 800 AIR MILES | 10,000 Scene+ Points |

| Limited Time Welcome Bonus Value* | $76 | $100 |

| Renewal or Additional Bonus | None | None |

| Travel Purchases | 3 miles for every $25 at participating AIR MILES car rental partners 1 mile for every $25 spent on all other travel purchases |

1 point per dollar spent |

| Grocery Purchases | 3 miles for every $25 at participating AIR MILES grocery store partners 1 mile for every $25 spent at all other grocery stores |

1 point per dollar spent |

| Dining Purchases | 1 point per dollar spent | 1 point per dollar spent |

| Gas & Transit Purchases | 3 miles for every $25 at participating AIR MILES gas station partners 1 mile for every $25 spent at all other gas and transit purchases |

1 point per dollar spent |

| Streaming Services | 1 miles for every $25 spent | 1 point per dollar spent |

| All Other Purchases | 3 miles for every $25 at participating AIR MILES partners 1 mile for every $25 spent at all other purchases |

5 points per dollar spent with Cineplex 1 point per dollar spent on all other purchases |

| Value of points per $1 spent* | 0.38 to 1.14 cents | 1 to 5 cents |

| * Valuations are based upon redeeming the points for travel at 9.5 cents per mile for AIR MILES & 1 cent per point for Scene+ see the next section for cash back and other redemption options |

||

Redemption/Exchange Options |

BMO AIR MILES®† Mastercard®* |

Scotia SCENE®* Visa* Card |

|---|---|---|

| Miles/Points deposited to | AIR MILES | Scene+ |

| Travel Redemption Value | 1 mile = 9.5 cents | 100 points = $1 |

| Exchange Options | None | None |

| Cash Back Redemption option | 95 Miles = $10 when you choose to earn Cash Miles | 3,000 points = $20 statement credit 4,500 points = $30 statement credit 7,500 points = $50 statement credit 11,000 points = $75 statement credit 14,500 points = $100 statement credit 21,500 points = $150 statement credit 43,000 points = $300 statement credit 71,500 points = $500 statement credit |

| Value of points for cash back redemptions | 0.4% to 1.26% | 0.67% to 3.5% |

Benefits |

BMO AIR MILES®† Mastercard®* |

Scotia SCENE®* Visa* Card |

|---|---|---|

| Annual credit | None | None |

| Business Class Lounge Access | None | None |

| Global Wi-Fi | None | None |

Insurance |

BMO AIR MILES®† Mastercard®* |

Scotia SCENE®* Visa* Card |

|---|---|---|

| Common Carrier Travel Accident Insurance | None | None |

| Flight Delay Insurance | None | None |

| Delayed Baggage Insurance | None | None |

| Lost / Stolen Baggage Insurance | None | None |

| Damaged Baggage Insurance | None | None |

| Trip Cancellation Insurance | None | None |

| Trip Interruption Insurance | None | None |

| Travel Medical Insurance up to 64 years old | None | None |

| Travel Medical Insurance 65+ | None | None |

| Auto Rental/Loss Damage Insurance | None | None |

| Hotel / Motel Burglary Insurance | None | None |

| Purchase Protection | 90 Days Up to $60,000 lifetime |

None |

| Price Protection | None | None |

| Extended Warranty Plan | Yes Up to 1 extra year |

None |

| Mobile Device Insurance | None | None |

| Link to Apply |