The travel rewards credit card market in Canada is over saturated with 80 plus cards available to the general public. Here at Rewards Canada we break down those 80 cards into five categories, several of which fall under the Travel Points card moniker. Essentially travel points cards are credit cards with their own proprietary rewards program and are often marketed as the 'any airline, any seat, no blackout cards' that you often see on TV, hear on the radio or read in print and online. What a lot of people don't see or hear in the ads is the little asterisk beside the any airline, no black outs etc. Obviously the issuers want your business so they don't tell you the details of the redemption side of the card and want you to think their card is the most flexible. Truth be told, there is great deal of variability with the cards in the travel points and hybrid categories in how flexible they really are. (Hybrid is a card that has a travel points program but also allows you to convert those points to another loyalty program)

Resources:

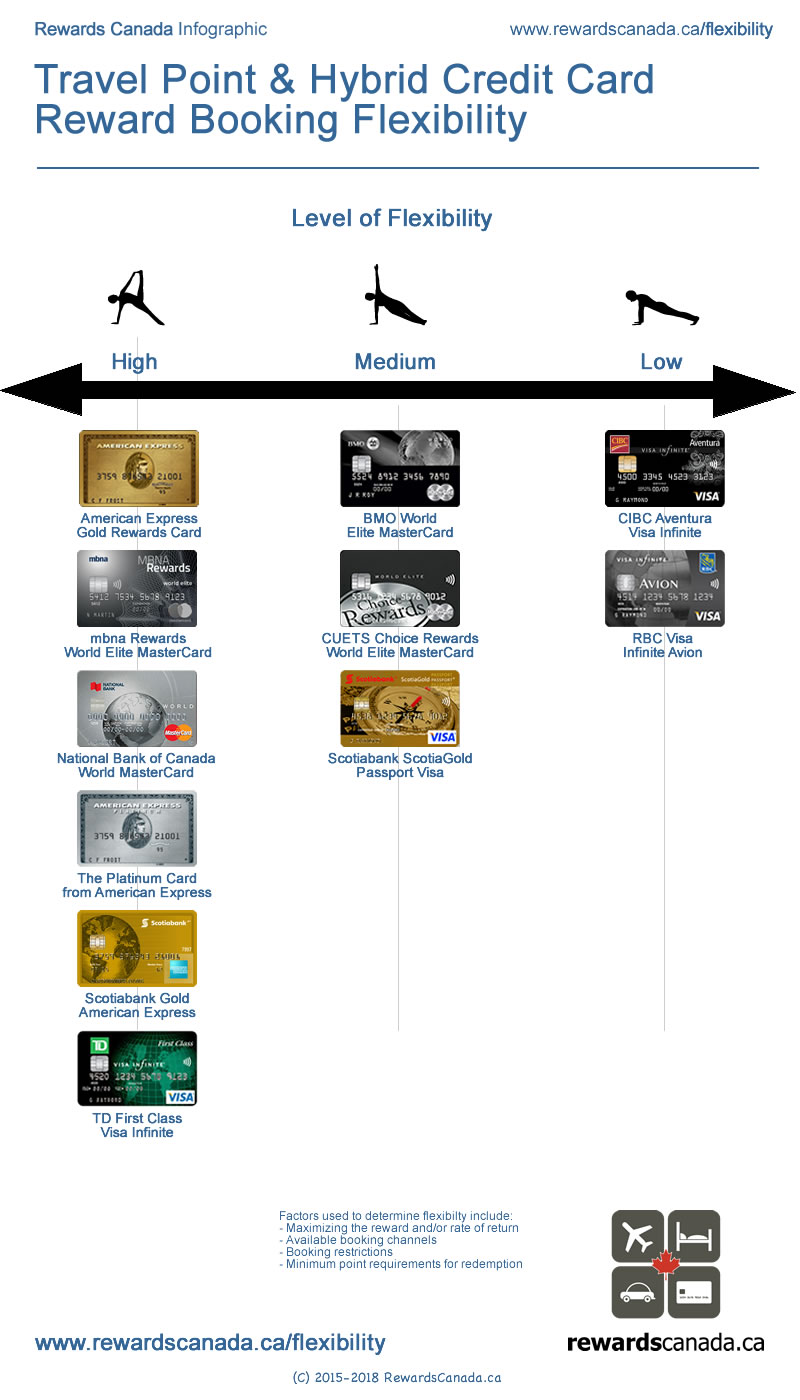

A few years ago we developed the famed yoga Infographic on card flexibility and we have updated it for this article to best show the range of flexibility in the most popular travel points and hybrid cards in Canada. Please note that there are even more cards available that have the 'any airline' option but we look at the best premium card options from the Travel Points and Hybrid card categories. You should also be aware that there are more factors that should be looked at when choosing a card and we recommend using this infographic/feature along with our complete guide to choosing to travel rewards credit card to choose a card.

Most flexible cards

Most flexible cards Flexible cards

Flexible cards Least Flexible cards

Least Flexible cards